Vodafone 2007 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2007 115

Financials

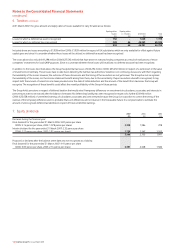

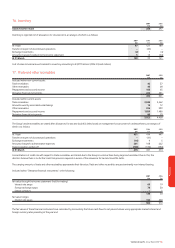

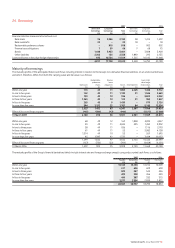

16. Inventory 2007 2006

£m £m

Goods held for resale 288 297

Inventory is reported net of allowances for obsolescence, an analysis of which is as follows:

2007 2006 2005

£m £m £m

At 1 April 97 121 189

Transfer in respect of discontinued operations –(40) –

Exchange movements (2) 1 (4)

Amounts charged/(credited) to the income statement 515 (64)

At 31 March 100 97 121

Cost of sales includes amounts related to inventory amounting to £3,797 million (2006: £3,662 million).

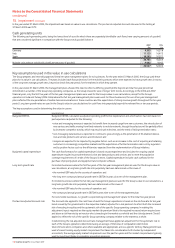

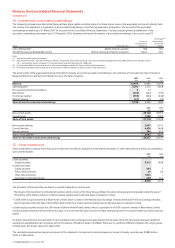

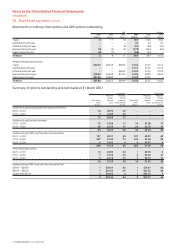

17. Trade and other receivables 2007 2006

£m £m

Included within non-current assets:

Trade receivables 42 37

Other receivables 45 28

Prepayments and accrued income 183 65

Derivative financial instruments 224 231

494 361

Included within current assets:

Trade receivables 2,844 2,462

Amounts owed by associated undertakings 14 12

Other receivables 226 399

Prepayments and accrued income 1,859 1,486

Derivative financial instruments 80 79

5,023 4,438

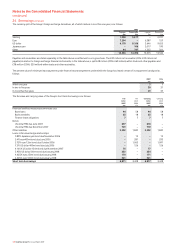

The Group’s trade receivables are stated after allowances for bad and doubtful debts based on management’s assessment of creditworthiness, an analysis of

which is as follows:

2007 2006 2005

£m £m £m

At 1 April 431 474 441

Transfer in respect of discontinued operations –(41) –

Exchange movements (16) 45

Amounts charged to administrative expenses 201 168 222

Trade receivables written off (143) (174) (194)

At 31 March 473 431 474

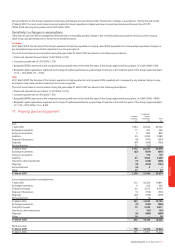

Concentrations of credit risk with respect to trade receivables are limited due to the Group’s customer base being large and unrelated. Due to this, the

directors believe there is no further credit risk provision required in excess of the allowance for bad and doubtful debts.

The carrying amounts of trade and other receivables approximate their fair value. Trade and other receivables are predominantly non-interest bearing.

Included within “Derivative financial instruments” is the following:

2007 2006

£m £m

Fair value through the income statement: (held for trading)

Interest rate swaps 60 19

Foreign exchange swaps 78 30

Option contracts –1

138 50

Fair value hedges:

Interest rate swaps 166 260

304 310

The fair values of these financial instruments are calculated by discounting the future cash flows to net present values using appropriate market interest and

foreign currency rates prevailing at the year end.