Vodafone 2007 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

126 Vodafone Group Plc Annual Report 2007

Notes to the Consolidated Financial Statements

continued

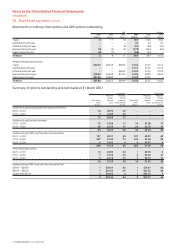

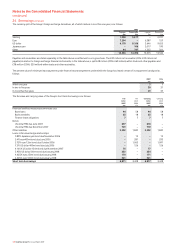

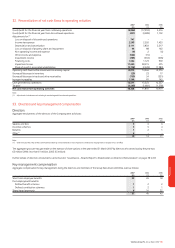

24. Borrowings continued

The Group has investments in preferred equity and a subordinated loan

received as part of the disposal of Vodafone Japan to SoftBank in the 2007

financial year. The carrying value of those investments at 31 March 2007 was

£1,046 million.

The deposits shown in the table equate to the principal of the amount

deposited. The foreign exchange transactions and interest rate swaps shown

in the table have been marked-to-market.

In respect of financial instruments used by the Group’s treasury function,

the aggregate credit risk the Group may have with one counterparty is

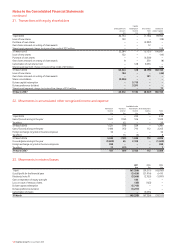

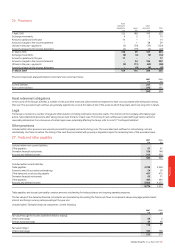

31 March of the previous year. The Group has chosen to recognise actuarial

gains and losses in the period in which they arise through the statement of

recognised income and expense. Payments to defined contribution schemes

are charged as an expense as they fall due.

In the UK, the majority of the UK employees are members of the Vodafone

Group Pension Scheme (the “main scheme”), which was closed to new

entrants from 1 January 2006. This is a tax approved final salary defined

benefit scheme, the assets of which are held in an external trustee-

administered fund. The investment policy and strategy of the scheme is the

responsibility of the plan trustees, who are required to consult with the

Company as well as take independent advice on key investment issues. In

setting the asset allocation, the trustees take into consideration a number of

criteria, including the key characteristics of the asset classes, expected risk

and return, the structure and term of the member liabilities, diversification of

assets, minimum funding and solvency requirements, as well as the

Company’s input on contribution requirements. The plan has a relatively low

level of pensioner liabilities already in payment, meaning that the overall

duration of plan liabilities is long term. The plan’s target asset allocation is

80% in equity investments (half of which is to be in UK equities) and 20% in

corporate bonds.

The main scheme is subject to quarterly funding updates by independent

actuaries and to formal actuarial valuations at least every three years. The

most recent formal triennial valuation of this scheme was carried out as at 31

March 2004. The triennial valuation of the scheme as at 31 March 2007 is

currently in progress.

limited by reference to the long term credit ratings assigned for that

counterparty by Moody’s, Fitch Ratings and Standard & Poor’s. While these

counterparties may expose the Group to credit losses in the event of non-

performance, it considers the possibility of material loss to be acceptable

because of this policy.

The Group targets low single A long term credit ratings. Credit ratings are not

a recommendation to purchase, hold or sell securities, in as much as ratings

do not comment on market price or suitability for a particular investor, and

are subject to revision or withdrawal at any time by the assigning rating

organisation. Each rating should be evaluated independently.

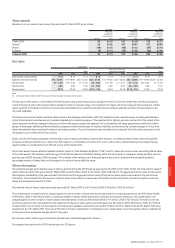

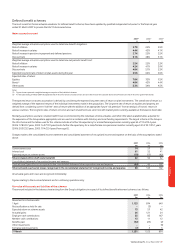

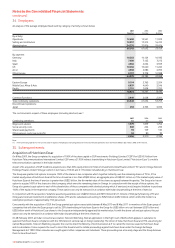

25. Post employment benefits

Background

As at 31 March 2007, the Group operated a number of pension plans for the

benefit of its employees throughout the world, which vary depending on the

conditions and practices in the countries concerned. The Group’s pension

plans are provided through both defined benefit and defined contribution

arrangements. Defined benefit schemes provide benefits based on the

employees’ length of pensionable service and their final pensionable salary

or other criteria. Defined contribution schemes offer employees individual

funds that are converted into benefits at the time of retirement.

The principal defined benefit pension scheme of the Group is in the United

Kingdom. In addition, the Group operates defined benefit schemes in

Germany, Greece, Ireland, Italy, Turkey and the United States. Defined

contribution pension schemes are provided in Australia, Egypt, Germany,

Greece, Hungary, Ireland, Italy, Malta, the Netherlands, New Zealand, Portugal,

Spain, the United Kingdom and the United States. There is a post retirement

medical plan in the United States for a small closed group of participants. The

Group also operated a defined benefit scheme for employees of its operation

in Japan. Both the Japanese operation and the related pension obligations

were disposed of on 27 April 2006.

The Group accounts for its pension schemes in accordance with IAS 19,

Employee Benefits (“IAS19”). Scheme liabilities are assessed using the

projected unit funding method and applying the principal actuarial

assumptions set out below. Assets are valued at market value.

The measurement date for the Group’s pension assets and obligations is

31 March. The measurement date for the Group’s net periodic cost is

Income statement expense

2007 2006 2005

£m £m £m

Defined contribution schemes 32 28 18

Defined benefit schemes 62 52 52

Total amount charged to the income statement (note 34) 94 80 70