Vodafone 2007 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2007 11

EMAPA

The EMAPA region covers Eastern Europe, Middle East, Africa and Asia,

Pacific and Affiliates, and includes the Group’s subsidiary operations in the

Czech Republic, Hungary, Romania, Turkey, Egypt, Australia and New

Zealand, joint ventures in Poland, Kenya, South Africa and Fiji, associated

undertakings in France and the US and the Group’s investments in China

and India.

The Group’s subsidiaries in EMAPA operate under the ‘Vodafone’ brand. The

joint ventures, associated undertakings and investments operate under the

following brands: China – China Mobile; Fiji – Vodafone; France – SFR and

Neuf Cegetel; India – Airtel; Kenya – Safaricom; Poland – Plus GSM; South

Africa – Vodacom; US – Verizon Wireless.

On 8 May 2007, the Group completed its acquisition of a controlling interest

in Hutchison Essar Limited (“Hutchison Essar”), a mobile telecommunications

operator in the Indian market, which operates under the ‘Hutch’ brand.

EMAPA’s results include the results from non-mobile telecommunications

businesses. The Group has a 17.91% indirect ownership in Neuf Cegetel, the

leading alternative operator for fixed telecommunication services in France,

offering a wide range of fixed line services to residential and business

customers as well as special corporate services ranging from internet and

customer relations management to internet and intranet hosting services.

The Group also has a direct and indirect interest constituting in aggregate a

9.99% ownership in Bharti Airtel, an Indian based mobile and fixed line

telecommunications operation with three strategic business units, mobile

services, broadband and telephone services and enterprise services. In

conjunction with the acquisition of Hutchison Essar Limited, a Bharti Group

entity agreed on 9 May 2007 to acquire 5.60% of Bharti Airtel from the

Group. Following the completion of this sale, the Group will continue to hold

an indirect stake of 4.39% in Bharti Airtel.

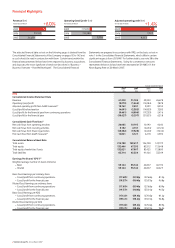

The mobile market share of the Group’s operators in its most significant EMAPA

markets, based on publicly available information, is estimated as follows:

Competition

The Group faces significant competition in each of its geographic markets.

It is subject to indirect competition from providers of other communications

services in the domestic markets in which it operates in addition to direct

competition from existing mobile communications network operators and

mobile virtual network operators (“MVNOs”) who do not operate a mobile

telecommunications network. There are also new types of competitors,

such as fixed line operators offering combined fixed and mobile service

offerings, and internet based companies extending their services to include

telecommunications. Competitive pressures impact the level of customer

churn, which the Group seeks to manage by a continued focus on tariffs and

customer acquisition and retention initiatives.

The Group expects that competition will continue from existing operators as

well as from a number of new market entrants, including those arising

following the award of new 3G licences and MVNOs. The scope of this

increased competition, and the impact on the results of operations, is

discussed further in “Performance – Risk Factors, Seasonality and Outlook”.

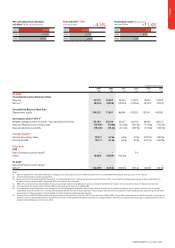

Many of Vodafone’s key markets are highly penetrated, some with

penetration rates of over 100% due to a number of customers owning more

than one subscriber identity module (“SIM”), which is, broadly, the Group’s

basis for defining a mobile customer. The penetration rates for the Group’s

operations in its principal markets, based on publicly available information,

is estimated as follows:

Business

020406080

Egypt

Australia

Romania

South

Africa

US

Customer market share (%)

At 31 December 2006

18

48

45

58

24

25

Turkey

Italy

UK

Spain

Germany

Estimated penetration – Europe (%)

At 31 December 2006

0 50 100 150 200

104

143

110

137

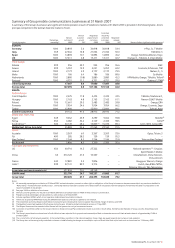

0 255075100

Australia

Egypt

India

Romania

Turkey

US

South

Africa

Estimated penetration – EMAPA (%)

At 31 December 2006

90

24

13

77

72

79

80