Vodafone 2007 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.98 Vodafone Group Plc Annual Report 2007

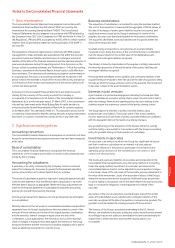

Notes to the Consolidated Financial Statements

continued

2. Significant accounting policies continued

Changes in the fair value of monetary securities denominated in foreign

currency classified as available for sale are analysed between translation

differences and other changes in the carrying amount of the security.

Translation differences are recognised in the income statement and other

changes in carrying amount are recognised in equity.

Translation differences on non-monetary financial assets and liabilities are

reported as part of the fair value gain or loss. Translation differences on non-

monetary financial assets, such as investments in equity securities classified

as available for sale, are included in the fair value reserve in equity.

For the purpose of presenting Consolidated Financial Statements, the

assets and liabilities of entities with a functional currency other than

sterling are expressed in sterling using exchange rates prevailing on the

balance sheet date. Income and expense items and cash flows are

translated at the average exchange rates for the period and exchange

differences arising are recognised directly in equity. Such translation

differences are recognised in the income statement in the period in which

a foreign operation is disposed of.

Goodwill and fair value adjustments arising on the acquisition of a foreign

operation are treated as assets and liabilities of the foreign operation and

translated accordingly.

In respect of all foreign operations, any exchange differences that have

arisen before 1 April 2004, the date of transition to IFRS, are deemed to be

nil and will be excluded from the determination of any subsequent profit or

loss on disposal.

Borrowing costs

All borrowing costs are recognised in the income statement in the period in

which they are incurred.

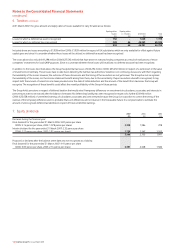

Post employment benefits

For defined benefit retirement plans, the difference between the fair value of

the plan assets and the present value of the plan liabilities is recognised as an

asset or liability on the balance sheet. During the year ended 31 March 2006,

the Group early adopted the amendment to IAS 19, “Employee Benefits”,

issued by the IASB on 16 December 2004 and applied it from 1 April 2004.

Accordingly, actuarial gains and losses are taken to the statement of

recognised income and expense. For this purpose, actuarial gains and losses

comprise both the effects of changes in actuarial assumptions and

experience adjustments arising because of differences between the previous

actuarial assumptions and what has actually occurred.

Other movements in the net surplus or deficit are recognised in the income

statement, including the current service cost, any past service cost and the

effect of any curtailment or settlements. The interest cost less the expected

return on assets is also charged to the income statement. The amount

charged to the income statement in respect of these plans is included within

operating costs or in the Group’s share of the results of equity accounted

operations as appropriate.

The values attributed to plan liabilities are assessed in accordance with the

advice of independent qualified actuaries.

The Group’s contributions to defined contribution pension plans are charged

to the income statement as they fall due.

Cumulative actuarial gains and losses as at 1 April 2004, the date of transition

to IFRS, have been recognised in the balance sheet.

Taxation

Income tax expense represents the sum of the current tax payable and

deferred tax.

Current tax payable or recoverable is based on taxable profit for the year.

Taxable profit differs from profit as reported in the income statement because

some items of income or expense are taxable or deductible in different years

or may never be taxable or deductible. The Group’s liability for current tax is

calculated using UK and foreign tax rates and laws that have been enacted or

substantively enacted by the balance sheet date.

Deferred tax is the tax expected to be payable or recoverable in the future

arising from temporary differences between the carrying amounts of assets

and liabilities in the financial statements and the corresponding tax bases

used in the computation of taxable profit. It is accounted for using the

balance sheet liability method. Deferred tax liabilities are generally

recognised for all taxable temporary differences and deferred tax assets are

recognised to the extent that it is probable that taxable profits will be

available against which deductible temporary differences can be utilised.

Such assets and liabilities are not recognised if the temporary difference

arises from goodwill or from the initial recognition (other than in a business

combination) of assets and liabilities in a transaction that affects neither the

taxable profit nor the accounting profit.

Deferred tax liabilities are recognised for taxable temporary differences arising

on investments in subsidiaries and associates, and interests in joint ventures,

except where the Group is able to control the reversal of the temporary

difference and it is probable that the temporary difference will not reverse in

the foreseeable future.

The carrying amount of deferred tax assets is reviewed at each balance

sheet date and reduced to the extent that it is no longer probable that

sufficient taxable profits will be available to allow all or part of the asset to

be recovered.

Deferred tax is calculated at the tax rates that are expected to apply in the

period when the liability is settled or the asset realised, based on tax rates

that have been enacted or substantively enacted by the balance sheet date.

Tax assets and liabilities are offset when there is a legally enforceable right to

set off current tax assets against current tax liabilities and when they either

relate to income taxes levied by the same taxation authority on either the

same taxable entity or on different taxable entities which intend to settle the

current tax assets and liabilities on a net basis.

Tax is charged or credited to the income statement, except when it relates to

items charged or credited directly to equity, in which case the tax is also

recognised directly in equity.

Financial instruments

Financial assets and financial liabilities, in respect of financial instruments, are

recognised on the Group’s balance sheet when the Group becomes a party to

the contractual provisions of the instrument.

The Group has applied the requirements of IFRS to financial instruments for

all periods presented and has not taken advantage of any exemptions

available to first time adopters of IFRS in this respect. During the year ended

31 March 2006, the Group early adopted IFRS 7, “Financial Instruments:

Disclosures”, amendments to IAS 39, “Financial Instruments: Recognition and

Measurement” and IFRS 4, “Insurance Contracts”, regarding “Financial

Guarantee Contracts” and amendments to IAS 39 regarding “The Fair Value

Option” and “Cash Flow Hedge Accounting of Forecast Intragroup

Transactions” and applied them from 1 April 2004.

Trade receivables

Trade receivables do not carry any interest and are stated at their nominal

value as reduced by appropriate allowances for estimated irrecoverable

amounts. Estimated irrecoverable amounts are based on the ageing of the

receivable balances and historical experience. Individual trade receivables are

written off when management deems them not to be collectible.