Vodafone 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 Vodafone Group Plc Annual Report 2007

Financial Position and Resources

continued

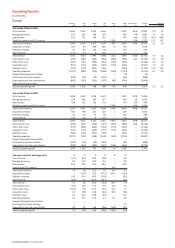

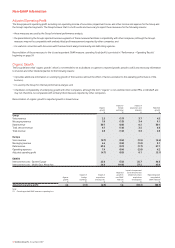

2007 2006

£m £m

Net cash flows from operating activities 10,328 11,841

Continuing operations 10,193 10,190

Discontinued operations 135 1,651

Taxation 2,243 1,682

Purchase of intangible fixed assets (899) (690)

Purchase of property, plant and equipment (3,633) (4,481)

Disposal of property, plant and equipment 34 26

Operating free cash flow 8,073 8,378

Taxation (2,243) (1,682)

Dividends from associated undertakings 791 835

Dividends paid to minority shareholders

in subsidiary undertakings (34) (51)

Dividends from investments 57 41

Interest received 526 319

Interest paid (1,051) (721)

Free cash flow 6,119 7,119

Continuing operations 6,127 6,418

Discontinued operations (8) 701

Net cash inflow/(outflow) from acquisitions

and disposals 7,081 (3,587)

Other cash flows from investing activities (92) (56)

Equity dividends paid (3,555) (2,749)

Other cash flows from financing activities (4,712) (1,555)

Increase/(decrease) in cash in the year 4,841 (828)

Capital expenditure

During the 2007 financial year, £3,633 million was spent on property, plant

and equipment, a decrease of 18.9% from the previous financial year.

The net cash outflow in intangible assets increased from £690 million in the

previous financial year to £899 million in the current financial year, with the

largest element being expenditure on computer software.

Dividends from associated undertakings and investments, and

dividends to minority shareholders

Dividends from the Group’s associated undertakings are generally paid at

the discretion of the Board of directors or shareholders of the individual

operating companies and Vodafone has no rights to receive dividends,

except where specified within certain of the companies’ shareholders’

agreements, such as with SFR, the Group’s associated undertaking in France.

Similarly, the Group does not have existing obligations under shareholders’

agreements to pay dividends to minority interest partners of Group

subsidiaries or joint ventures, except as specified below.

Included in the dividends received from associated undertakings and

investments was an amount of £328 million (2006: £195 million) received

from Verizon Wireless. Until April 2005, Verizon Wireless’ distributions were

determined by the terms of the partnership agreement distribution policy

and comprised income distributions and tax distributions. Since April 2005,

tax distributions have continued. Current projections forecast that tax

distributions will not be sufficient to cover the US tax liabilities arising from

the Group’s partnership interest in Verizon Wireless until 2015 and, in the

absence of additional distributions above the level of tax distributions

during this period, will result in a net cash outflow for the Group. Under the

terms of the partnership agreement, the board of directors has no

obligation to provide for additional distributions above the level of the tax

distributions. It is the current expectation that Verizon Wireless will continue

to re-invest free cash flow in the business and reduce indebtedness.

During the year ended 31 March 2007, cash dividends totalling

£450 million (2006: £511 million) were received from SFR in accordance

with the shareholders’ agreement.

Verizon Communications Inc. (“Verizon Communications”) has an indirect

23.1% shareholding in Vodafone Italy and, under the shareholders’

agreement, the shareholders have agreed to take steps to cause Vodafone

Italy to pay dividends at least annually, provided that such dividends would

not impair the financial condition or prospects of Vodafone Italy including,

without limitation, its credit rating. Vodafone Italy’s board of directors is

considering the level of a dividend that may be paid during the 2008

financial year. No dividends were or have been proposed or paid by

Vodafone Italy during or since the year ended 31 March 2007.

The Hutchison Essar shareholders’ agreement provides for the payment of

dividends to minority partners under certain circumstances (see page 136

for further details on the Hutchison Essar acquisition).

Acquisitions and disposals

The Group received a net £6,989 million cash and cash equivalents from

acquisition and disposal activities, including a net cash outflow of

£92 million from the purchase and disposal of investments, in the year to

31 March 2007. The acquisitions are described in more detail under

“Business – Business Overview – How We Developed”.

An analysis of the main transactions in the 2007 financial year, including

the changes in the Group’s effective shareholding, is shown below:

£m

Acquisitions:

Telsim Mobil Telekomunikasyon Hizmetleri

(from nil to 100% of trade and assets) (2,569)

Disposals:

Vodafone Japan (from 97.7% to nil)(1) 6,810

Belgacom Mobile (25% to nil) 1,343

Swisscom Mobile (25% to nil) 1,776

Other net acquisitions and disposals, including investments(1) (371)

Total 6,989

Note:

(1) Amounts are shown net of cash and cash equivalents acquired or disposed.

On disposal of Vodafone Japan to SoftBank on 27 April 2006, the Group

received non-cash consideration with a fair value of approximately

¥0.23 trillion (£1.1 billion), comprised of preferred equity and a

subordinated loan. Softbank also assumed external debt of approximately

¥0.13 trillion (£0.6 billion).

In December 2006, the subordinated loan was partly repaid by SoftBank,

with the remaining portion refinanced with a new subordinated loan, and

the terms of the preferred equity were improved. As a result of this

refinancing, the Group recorded a gain of £86 million, which is reported in

investment income.

Special distribution of £9 billion

On 17 March 2006, following the announcement of the sale of Vodafone

Japan, the Group stated that it would make a special distribution to

shareholders of approximately £6 billion. Consistent with the Group’s

strategy of targeting a low single A credit rating over the long term, on

30 May 2006 the Group announced that it would return a further £3 billion

to shareholders, resulting in a total distribution of approximately £9 billion

in the form of a B share arrangement.

The B share arrangement was approved at an Extraordinary General Meeting

of the Company on 25 July 2006. Payment in respect of redemption of the

B share arrangement was made in August 2006 and February 2007 and all

but £20 million of the total amount payable had been settled as at