Vodafone 2007 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

136 Vodafone Group Plc Annual Report 2007

Notes to the Consolidated Financial Statements

continued

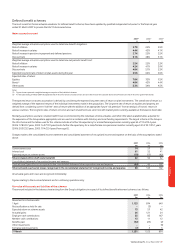

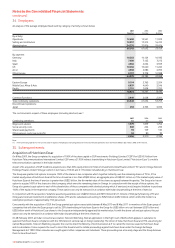

34. Employees

An analysis of the average employee headcount by category of activity is shown below.

2007 2006 2005

Number Number Number

By activity:

Operations 12,630 12,541 11,923

Selling and distribution 18,937 17,315 16,410

Administration 34,776 31,816 29,426

66,343 61,672 57,759

By segment:

Germany 10,383 10,124 10,183

Italy 7,030 7,123 7,213

Spain 4,066 4,052 3,949

UK 10,256 10,620 11,260

Arcor 4,038 4,086 4,095

Other Europe 8,797 9,778 10,388

44,570 45,783 47,088

Eastern Europe 9,194 5,763 2,204

Middle East, Africa & Asia 6,839 4,640 3,546

Pacific 2,791 2,858 2,720

18,824 13,261 8,470

Common Functions 2,949 2,628 2,201

Total continuing operations 66,343 61,672 57,759

Discontinued operations:

Japan 233 2,733 3,033

The cost incurred in respect of these employees (including directors) was:(1)

2007 2006 2005

Continuing operations: £m £m £m

Wages and salaries 1,979 1,879 1,752

Social security costs 300 242 233

Share based payments 93 109 130

Other pension costs (see note 25) 94 80 70

2,466 2,310 2,185

Note:

(1) From continuing operations. The cost incurred in respect of employees (including directors) from discontinued operations was £16 million (2006: £155 million, 2005: £191 million).

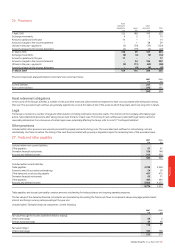

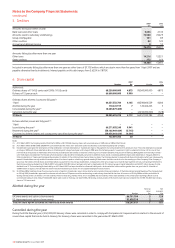

35. Subsequent events

Acquisition of Hutchison Essar

On 8 May 2007, the Group completed its acquisition of 100% of the share capital in CGP Investments (Holdings) Limited (“CGP”) for US$10.9 billion from

Hutchison Telecommunications International Limited. CGP owns a 51.95% indirect shareholding in Hutchison Essar Limited (“Hutchison Essar”), a mobile

telecommunications operator in the Indian market.

As part of its acquisition of CGP, Vodafone acquired a less than 50% equity interest in Telecom Investments India Private Limited (“TII”) and in Omega Telecom

Holdings Private Limited (“Omega”), which in turn have a 19.54% and 5.11% indirect shareholding in Hutchison Essar.

The Group was granted call options to acquire 100% of the shares in two companies which together indirectly own the remaining shares of TII for, if the

market equity value of Hutchison Essar at the time of exercise is less than US$25 billion, an aggregate price of US$431 million or, if the market equity value of

Hutchison Essar at the time of exercise is greater than US$25 billion, the fair market value of the shares as agreed between the parties. The Group also has an

option to acquire 100% of the shares in a third company, which owns the remaining shares in Omega. In conjunction with the receipt of these options, the

Group also granted a put option to each of the shareholders of these companies with identical pricing which, if exercised, would require Vodafone to purchase

100% of the equity in the respective company. These options can only be exercised in accordance with Indian law prevailing at the time of exercise.

In conjunction with the acquisition, Vodafone assumed guarantees over US$450 million and INR10 billion (£121 million) of third party financing of TII and

Omega and received investments in preference shares of TII and its subsidiaries amounting to INR25 billion (£292 million), which entitle the holder to a

redemption premium of approximately 13% per annum.

Concurrently with the acquisition of CGP, the Group granted put options exercisable between 8 May 2010 and 8 May 2011 to members of the Essar group of

companies that will allow the Essar group to sell its 33% shareholding in Hutchison Essar to the Group for US$5 billion or to sell between US$1 billion and

US$5 billion worth of Hutchison Essar shares to the Group at an independently appraised fair market value. As with the above call and put options, this put

option can only be exercised in accordance with Indian law prevailing at the time of exercise.

On 28 February 2007, an Indian consumer association, Telecom Watchdog, filed an application in the High Court of Delhi which appears in substance to

question Hutchison Essar’s compliance with the 74% telecom sectoral cap on foreign ownership. The Union of India, Hutchison Essar and HTIL are among 22

named Respondents. Telecom Watchdog requests the court to direct the Ministry of Communication & IT to cancel the licences issued to Hutchison Essar

and its subsidiaries. It also requests the court to direct the Government to initiate proceedings against Hutchison Essar under the Foreign Exchange

Management Act 1999. Other remedies are sought against other companies and individuals. These proceedings are at an early stage and the Group believes

them to be without merit.