Vodafone 2007 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2007 107

Financials

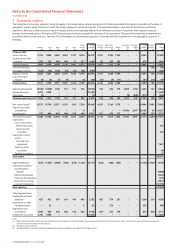

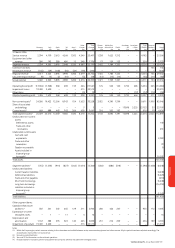

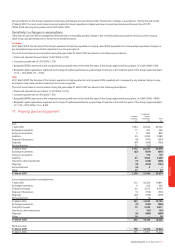

8. (Loss)/earnings per share 2007 2006 2005

Millions Millions Millions

Weighted average number of shares for basic (loss)/earnings per share 55,144 62,607 66,196

Effect of dilutive potential shares: restricted shares and share options – – 231

Weighted average number of shares for diluted (loss)/earnings per share 55,144 62,607 66,427

£m £m £m

(Loss)/earnings for basic and diluted earnings per share:

Continuing operations (4,932) (17,318) 5,375

Discontinued operations (494) (4,598) 1,035

Total (5,426) (21,916) 6,410

Pence per Pence per Pence per

share share share

Basic (loss)/earnings per share:

(Loss)/profit from continuing operations (8.94) (27.66) 8.12

(Loss)/profit from discontinued operations(1) (0.90) (7.35) 1.56

(Loss)/profit for the financial year (9.84) (35.01) 9.68

Diluted (loss)/earnings per share:(2)

(Loss)/profit from continuing operations (8.94) (27.66) 8.09

(Loss)/profit from discontinued operations(1) (0.90) (7.35) 1.56

(Loss)/profit for the financial year (9.84) (35.01) 9.65

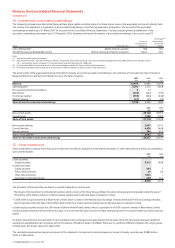

£m £m £m

Basic and diluted (loss)/earnings per share for continuing operations is stated inclusive of the following items:

Impairment losses (note 10) (11,600) (23,515) (475)

Other income and expense 502 15 –

Share of associated undertakings non-operating income (note 14) 317 –

Non-operating income and expense 4(2) (7)

Changes in the fair value of equity put rights and similar arrangements (note 5)(3)(4) 2(161) (67)

Foreign exchange(4)(5) (41) ––

Tax on the above items (13) – (3)

Pence per Pence per Pence per

share share share

Impairment losses (21.04) (37.56) (0.72)

Other income and expense 0.91 0.02 –

Share of associated undertakings non-operating income 0.01 0.03 –

Non-operating income and expense 0.01 – (0.01)

Changes in the fair value of equity put rights and similar arrangements (note 5)(3)(4) –(0.26) (0.10)

Foreign exchange(4)(5) (0.07) ––

Tax on the above items (0.02) ––

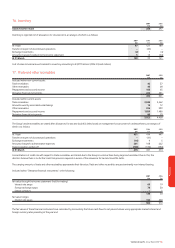

Notes:

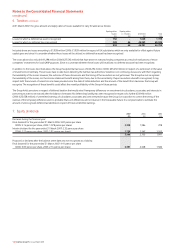

(1) See note 29 for further information on discontinued operations, including the per share effect of discontinued operations.

(2) In the year ended 31 March 2007, 215 million (2006: 183 million; 2005: nil) shares have been excluded from the calculation of diluted loss per share as they are not dilutive.

(3) Includes the fair value movement in relation to the potential put rights held by Telecom Egypt over its 25.5% interest in Vodafone Egypt and the fair value of a financial liability in relation to the minority

partners of Arcor, the Group’s non-mobile operation in Germany.

Following the sale of 16.9% of Vodafone Egypt to Telecom Egypt in the 2005 financial year, the Group signed a shareholder agreement with Telecom Egypt setting out the basis under which the Group

and Telecom Egypt would each contribute a 25.5% interest in Vodafone Egypt to a newly formed company to be 50% owned by each party. Within this shareholder agreement, Telecom Egypt was

granted a put option over its entire interest in Vodafone Egypt giving Telecom Egypt the right to put its shares back to the Group at deemed fair value. In the 2006 financial year, the shareholder

agreement between Telecom Egypt and Vodafone expired and the associated rights and obligations contained in the shareholder agreement terminated, including the aforementioned put option.

However, the original shareholders agreement contained an obligation on both parties to use reasonable efforts to renegotiate a revised shareholder agreement for their direct shareholding in Vodafone

Egypt on substantially the same terms as the original agreement. During the year, the parties agreed to abandon such efforts and as such the financial liability relating to the initial shareholder

agreement was released from the Group’s balance sheet. Fair value movements are determined by reference to the quoted share price of Vodafone Egypt. For the 2007 financial year, a credit of

£34 million was recognised.

The capital structure of Arcor provides all partners, including Vodafone, the right to withdraw capital from 31 December 2026 onwards and this right in relation to the minority partners has been

recognised as a financial liability. Fair value movements are determined by reference to a calculation of enterprise value of the partnership. For the year ended 31 March 2007, a charge of £23 million

(2006: £56 million; 2005: £nil) was recognised.

The valuation of these financial liabilities is inherently unpredictable and changes in the fair value could have a material impact on the future results and financial position of Vodafone.

(4) Changes in the fair value of equity put rights and similar arrangements and foreign exchange are included in investment income and financing costs.

(5) Comprises the foreign exchange reflected in the income statement in relation to certain intercompany balances, and the foreign exchange on financial instruments received as consideration in the

disposal of Vodafone Japan to SoftBank, which completed in April 2006.