Vodafone 2007 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 Vodafone Group Plc Annual Report 2007

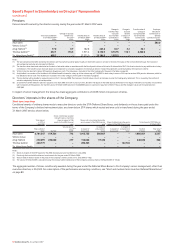

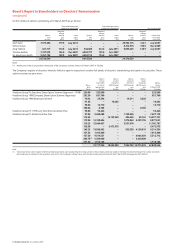

Board’s Report to Shareholders on Directors’ Remuneration

continued

July 2004 under the Vodafone Short Term Incentive Plan (“STIP”) (the

predecessor to the Deferred Share Bonus) vested in July 2006. Details of

STIP awards are given in the table on page 84.

Annual bonus (“GSTIP”)

The annual bonus is earned by achievement of one year’s KPI linked

performance targets and is either delivered in cash or shares. If the bonus is

delivered in shares they will be deferred for a two year period and the

executive will be eligible to receive 50% of the gross bonus under the

Deferred Share Bonus Plan, which is detailed below.

The target base award level for the 2007 financial year was 100% of salary,

with a maximum of 200% of salary available for exceptional performance.

The Remuneration Committee reviews and sets the GSTIP performance

targets on an annual basis, taking into account business strategy. The

performance measures for the 2007 financial year were adjusted operating

profit, revenue, free cash flow and customer delight. Each element is

weighted according to the responsibilities of the relevant director. For the

Chief Executive, in the 2007 financial year, the adjusted operating profit

target was 30% of the total, revenue 35%, free cash flow 20% and customer

delight 15%, and the payout achieved was 151.6%. The targets are not

disclosed, as they are commercially sensitive.

The target base award level for the 2008 financial year will continue to be

100% of salary, with a maximum of 200% of salary available for exceptional

performance.

For the 2008 financial year, the Group performance measures will be

changed to include the development of total communications revenue with

a 10% weighting, and the revenue measure will be changed to total service

revenue with a 25% weighting. More information on KPIs, against which

Group performance is measured, can be found in “Performance – Key

Performance Indicators” on page 33.

Deferred Share Bonus (“DSB”)

If executives choose to defer their annual bonus into shares, then they will

be eligible for an award under the DSB arrangement of matching shares

equal to 50% of the number of shares comprised in the pre-tax base award.

The award is earned by achievement of a subsequent two year performance

target following the initial 12 month period.

For awards made in 2006, which will vest in July 2008, the performance

measure is growth in adjusted EPS. Three quarters of the DSB award will vest

for achievement of EPS growth of 11%, rising to full vesting for achievement

of EPS growth of 15% over the two year performance period.

For awards made in 2007, which will vest in July 2009, the performance

measure will be free cash flow. The target itself will be set by the

Remuneration Committee at the time of the award based on the Group’s

long-range plan with reference to market expectations.

Long term incentives

Awards of performance shares and share options were made to executive

directors following the 2006 AGM on 25 July 2006. The awards for the 2007

financial year will be also be made following the AGM and will be made

under the Vodafone Global Incentive Plan.

Awards are delivered in the form of ordinary shares of the Company. All

awards are made under plans that incorporate dilution limits as set out in

the Guidelines for Share Incentive Schemes published by the Association of

British Insurers. The current estimated dilution from subsisting awards,

including executive and all-employee share awards, is approximately 2.9%

of the Company’s share capital at 31 March 2007 (2.6% as at 31 March

2006).

Performance shares

Performance shares are awarded annually to executive directors. Vesting of

the performance shares depends upon the Company’s relative TSR

performance. TSR measures the change in value of a share and reinvested

dividends over the period of measurement.

For the award made in the 2007 financial year, the Company’s TSR

performance is compared to that of other companies in the FTSE Global

Telecommunications index as at the date of grant, over a three-year

performance period.

In the 2007 financial year, the Chief Executive received an award of

performance shares with a face value of 227% of base salary; other

executive directors received 182% of base salary.

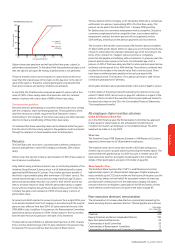

Performance shares will vest only if the Company ranks in the top half of the

ranking table; maximum vesting will only occur if the Company is in the top

20%. Vesting is also conditional on underlying improvement in the

performance of the Company. Awards will vest to the extent that the

performance condition has been satisfied at the end of the three-year

performance period. To the extent that the performance target is not met,

the awards will be forfeited.

For awards made in the 2008 financial year, the TSR comparator group will

be changed to the top 50% of companies in the FTSE Global

Telecommunications Index by market capitalisation. This removes the

smaller companies from the group and allows us to move from a weighted

to an unweighted ranking system. In addition, the vesting curve has been

straightened between threshold and maximum performance. The following

chart shows the basis on which the performance shares will vest:

Previously disclosed performance share awards granted in the 2004

financial year vested in the 2007 financial year. Details are given in the table

on page 85.

Share options

Share options are granted annually to executive directors. The exercise of

share options is subject to the achievement of a three year adjusted EPS

performance condition set prior to grant.

For the award made in the 2007 financial year, one quarter of the option

award will vest for achievement of EPS growth of 5% p.a., rising to full

vesting for achievement of EPS growth of 10% p.a. over the performance

period. In setting this target, the Remuneration Committee has taken the

internal long range plan and market expectations into account.

The Remuneration Committee has decided that for the 2008 financial year

grants, the performance range will be 5% – 8% p.a. As in previous years, 25%

vests at threshold (5% p.a.) with a straight line up to 100% vesting at

maximum (8% p.a.). The following chart illustrates the basis on which share

options granted in the 2007 and 2008 financial years will vest:

Percentage vesting

0% 20% 40% 60% 80% 100%

0%

20%

40%

60%

80%

100%

Relative TSR peformance measures

Relative TSR Percentile

2006/07 Grant – All FTSE

Global Telecoms

2007/08 Grant – Top 50%

FTSE Global Telecoms