Vodafone 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.72 Vodafone Group Plc Annual Report 2007

Corporate Governance

continued

each time the Company publishes such documentation on its website.

Shareholders may also appoint proxies and give voting instructions

electronically.

The principal communication with private investors is through the provision

of the Annual Review and Summary Financial Statement and the AGM, an

occasion which is attended by all the Company’s directors and at which all

shareholders present are given the opportunity to question the Chairman and

the Board as well as the Chairmen of the Audit, Remuneration and

Nominations and Governance Committees. After the AGM, shareholders can

meet informally with directors.

A summary presentation of results and development plans is also given at

the AGM before the Chairman deals with the formal business of the meeting.

The AGM is broadcast live on the Group’s website, www.vodafone.com, and a

recording of the webcast can subsequently be viewed on the website. All

substantive resolutions at the Company’s AGMs are decided on a poll. The

poll is conducted by the Company’s Registrars and scrutinised by Electoral

Reform Services. The proxy votes cast in relation to all resolutions are

disclosed to those in attendance at the meeting and the results of the poll

are published on the Company’s website and announced via the regulatory

news service. Financial and other information is made available on the

Company’s website, www.vodafone.com, which is regularly updated.

Political Donations

Prior to the 2006 AGM, the Board annually sought and obtained shareholders’

approval to enable the Group to make donations to EU Political Organisations

or incur EU Political Expenditure, under the relevant provisions of the Political

Parties, Elections and Referendums Act 2000 (“PPERA”). The approval given

restricted such expenditure to an aggregate limit of £100,000 in the period of

12 months following the date of the AGM.

At last year’s AGM, held on 25 July 2006, the directors sought and received a

renewal of shareholders’ approval for a period of three years (until the AGM in

2009) to enable the Group to make donations to EU Political Organisations or

incur EU Political Expenditure, under the PPERA. The approval given restricted

such expenditure for each year until the AGM in 2009 to an aggregate

amount of £100,000 (£50,000 in respect of donations to EU Political

Organisations and £50,000 in respect of EU Political Expenditure).

The Group has made no political donations during the year.

Although the directors have received shareholders’ approval for a three-year

period, as with previous annual approvals, the Group has no intention of

changing its current policy and practice of not making political donations and

will not do so without the specific endorsement of shareholders. The Board

obtained the approval on a precautionary basis to avoid any possibility of

unintentionally breaching the PPERA.

Auditors

Following a recommendation by the Audit Committee and, in accordance

with Section 384 of the Companies Act 1985, a resolution proposing the re-

appointment of Deloitte & Touche LLP as auditors to the Company will be put

to the 2007 AGM.

In their assessment of the independence of the auditors and in accordance

with the US Independence Standards Board Standard No. 1, “Independence

Discussions with Audit Committees”, the Audit Committee receives in writing

details of relationships between Deloitte & Touche LLP and the Company

that may have a bearing on their independence and receives confirmation

that they are independent of the Company within the meaning of the

securities laws administered by the SEC.

In addition, the Audit Committee pre-approves the audit fee after a review of

both the level of the audit fee against other comparable companies,

including those in the telecommunications industry, and the level and nature

of non-audit fees, as part of its review of the adequacy and objectivity of the

audit process.

In a further measure to ensure auditor independence is not compromised,

policies were in place throughout the year to provide for the pre-approval by

the Audit Committee of permitted non-audit services by Deloitte & Touche

LLP. Where there was an immediate requirement for permitted non-audit

services to be provided by Deloitte & Touche LLP which were not

pre-approved by the Audit Committee, the policies provided that the Group

consulted with the Chairman of the Audit Committee, or in his absence

another member, for pre-approval. Since the year end, the Audit Committee

has amended the pre-approval policies and procedures for the engagement

of the Group’s auditors to provide non-audit services. The Audit Committee

has pre-approved certain specific permitted services that can be engaged by

Group management subject to specified fee limits for individual

engagements and fee limits for each type of specific service permitted. The

provision under the policy for the Chairman of the Audit Committee, or in his

absence another member, to pre-approve services which were not pre-

approved by the Audit Committee remains.

In addition to their statutory duties, Deloitte & Touche LLP are also employed

where, as a result of their position as auditors, they either must, or are best

placed to, perform the work in question. This is primarily work in relation to

matters such as shareholder circulars, Group borrowings, regulatory filings

and certain business acquisitions and disposals. Other work is awarded on the

basis of competitive tender.

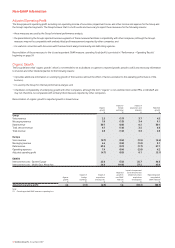

During the year, Deloitte & Touche LLP and its affiliates charged the Group

£7 million (2006: £4 million) for audit and audit-related services and a further

£3 million (2006: £4 million) for non-audit assignments. An analysis of these

fees can be found in note 4 to the Consolidated Financial Statements.

US Listing Requirements

The Company’s ADS are listed on the NYSE and the Company is, therefore,

subject to the rules of the NYSE as well as US securities laws and the rules of

the SEC. The NYSE requires US companies listed on the exchange to comply

with the NYSE’s corporate governance rules but foreign private issuers, such

as the Company, are exempt from most of those rules. However, pursuant to

NYSE Rule 303A.11, the Company is required to disclose a summary of any

significant ways in which the corporate governance practices it follows differ

from those required by the NYSE for US companies. A summary of such

differences is set out below.

The Company has also adopted a corporate Code of Ethics for senior

executive, financial and accounting officers, separate from and additional to

its Business Principles. A copy of this code is available on the Group’s website

at www.vodafone.com.

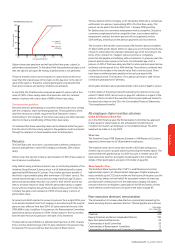

Differences from the New York Stock Exchange

Corporate Governance Practices

Independence

The NYSE rules require that a majority of the Board must be comprised of

independent directors and the rules include detailed tests that US companies

must use for determining independence. The Combined Code requires a

company’s board of directors to assess and make a determination as to the

independence of its directors. While the Board does not explicitly take into

consideration the NYSE’s detailed tests, it has carried out an assessment

based on the requirements of the Combined Code and has determined in its

judgement that all of the non-executive directors are independent within

those requirements. As at the date of this Annual Report, the Board

comprised the Chairman, three executive directors and ten non-executive

directors.