Vodafone 2007 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2007 33

Performance

Key Performance Indicators

The Board and the Executive Committee monitor the

Group’s progress against its strategic objectives and the

financial performance of the Group’s operations on a

regular basis. Performance is assessed against the

strategy, budgets and forecasts using financial and

non-financial measures.

The following section details the most significant Key

Performance Indicators (“KPIs”) used by the Group,

describing their purpose, the basis of calculation and

the source of the underlying data. Definitions of the

key terms are provided on page 159.

Financial

The Group uses the following primary measures to assess the performance

of the Group and its individual businesses. A number of these measures at a

Group level are presented on an organic basis, which provides an

assessment of underlying growth excluding the effect of business

acquisitions and disposals and changes in exchange rates. Financial

measures presented on an organic basis are non-GAAP financial measures.

For more information on these measures and the basis of calculation of

organic growth see “Performance – Non-GAAP Information” on page 62.

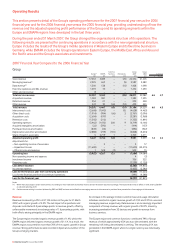

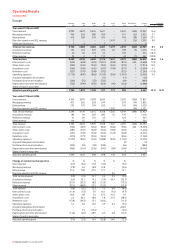

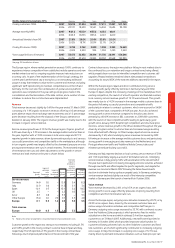

Revenue

Revenue and its growth for the Group, and its regions, covering the 2007,

2006 and 2005 financial years, is reviewed in “Performance – Operating

Results” on pages 34 to 51.

Revenue and revenue growth are used for internal performance analysis and

by investors to assess progress against outlook statements provided

externally by the Group.

Adjusted operating profit

Adjusted operating profit is used by the Group for internal performance

analysis as it represents the underlying operating profitability of the Group’s

businesses. The measure is presented both for the Group and its regions,

covering the 2007, 2006 and 2005 financial years, in “Performance –

Operating Results” on pages 34 to 51. The basis of calculation, along with

an analysis of why the Group believes it is a useful measure, is provided in

the section titled “Performance – Non-GAAP Information” on page 62.

Free cash flow

Free cash flow provides an evaluation of the Group’s liquidity and the cash

generated by the Group’s operations. The calculation of free cash flow,

along with an analysis of why the Group believes it is a useful measure, is

provided in the section titled “Performance – Non-GAAP Information” on

page 62. The Group has provided an outlook for free cash flow in the 2008

financial year on page 59.

Operational

Certain operational measures relating to customers and revenue for the

Group and its regions, covering the 2007, 2006 and 2005 financial years, are

provided in “Performance – Operating Results” on pages 34 to 51, with the

exception of customer delight. These measures are commonly used in the

mobile communications industry.

Customers

The Group highly values its customers and strives to delight them. As a result,

customer based KPIs are important measures for internal performance

analysis. Management also believes that some of these measures provide

useful information for investors regarding the success of the Group’s

customer acquisition and retention activities. For customer numbers and

churn, the data used to calculate the KPIs is derived from the customer

relationship management systems of each of the Group’s operations.

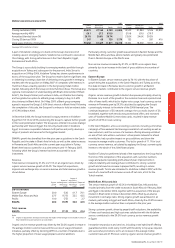

Customer numbers

The Group prepares customer numbers on a venture, proportionate and

controlled or jointly controlled basis for its mobile operations. A summary of

the customer numbers on all bases is presented in “Business Overview –

Where We Operate” on page 13.

Churn

Churn represents the disconnection rate of customers in each of the Group’s

mobile operations. It is calculated as the total gross customer disconnections

in the period divided by the average total customers in the period. Churn rates

stated in this Annual Report are calculated for the entire financial year.

Customer delight

The Group uses a proprietary ‘customer delight’ system to track customer

satisfaction across its controlled markets and jointly controlled market in

Italy. More information on the benefits of the system are provided in

“Business Overview – How We Deliver Our Services” on page 17.

Customer delight is measured by an index based on the results of surveys

performed by an external research company which cover all aspects of

service provided by Vodafone and incorporates the results of the relative

satisfaction of the competitors’ customers. An overall index for the Group is

calculated by weighting the results for each of the Group’s operations based

on service revenue.

Increased customer expectations are putting a downward pressure on

customer satisfaction for the Group and many of its competitors. Despite

this trend, the Group outperformed its target for customer delight in the

2007 financial year and the index was broadly stable compared to the

previous financial year.

Revenue based measures

Management believes that revenue based measures provide useful

information for investors regarding trends in customer revenue derived from

mobile communications services and the extent to which customers use

mobile services.

The data used to calculate these KPIs is derived from a number of sources.

Financial information, such as service revenue, is extracted from the Group’s

financial systems, whilst operational information, including customer and

usage metrics, is derived from the customer relationship management and

billing systems of each of the Group’s operations.

Average revenue per user (“ARPU”)

ARPU represents the average revenue by customers over a period and is

calculated as service revenue, being total revenue excluding equipment

revenue and connection fees, divided by the weighted average number of

customers during the period. ARPU disclosed in this Annual Report is

presented on a monthly basis and represents the total ARPU for the

financial year divided by twelve.

Voice usage

Voice usage is the total number of minutes of voice use on the Group’s

mobile networks, including calls made by the Group’s customers, often

referred to as outgoing usage, and calls received by the Group’s customers,

often referred to as incoming usage.

Messaging and data revenue

Messaging and data revenue represent the non-voice element of service

revenue. In recent years, these revenues have grown at a faster rate than voice

revenue as customers increasingly use these services and new products and

services have been launched. As competition has intensified in many of the

markets in which the Group operates and penetration rates have increased,

the ability of the Group to grow messaging and data revenue has become an

increasingly important factor, internally and for investors.

Costs

Europe targets

The Group has set targets in respect of revenue market share, operating

expenses and capitalised fixed asset additions. Progress against the revenue

market share target is measured by tracking performance in Germany, Italy,

Spain and the UK against their principal competitors. The operating expense

and capitalised fixed asset additions targets relate to the Europe region and

common functions in aggregate. These targets are discussed in more detail

on pages 38 to 39.