Vodafone 2007 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

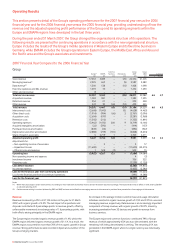

42 Vodafone Group Plc Annual Report 2007

Operating Results

continued

South Africa, whilst the continued rollout of the 3G network led to strong

growth in data revenue.

Bharti Airtel continued to perform well with strong growth in customers and

revenue, demonstrating the growth potential in the Indian market.

Pacific

Service revenue increased by 2.7%, with the impact of adverse foreign

exchange movements reducing reported growth by 7.3 percentage points.

In Australia, a continued focus on higher value customers delivered local

currency service revenue growth of 13.7%, with improvements in both

prepaid and contract ARPU. The performance in Australia more than offset

the reduced growth in local currency service revenue in New Zealand,

where local currency service revenue growth was 2.6% following a cut in

termination rates, which reduced reported service revenue growth by 4.1%.

After the negative impact of foreign exchange movements, reported service

revenue in New Zealand declined by 7.9%.

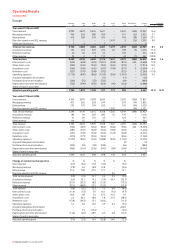

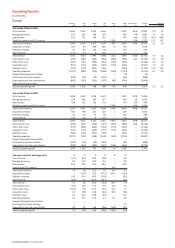

Adjusted operating profit

The impact of acquisitions, disposal and exchange rates on adjusted operating

profit is shown below.

Impact of Impact of

exchange acquisitions

Organic rates and disposal(1) Reported

growth Percentage Percentage growth

% points points %

Adjusted operating profit

Eastern Europe 49.2 (7.6) (37.1) 4.5

Middle East, Africa and Asia 18.5 (16.9) 31.1 32.7

Pacific 25.4 (11.8) – 13.6

EMAPA 24.3 (7.2) (1.1) 16.0

Note:

(1) Impact of acquisitions and disposal includes the impact of the change in consolidation status

of Bharti Airtel from a joint venture to an investment

Adjusted operating profit increased by 16.0%. On an organic basis, growth

was 24.3%, as the acquisitions and stake increases led to the rise in acquired

intangible asset amortisation reducing reported growth in operating profit.

These acquisitions, combined with the continued expansion of network

infrastructure in the region, including 3G and HSDPA upgrades, resulted in

higher depreciation charges. Organic growth in adjusted operating profit

was driven by a strong performance in Romania, Egypt, South Africa and the

Group’s associated undertaking in the US.

Eastern Europe

Interconnect costs increased by 46.3%, or 23.8% on an organic basis,

principally as a result of the higher usage in Romania. An ongoing

regulatory fee in Turkey amounting to 15% of revenue has increased other

direct costs compared to the 2006 financial year.

Acquisition costs fell as a percentage of service revenue throughout most of

Eastern Europe, with increased investment in the direct distribution channel

in Romania resulting in lower subsidies on handsets. Retention costs

decreased as a percentage of service revenue, but increased on an organic

basis due to a focus on retaining customers through loyalty programmes in

response to the increasing competition in Romania, which had a positive

impact on contract and prepaid churn.

Operating expenses increased by 1.0 percentage point as a percentage of

service revenue, primarily as a result of inflationary pressures in Romania

and investment in Turkey.

Middle East, Africa and Asia

Interconnect costs increased by 45.0%, or 26.8% on an organic basis, due to

the usage stimulation initiatives throughout the region.

Acquisition costs remained stable as a percentage of service revenue, whilst

retention costs increased, principally due to increased investment in

retaining customers in Egypt ahead of the forthcoming launch of services

by a new operator and in South Africa in response to the introduction of

mobile number portability during the year, with the provision of 3G and data

enabled device upgrades for contract customers and a loyalty point

scheme. Operating expenses remained stable as a percentage of service

revenue.

Pacific

The improved profitability in Australia was more than offset by the lower

profitability in New Zealand resulting from the increased cost of

telecommunications service obligation regulation, the impact of the

acquisition of ihug and adverse foreign exchange rates.

Acquisition and retention costs increased as a percentage of service

revenue due to the investment in higher value customers in Australia, which

also had a favourable impact on contract churn and were partially offset by

savings in network costs and operating expenses.

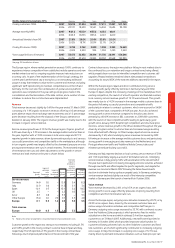

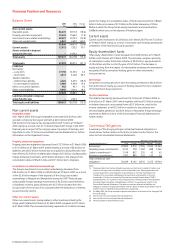

Associates

2007 % change

Verizon Verizon

Wireless Other Total Wireless

Share of result of associates £m £m £m £$

Operating profit 2,442 940 3,382 15.6 22.9

Interest (179) (27) (206) (12.3) (7.0)

Tax (125) (271) (396) 7.8 14.6

Minority interest (61) – (61) 1.7 6.7

2,077 642 2,719 19.9 27.6

2006

Verizon

Wireless Other Total

Share of result of associates £m £m £m

Operating profit 2,112 1,010 3,122

Interest (204) (23) (227)

Tax (116) (329) (445)

Minority interest (60) 8 (52)

1,732 666 2,398

% change

Verizon

Wireless

Verizon Wireless (100% basis) 2007 2006 £ $

Total revenue (£m) 20,860 18,875 10.5 17.4

Closing customers (’000) 60,716 53,020

Average monthly ARPU ($) 52.5 51.4

Blended churn (%) 13.9% 14.7%

Mobile non-voice service revenue

as a percentage of mobile service

revenue (%) 14.4% 8.9%

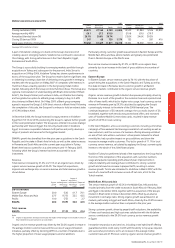

Verizon Wireless produced another year of record growth in organic net

additions, increasing its customer base by 7.7 million in the year ended

31 March 2007. The performance was particularly robust in the higher value

contract segment and was achieved in a market where the estimated

closing mobile penetration reached 80%.

The strong customer growth was achieved through a combination of higher

gross additions and improvements in Verizon Wireless’s customer loyalty,

with the latter evidenced through lower levels of churn. The 15.4% growth

in the average mobile customer base combined with a 2.1% increase in

ARPU resulted in a 17.8% increase in service revenue. ARPU growth was

achieved through the continued success of data services, driven

predominantly by data cards, wireless e-mail and messaging services.

Verizon Wireless’s operating profit also improved due to efficiencies in other

direct costs and operating expenses, partly offset by a higher level of

customer acquisition and retention activity.

Verizon Wireless continued to lay the foundations for future data revenue

growth through the launch of both CDMA EV-DO Rev A, an enhanced

wireless broadband service, and broadcast mobile TV services during the

first calendar quarter of 2007. In addition, Verizon Wireless consolidated its

spectrum position during the year with the acquisition of spectrum through

the FCC’s Advanced Wireless Services auction for $2.8 billion.