Vodafone 2007 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2007 35

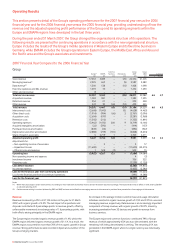

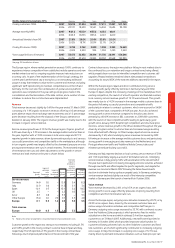

Investment income and financing costs

2007 2006 Change

£m £m %

Net financing costs before dividends

from investments(1) (435) (318) 36.8

Potential interest charges arising on

settlement of outstanding tax issues (406) (329) 23.4

Changes in the fair value of equity put

rights and similar arrangements 2(161) 101.2

Dividends from investments 57 41 39.0

Foreign exchange(2) (41) ––

Net financing costs (823) (767) 7.3

Notes:

(1) Includes a one off gain of £86 million related to the Group renegotiating its investments in

SoftBank

(2) Comprises foreign exchange differences reflected in the income statement in relation to certain

intercompany balances and the foreign exchange differences on financial instruments

received as consideration in the disposal of Vodafone Japan to SoftBank, which completed in

April 2006

Net financing costs before dividends from investments increased by 36.8%

to £435 million as increased financing costs, reflecting higher average debt

and interest rates, and losses on mark to market adjustments on financial

instruments more than offset higher investment income resulting from new

investments in SoftBank, which arose on the sale of Vodafone Japan during

the year, including an £86 million gain related to the renegotiation of these

investments. At 31 March 2007, the provision for potential interest charges

arising on settlement of outstanding tax issues was £1,213 million.

Taxation

The effective tax rate, exclusive of impairment losses, is 26.3% (2006: 27.5%),

which is lower than the Group’s weighted average tax rate due to the

resolution of a number of historic tax issues with tax authorities and additional

tax deductions in Italy. The prior year benefited from the tax treatment of a

share repurchase in Vodafone Italy and favourable tax settlements.

A significant event in the year was a European Court decision in respect of

the UK Controlled Foreign Company (“CFC”) legislation, following which

Vodafone has not accrued any additional provision in respect of the

application of UK CFC legislation to the Group.

The effective tax rate including impairment losses is (101.7)% compared to

(16.0)% for the prior year. The negative tax rates arise from no tax benefit

being recorded for the impairment losses of £11,600m (2006: £23,515m).

Basic loss per share

Basic loss per share from continuing operations decreased from 27.66 pence

to a loss per share of 8.94 pence for the current year. The basic loss per share

is after a charge of 21.04 pence per share (2006: 37.56 pence per share) in

relation to an impairment of the carrying value of goodwill.

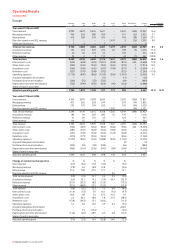

Operating result

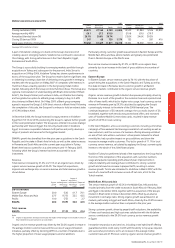

Adjusted operating profit increased by 1.4% to £9,531 million, with organic

growth of 4.2%. The net impact of acquisitions and disposals and

unfavourable exchange rate movements reduced reported growth by

0.3 percentage points and 2.5 percentage points, respectively, with both

effects arising principally in the EMAPA region. The Europe region declined

4.7% on an organic basis, whilst the EMAPA region recorded organic growth of

24.3%. Strong performances were delivered in Spain, the US and a number of

emerging markets.

Adjusted operating profit is stated after charges in relation to regulatory fines

in Greece of £53 million and restructuring costs within common functions,

Vodafone Germany, Vodafone UK and Other Europe of £79 million. The

EMAPA region accounted for all of the Group’s reported and organic growth in

adjusted operating profit.

Adjusted operating profit for the 2007 financial year was principally

denominated in euro (55%), US dollar (22%) and sterling (5%), with the

remaining 18% being denominated in other currencies.

The acquisitions and stake increases led to the rise in acquired intangible

asset amortisation, and these acquisitions, combined with the continued

expansion of network infrastructure in the region, resulted in higher

depreciation charges.

The Group’s share of results from associates increased by 13.0%, mainly due

to Verizon Wireless which reported record growth in net additions and

increased ARPU. The growth in Verizon Wireless was offset by a reduction in

the Group’s share of results from its other associated undertakings, which

fell due to the disposals of Belgacom Mobile S.A. and Swisscom Mobile A.G.

as well as the impact of reductions in termination rates and intense

competition experienced by SFR in France.

Statutory operating loss was £1,564 million compared with a loss of £14,084

million in the previous financial year following lower impairment charges. In

the year ended 31 March 2007, the Group recorded an impairment charge of

£11,600 million (2006: £23,515 million) in relation to the carrying value of

goodwill in the Group’s operations in Germany (£6,700 million) and Italy

(£4,900 million). The impairment in Germany resulted from an increase in

long term interest rates, which led to higher discount rates, along with

increased price competition and continued regulatory pressures in the

German market. The impairment in Italy resulted from an increase in long

term interest rates and the estimated impact of legislation cancelling the

fixed fees for the top up of prepaid cards and the related competitive response

in the Italian market. The increase in interest rates accounted for £3,700

million of the reduction in value during the year.

Certain of the Group’s cost reduction and revenue stimulation initiatives are

managed centrally within common functions. Consequently, operating and

capital expenses are incurred centrally and recharged to the relevant

countries, primarily in Europe. This typically results in higher operating

expenses with a corresponding reduction in depreciation for the countries

concerned.

Other income and expense for the year ended 31 March 2007 included the

gains on disposal of Belgacom Mobile S.A. and Swisscom Mobile A.G.,

amounting to £441 million and £68 million, respectively.

PerformancePerformance