Vodafone 2007 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

130 Vodafone Group Plc Annual Report 2007

Notes to the Consolidated Financial Statements

continued

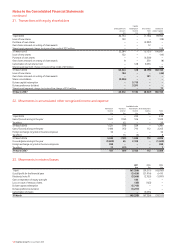

28. Acquisitions

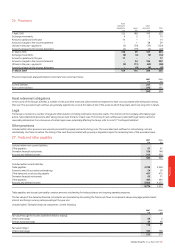

The principal acquisition made by the Group during the financial year is as follows:

On 24 May 2006, the Group acquired substantially all the assets and business of Telsim Mobil Telekomunikasyon Hizmetleri (“Telsim”) from the Turkish

Savings and Deposit Insurance Fund for consideration of approximately US$ 4.7 billion. Additionally, in April 2007 the Group paid US$ 0.4 billion of VAT, which

is recoverable against Telsim’s future VAT liabilities. The Group did not acquire Telsim’s liabilities, other than certain minor employee-related liabilities and

outstanding service credits to be fulfilled. The transaction has been accounted for by the purchase method of accounting.

Fair value

Book value adjustments Fair value

£m £m £m

Net assets acquired:

Intangible assets(1) 16 860 876

Property, plant and equipment 166 – 166

Inventory 2–2

Trade and other receivables 178 – 178

Trade and other payables (250) – (250)

112 860 972

Goodwill 1,597

Total cash consideration (including £34 million of directly attributable costs) 2,569

Net cash outflow arising on acquisition:

Cash consideration 2,569

Note:

(1) Intangible assets consist of licences and spectrum fees of £661 million and other intangibles of £215 million.

The goodwill is reported within Eastern Europe and is attributable to the expected profitability of the acquired business and the synergies expected to arise

within that business after the Group’s acquisition of Telsim. £1,639 million of goodwill is expected to be deductible for tax purposes.

The result of the acquired entity has been consolidated in the income statement from the date of acquisition.

From the date of acquisition, the acquired entity contributed a loss of £146 million to the net loss of the Group.

For the acquisition mentioned above, the weighted average life of licences and spectrum fees was 17 years, the weighted average life of other intangible

assets was two years and the weighted average of total intangible assets was 13 years.

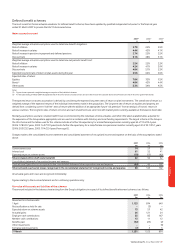

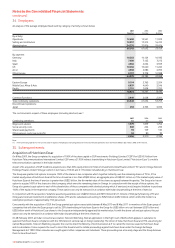

Acquisition of Hutchison Essar

On 8 May 2007, Vodafone completed the acquisition from Hutchison Telecommunications International Limited (“HTIL”) of companies with interests in

Hutchison Essar for cash consideration of US$10.9 billion (£5.5 billion), see note 35 for further details. It is impractical to provide further information due to

the proximity of the acquisition date to the date of approval of the Consolidated Financial Statements.

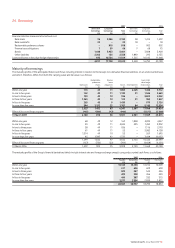

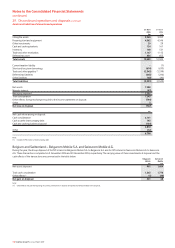

Pro forma full year information

The following unaudited pro forma summary presents the Group as if Telsim had been acquired on 1 April 2006 or 1 April 2005, respectively. The pro forma

amounts include the results of the acquired company, amortisation of the acquired intangible assets recognised on acquisition and the interest expense on

debt incurred as a result of the acquisition. The pro forma amounts do not include any possible synergies from the acquisition. The pro forma information is

provided for comparative purposes only and does not necessarily reflect the actual results that would have occurred, nor is it necessarily indicative of future

results of operations of the combined companies.

2007 2006

£m £m

Revenue 31,208 29,919

Loss for the financial year (5,375) (22,281)

Loss profit attributable to equity shareholders (5,504) (22,376)

Pence per share Pence per share

Basic and diluted loss per share – loss for the financial year (9.98) (35.74)