Vodafone 2007 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8Vodafone Group Plc Annual Report 2007

Delivering on Our Strategic Objectives

The Group’s strategy is to drive

additional usage and revenue from

core mobile voice and messaging

services, which represents around

80% of revenue in Europe today, and

to reduce its cost base.

Today, around one third of voice traffic

is carried over mobile networks, with

Vodafone’s customers only using their

mobiles for approximately 140

minutes on average per month. This

provides a significant opportunity to

drive greater voice usage onto mobile.

The Group has launched a number of

initiatives to achieve this through

larger minute bundles, innovative

tariffs, prepaid to contract migrations

and targeted promotions, with a key

focus also on leveraging Vodafone’s

market leading presence across Europe

in the business segment, which

represents around 25% of service

revenue. Vodafone’s unique presence

also allows it to offer Pan-European

products and services such as Vodafone

Passport for roaming customers.

Whilst usage growth in the year was

strong, pricing pressure continues to

be high and the Group’s key focus is

to improve the overall price

elasticity of its offerings in the

market place.

The Group has established several core

cost reduction programmes,

leveraging the benefits of its local and

regional scale. Key initiatives have

focused on the outsourcing and

centralisation of certain activities, as

well as network sharing arrangements

with other operators.

Summer promotions driving

usage in Italy

Over 3 million customers benefited

from successful summer promotions

in Italy which stimulated voice and

messaging usage and revenue. For a

monthly fee and per call set up

charge, customers were able to make

calls and send messages for free to

other Vodafone customers. Customers

in the voice promotion generated 22%

more ARPU than before and 9% more

in the messaging promotion.

The communications environment is

constantly evolving and Vodafone is

at the forefront of this change.

Customers are increasingly looking

for one supplier to address all their

needs, whether that is for mobile or

fixed services.

The Group is increasingly targeting

its propositions on replacing

traditional fixed line providers in the

home or office, as well as developing

new and innovative ways

for customers to enjoy the benefits

of mobility.

Vodafone is already delivering

broadband and data services to

customers and, together with

industry leading partners, will

shortly be driving new revenue

streams from opening up the

internet to the mobile and from

mobile advertising.

In total, the Group expects its total

communications initiatives to

represent approximately 20% of

Group revenue in three years’ time,

increasing from approximately 10%

for the 2007 financial year.

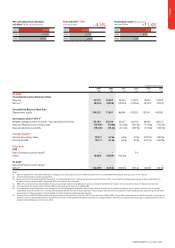

Total communications initiatives

(share of Group revenue, %)

The Group’s focus is to build on its

strong track record of creating value

in emerging markets where average

market penetration is relatively low,

offering significant customer and

revenue growth potential.

In the last 12 months, Vodafone has

gained control of businesses in

Turkey, with a population of 70 million,

and in India, with a population of

1.1 billion, adding to the Group’s

existing emerging market presence in

parts of the Middle East, Africa and

Eastern Europe.

During the 2007 financial year, the

Group saw strong performances in

Egypt, Romania and South Africa,

with Turkey performing ahead of the

business plan at the time of the

acquisition.

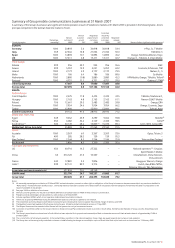

As a result of the Group’s increased

presence in emerging markets, the

proportion of Group EBITDA from

the EMAPA region is expected to

increase from 19% this year to

around 33% in five years’ time.

Vodafone will continue to seek

selective opportunities to increase

its emerging markets footprint as

well as taking opportunities to

increase its stakes in existing

markets, with a view to gaining

control over time.

Romania: Market leader

for business services

Vodafone extended its leadership in

the business segment in Romania

during the year, with 38% growth in

business customers giving a market

share of 42%. Key to success has

been its integrated mobile and fixed

communications solution which

delivered over 50% revenue growth

in the year and now represents one

third of business revenues.

Revenue stimulation and cost reduction in Europe

Innovate and deliver on our customers’ total communications needs

Deliver strong growth in emerging markets

EMAPA region – annual growth for 2007 Reported Organic

Closing customers 55% 27%

Revenue 41% 21%

Where applicable, growth percentages are stated on local currency and are calculated by applying

the Group’s current equity interest to the whole of the 2007 and 2006 financial years.

10% 20%

2007 2010

Total communications initiatives principally include revenue

from data, fixed location services, DSL and advertising.

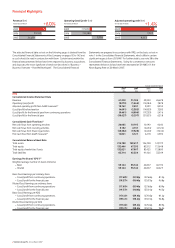

Outgoing voice revenue (% change)

2007

+8

+14

-17

+2

Average customer growth

Outgoing voice usage growth

per customer

Change in effective

outgoing price per minute

Outgoing voice revenue growth