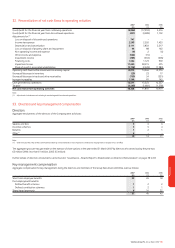

Vodafone 2007 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2007 125

Financials

Financial risk management

The Group’s treasury function provides a centralised service to the Group for

funding, foreign exchange, interest rate management and counterparty risk

management.

Treasury operations are conducted within a framework of policies and

guidelines authorised and reviewed annually by the Company’s Board of

directors, most recently on 25 September 2006. A Treasury Risk Committee,

comprising of the Group’s Chief Financial Officer, Group General Counsel and

Company Secretary, Group Treasurer and Director of Financial Reporting,

meets at least annually to review treasury activities and its members receive

management information relating to treasury activities on a quarterly basis.

In accordance with the Group treasury policy, a quorum for meetings is four

members and either the Chief Financial Officer or Group General Counsel and

Company Secretary must be present at each meeting. The Group accounting

function, which does not report to the Group Treasurer, provides regular

update reports of treasury activity to the Board of directors. The Group’s

internal auditors review the internal control environment regularly.

The Group uses a number of derivative instruments that are transacted, for

risk management purposes only, by specialist treasury personnel. There has

been no significant change during the financial year, or since the end of the

year, to the types of financial risks faced by the Group or the Group’s

approach to the management of those risks.

Capital management

The Group’s policy is to borrow centrally, using a mixture of long term and

short term capital market issues and borrowing facilities, to meet anticipated

funding requirements. These borrowings, together with cash generated from

operations, are on-lent or contributed as equity to certain subsidiaries. The

Board of directors has approved three debt protection ratios, being: net

interest to operating cash flow (plus dividends from associated undertakings);

retained cash flow (operating cash flow plus dividends from associated

undertakings less interest, tax, dividends to minorities and equity dividends)

to net debt; and operating cash flow (plus dividends from associated

undertakings) to net debt.

These internal ratios establish levels of debt that the Group should not

exceed other than for relatively short periods of time and are shared with

the Group’s debt rating agencies, being Moody’s, Fitch Ratings and Standard

& Poor’s.

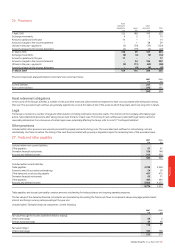

Liquidity risk

As at 31 March 2007, the Group had $10.9 billion committed undrawn bank

facilities and $15 billion and £5 billion commercial paper programmes,

supported by the $10.9 billion committed bank facilities, available to manage

its liquidity. The Group uses commercial paper and bank facilities to manage

short term liquidity and manages long term liquidity by raising funds on

capital markets.

Market risk

Interest rate management

Under the Group’s interest rate management policy, interest rates on

monetary assets and liabilities denominated in euros, sterling and US dollars

are maintained on a floating rate basis, unless the forecast interest charge for

the next eighteen months is material in relation to forecast results, in which

case rates are fixed. Where assets and liabilities are denominated in other

currencies, interest rates may also be fixed. In addition, fixing is undertaken

for longer periods when interest rates are statistically low.

At 31 March 2007, 29% (2006: 29%) of the Group’s gross borrowings were

fixed for a period of at least one year. A one hundred basis point fall or rise

in market interest rates for all currencies in which the Group had

borrowings at 31 March 2007 would reduce or increase profit before tax by

approximately £24 million (2006: increase or reduce by £91 million),

including mark-to-market revaluations of interest rate and other derivatives

and the potential interest on outstanding tax issues. There would be no

material impact on equity.

Foreign exchange management

As Vodafone’s primary listing is on the London Stock Exchange, its share price is

quoted in sterling. Since the sterling share price represents the value of its

future multi-currency cash flows, principally in euro, sterling and US dollars, the

Group has a policy to hedge external foreign exchange risks on transactions

denominated in other currencies above certain de minimis levels. As the

Group’s future cash flows are increasingly likely to be derived from emerging

markets, it is likely that more debt in emerging market currencies will be drawn.

The Group also maintains the currency of debt and interest charges in

proportion to its expected future principal multi-currency cash flows. As such,

at 31 March 2007, 135% of net debt was denominated in currencies other than

sterling (107% euro, 20% US dollar and 8% other), whilst 35% of net debt had

been purchased forward in sterling in anticipation of sterling denominated

shareholder returns via dividends. This allows euro, US dollar and other debt to

be serviced in proportion to expected future cash flows and, therefore, provides

a partial hedge against income statement translation exposure, as interest

costs will be denominated in foreign currencies. Yen debt is used as a hedge

against the value of yen assets as the Group has minimal yen cash flows. A

relative strengthening in the value of sterling against certain currencies in

which the Group maintains cash and cash equivalents has resulted in a

decrease in cash and cash equivalents of £315 million from currency

translation differences.

The Group recognises foreign exchange movements in equity for the

translation of net investment hedging instruments and balances treated as

investments in foreign operations. However, there is no net impact on equity

for exchange rate movements as there would be an offset in the currency

translation of the foreign operation.

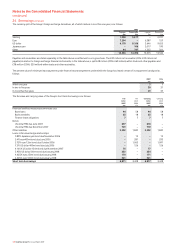

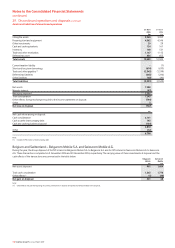

The following table details the Group’s sensitivity of the Group’s adjusted

operating profit to a strengthening of the Group’s major currencies in which it

transacts. Adjusted operating profit is defined as operating profit before non-

operating income of associated undertakings, impairment losses and other

income and expense. The percentage movement applied to each currency is

based on the average movements in the previous three reporting periods. The

analysis has been performed based on the movement occurring at the start of

the reporting period.

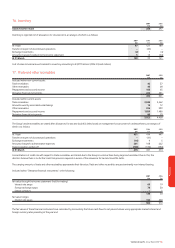

2007

£m

EUR 3% change

Adjusted operating profit 175

USD 8% change

Adjusted operating profit 176

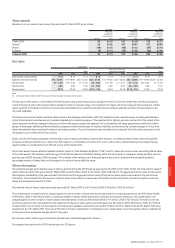

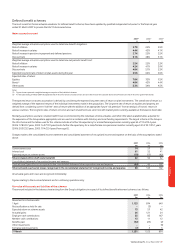

Credit risk

The Group considers its maximum exposure to credit risk to be as follows:

2007 2006

£m £m

Bank deposits 827 948

Money market fund investments 5,525 1,841

Commercial paper investments 1,129 –

Derivative financial instruments 304 310

Trade receivables 2,886 2,499

10,671 5,598

The majority of the Group’s trade receivables are due for maturity within

90 days and largely comprise amounts receivable from consumers and

business customers.

Concentrations of credit risk with respect to trade receivables are limited due to

the Group’s customer base being large and unrelated. Due to this,

management believes there is no further credit risk provision required in excess

of the normal provision for bad and doubtful receivables (note 17).