Vodafone 2007 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 Vodafone Group Plc Annual Report 2007

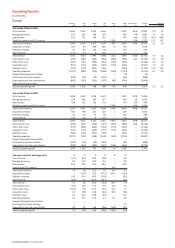

Operating Results

continued

organic increase was a consequence of the rapid growth in the Group’s

operations in Eastern Europe.

Middle East, Africa and Asia

Adjusted operating profit increased by 39.5%, or by 31.8% on an organic

basis. This increase was largely a result of the growth experienced in Egypt

and South Africa. In the Middle East, Africa and Asia region, total costs fell to

69.0% of total revenue compared to 71.0% in the 2005 financial year.

Pacific

Adjusted operating profit in the Pacific region declined by 30.0% largely due

to increased competition in Australia, where the launch of capped price

plans led to a large increase in voice usage which impacted interconnect

costs. Additionally, higher depreciation and purchased licence amortisation

charges were incurred during the year ended 31 March 2006 due to the

launch of 3G services in Australia and New Zealand.

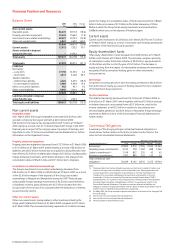

Associates

2006 % change

Verizon Verizon

Wireless Other Total Wireless

Share of result of associates £m £m £m £ $

Operating profit 2,112 1,010 3,122 25.5 21.5

Interest (204) (23) (227) 9.1 5.4

Tax (116) (329) (445) 27.5 22.5

Minority interest (60) 8 (52) 17.6 14.9

1,732 666 2,398 27.9 23.8

2005

Verizon

Wireless Other Total

Share of result of associates £m £m £m

Operating profit 1,683 985 2,668

Interest (187) (10) (197)

Tax (91) (357) (448)

Minority interest (51) 8 (43)

1,354 626 1,980

The US mobile telecommunications market saw continued significant

growth in customer numbers in the 2006 financial year, with penetration

reaching an estimated 72% at 31 March 2006. In this environment, Verizon

Wireless continued to increase its market share and improve its market

leading margin performance.

Verizon Wireless outperformed its competitors with record net additions,

increasing the proportionate customer base by 16.6% over the 2006

financial year to 23,530,000 and improving customer market share to

approximately 25% whilst also maintaining the proportion of contract

customers at 94.5% of the total customer base at 31 March 2006. The

strong customer performance benefited from continuing improvements in

customer loyalty, with a reduction in blended churn of 2.5 percentage

points to 14.7% compared with the 2005 financial year, the lowest in the

US mobile telecommunications industry.

In local currency, Verizon Wireless’ revenue increased by 14.9% due to the

strong customer growth, partially offset by a fall in ARPU of 1.9%. The ARPU

decline primarily resulted from an increase in the proportion of family share

customers and voice tariff pricing changes implemented early in 2005,

which included increases in the size of bundled minute plans.

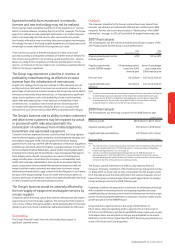

The EMAPA region continued to grow strongly due to a combination of a

focus on existing operations where the potential for creating additional

value is strong, as well as the contribution of stake increases in South Africa

and Romania and acquisitions during the 2006 financial year in India and

the Czech Republic.

Revenue

Total revenue increased by 52.5%, or by 19.4% on an organic basis, driven

by organic service revenue growth of 20.9%. The stake increases in Romania

and South Africa and the acquisitions in India and the Czech Republic

increased reported total revenue by 26.5%, while favourable exchange rates

increased total revenue growth by 6.6%.

Eastern Europe

The key drivers behind the growth in service revenue in Eastern Europe were

the acquisitions in the Czech Republic and the increase in the Group’s stake

in Romania. On an organic basis, service revenue growth of 25.7% was

achieved, primarily due to strong service revenue growth of 39.0% in local

currency in Romania, which assumes the Group’s increased equity interest

was reflected in the whole of the 2006 and 2005 financial years.

Middle East, Africa and Asia

Service revenue growth was 43.7%, or 26.0% on an organic basis. The

increased stake in South Africa and the acquisition in India were responsible

for an 11.6% increase in service revenue. The organic increase was

predominantly a result of a rise in the average prepaid customer base of

82.0% in Egypt, which was driven by new innovative tariffs improving access

and affordability in the market place, and resulted in service revenue growth

in Egypt of 36.2%. Organic growth in South Africa was 21.8%, mostly a result

of significant prepaid additions which contributed to an increase in total

voice usage of 23.6%.

Pacific

Service revenue growth was 16.3%, or 10.3% on an organic basis. In

Australia the popularity of the capped plans had resulted in a significant

49.0% increase in total voice usage and an increase in its customer base of

16.0%, resulting in local currency service revenue growth of 11.8%. 3G

services were launched on 31 October 2005, with strong uptake resulting in

171,000 consumer 3G devices being registered on the network by 31 March

2006.

New Zealand achieved service revenue growth of 8.5%, driven by a 12.3%

growth in the average customer base, due principally to the launch of

competitive promotions during the 2006 financial year. 3G services were

launched on 10 August 2005, with 103,000 3G devices registered by the

end of the financial year.

Adjusted operating profit

Adjusted operating profit increased by 22.4%, or by 18.0% on an organic

basis. Favourable exchange rates increased growth by 3.5%, while the

impact of the increased stakes in Romania and South Africa and the

acquisitions in India and the Czech Republic increased growth by 0.9%.

Eastern Europe

Adjusted operating profit increased by 95.6%, or by 30.5% on an organic

basis. The acquisition in the Czech Republic and the increased stake in

Romania contributed 52.8% of the growth in the region, whereas the

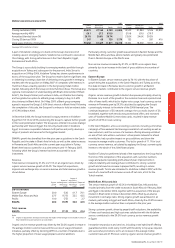

Mobile telecommunications KPIs

2006 2005

Eastern Middle East, Eastern Middle East,

Europe Africa & Asia Pacific EMAPA Europe Africa & Asia Pacific EMAPA

Closing customers (’000) 12,579 21,884 5,346 39,809 4,188 10,560 4,698 19,446

Average monthly ARPU £10.8 £9.0 £19.7 £11.7 £10.7 £19.6

Annualised blended churn (%) 23.6% 34.6% 39.2% 24.3% 23.3% 36.7%

Closing 3G devices (’000) 135 −281 416 −−−−

Voice usage (millions of minutes) 13,302 18,300 9,811 41,413 4,500 11,658 7,078 23,236

See page 159 for definition of terms