Vodafone 2007 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2007 81

Options have a ten year term and will vest after three years, subject to

performance achievement. To the extent that the performance target is not

met, the options will lapse. Re-testing of performance is not permitted.

The price at which shares can be acquired on option exercise will be no

lower than the market value of the shares on the day prior to the date of

grant of the options. Therefore, scheme participants only benefit if the

share price increases and vesting conditions are achieved.

In July 2006, the Chief Executive received an award of options with a face

value of 735% of base salary, while other executive directors received

awards of options with a face value of 588% of their base salary.

Share ownership guidelines

Executive directors participating in long term incentive plans must comply

with the Company’s share ownership guidelines. These guidelines, which

were first introduced in 2000, require the Chief Executive to have a

shareholding in the Company of four times base salary and other executive

directors to have a shareholding of three times base salary.

It is intended that these ownership levels will be attained within five years

from the director first becoming subject to the guidelines and be achieved

through the retention of shares awarded under incentive plans.

Pensions

The Chief Executive, Arun Sarin, is provided with a defined contribution

pension arrangement to which the Company contributes 30% of base

salary.

Vittorio Colao has elected to take a cash allowance of 30% of base salary in

lieu of pension contributions.

Andy Halford, being a UK based director, was a contributing member of the

Vodafone Group Pension Scheme, which is a UK defined benefit scheme

approved by HM Revenue & Customs. The scheme provides a benefit of

two-thirds of pensionable salary after a minimum of 20 years’ service. The

normal retirement age is 60, but directors may retire from age 55 with a

pension proportionately reduced to account for their shorter service but

with no actuarial reduction. Andy Halford’s pensionable salary is capped

in-line with the Vodafone Group Pension Scheme Rules at £110,000. The

Company has paid a cash allowance of 30% of base salary in excess of

pensionable salary.

Sir Julian Horn-Smith elected to receive his pension from 6 April 2006, prior

to his actual retirement from the Company, in accordance with the new UK

pension rules effective from April 2006. Sir Julian retired at the end of the

2006 AGM in July. In addition to his pension, the Remuneration Committee

authorised a pension allowance of 30% of base salary for the four months

from the date he took his pension to the date of his retirement.

Thomas Geitner was entitled to a defined benefit pension of 40% of salary

from a normal retirement age of 60. On early retirement, the pension may

be reduced if he has accrued less than ten years of Board service.

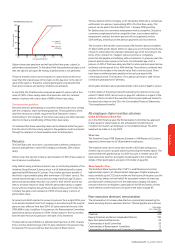

Percentage vesting

Annualised EPS growth

2006/07

EPS range

2007/08

EPS range

0% 3% 6% 9% 12% 15%

0%

20%

40%

60%

80%

100%

EPS Peformance measure

Thomas Geitner left the Company on 31 December 2006 with a contractual

entitlement to a pension, representing 30% of his final base salary. This

pension can be paid in full with effect from 1 January 2008 providing

Mr Geitner does not commence employment with a competitor. Should he

commence employment with a competitor, then, in accordance with his

employment contract, the above pension will be suspended until his

55th birthday, at which point the pension payments will recommence.

The increase in the transfer value amount of Mr Geitner’s pension between

31 March 2006 and 31 March 2007 is to take account of the fact that he has

chosen to retire before the standard retirement age of 60. According to the

terms of his contract, his “stepped” pension promise is completely

protected and payable immediately, without reduction. In previous years the

pension promise was valued on the basis of a retirement age of 60, a

pension of 40% of final base salary and that his whole pension would accrue

uniformly over the period to his 60th birthday. These factors combined have

resulted in the increase in the transfer value that is now disclosed. There

have been no enhancements awarded in the last year beyond the

contractual promise. The valuation of his pension promise to date follows

normal actuarial practice in Germany.

All the plans referred to above provide benefits in the event of death in service.

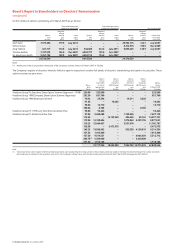

Further details of the pension benefits earned by the directors in the year

ended 31 March 2007 can be found on page 84. Liabilities in respect of the

pension schemes in which the executive directors participate are funded to

the extent described in note 25 to the Consolidated Financial Statements,

“Post employment benefits”.

All-employee share incentive schemes

Global All Employee Share Plan

As in the 2006 financial year, the Remuneration Committee has approved

that an award of shares based on the achievement of performance

conditions be made to all employees in the Vodafone Group. The 2007

award will be made on 2 July 2007.

Sharesave

The Vodafone Group 1998 Sharesave Scheme is a HM Revenue & Customs

approved scheme open to all UK permanent employees.

The maximum that can be saved each month is £250 and savings plus

interest may be used to acquire shares by exercising the related option. The

options have been granted at up to a 20% discount to market value. UK

based executive directors are eligible to participate in the scheme and

details of their participation are given in the table on page 86.

Share Incentive Plan

The Vodafone Share Incentive Plan (“SIP”) is a HM Revenue & Customs

approved plan open to all UK permanent employees. Eligible employees

may contribute up to £125 each month and the trustee of the plan uses the

money to buy shares on their behalf. An equivalent number of shares are

purchased with contributions from the employing company. UK based

executive directors are eligible to participate in the SIP and details of their

share interests under these plans are given in the table on page 87.

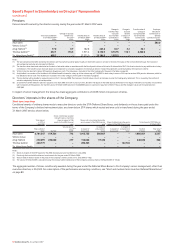

Non-executive directors’ remuneration

The remuneration of non-executive directors is periodically reviewed by the

Board, excluding the non-executive directors. The fees payable are as follows:

Fees payable

from 1 April 2006

£’000

Chairman 475

Deputy Chairman and Senior Independent Director 130

Basic Non-Executive Director fee 95

Chairmanship of Audit Committee 20

Chairmanship of Remuneration Committee 15

Chairmanship of Nominations and Governance Committee 10

GovernanceGovernance