Vodafone 2007 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

140 Vodafone Group Plc Annual Report 2007

Notes to the Consolidated Financial Statements

continued

38. US GAAP information continued

d. Goodwill and other intangible assets

The differences related to goodwill and other intangible assets included in

the reconciliations of net loss and shareholders’ equity relate to acquisitions

prior to the Group’s adoption of SEC guidance issued on 29 September 2004.

In determining the value of licences purchased in business combinations

prior to 29 September 2004, the Group allocated the portion of the purchase

price in excess of the fair value attributed to the share of net assets acquired

to licences. The Group had previously concluded that the nature of the

licences and the related goodwill acquired in business combinations was

fundamentally indistinguishable.

Following the adoption of the SEC guidance issued on 29 September 2004,

the Group’s US GAAP accounting policy for initial and subsequent

measurement of goodwill and other intangible assets, other than

determination of impairment of goodwill and finite lived intangible assets, is

substantially aligned to that of IFRS described in note 2. However, there are

substantial adjustments arising prior to 29 September 2004 from different

methods of transition to current IFRS and US GAAP as discussed below.

Goodwill arising before the date of transition to IFRS has been retained under

IFRS at the previous UK GAAP amounts for acquisitions prior to 1 April 2004.

The Group has assigned amounts to licences and customer bases under US

GAAP as they meet the criteria for recognition separately from goodwill, while

these had not been recognised separately from goodwill under UK GAAP

because they did not meet the recognition criteria. Under US GAAP, goodwill

and other intangible assets with indefinite lives are capitalised and not

amortised, but tested for impairment at least annually. Intangible assets with

finite lives are capitalised and amortised over their useful economic lives.

Under IFRS and US GAAP, the purchase price of a transaction accounted for as

an acquisition is based on the fair value of the consideration. In the case of

share consideration, under IFRS the fair value of such consideration is based

on the share price on the date of exchange. Under US GAAP, the fair value of

the share consideration is based on the average share price over a reasonable

period of time before and after the proposed acquisition is agreed to and

announced. This has resulted in a difference in the fair value of the

consideration for certain acquisitions and consequently in the amount of

goodwill capitalised under IFRS and US GAAP.

The Group’s accounting policy for testing goodwill and finite lived intangible

assets for impairment under IFRS is discussed in note 2. For the purpose of

goodwill impairment testing under US GAAP, the fair value of a reporting unit

including goodwill is compared to its carrying value. If the fair value of a

reporting unit is lower than its carrying value, the fair value of the goodwill

within that reporting unit is compared to its respective carrying value, with

any excess carrying value written off as an impairment loss. The fair value of

the goodwill is the difference between the fair value of the reporting unit and

the fair value of the identifiable net assets of the reporting unit. Intangible

assets with finite lives are subject to periodic impairment tests when

circumstances indicate that an impairment loss may exist. Where an asset’s

(or asset group’s) carrying amount exceeds its sum of undiscounted future

cash flows, an impairment loss is recognised in an amount equal to the

amount by which the asset’s (or asset group’s) carrying amount exceeds its

fair value, which is generally based on discounted cash flows.

As a result of the above, there are significant amounts reported as goodwill

and not amortised under IFRS which are reported as licences, customers

and deferred tax liabilities under US GAAP.

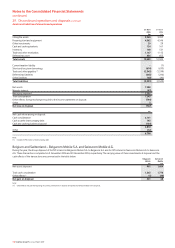

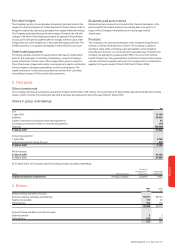

Finite-lived intangible assets

2007 2006

Licences £m £m

Gross carrying value 152,358 154,135

Accumulated amortisation (88,541) (75,170)

63,817 78,965

Customer bases

Gross carrying value 493 1,663

Accumulated amortisation (168) (1,071)

325 592

The total amortisation charge for the year ended 31 March 2007, under US

GAAP, was £15,207 million (2006: £15,011 million; 2005: £15,400 million).

During the year ended 31 March 2007, the Group revised the estimated

useful life of certain customer bases. As a result, an additional £113 million of

amortisation expense has been recorded during the year.

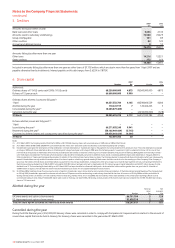

The estimated future amortisation charge on finite-lived intangible assets for

each of the next five years is set out in the following table. The estimate is

based on finite-lived intangible assets recognised at 31 March 2007 using

foreign exchange rates on that date. It is probable that future amortisation

charges will vary from the figures below, as the estimate does not include the

impact of any future investments, disposals, capital expenditures or

fluctuations in foreign exchange rates.

Year ending 31 March £m

2008 14,966

2009 14,959

2010 12,114

2011 3,623

2012 3,355

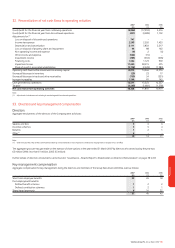

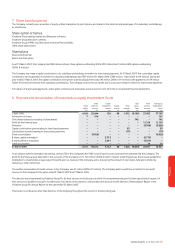

e. Impairment losses

As discussed in note 10, during the year ended 31 March 2007, the Group

recorded impairment losses of £11,600 million (2006: £23,000 million) in

relation to the goodwill of Vodafone Germany and Vodafone Italy under IFRS.

Under US GAAP, the Group evaluated the recoverability of the long-lived

assets, comprised primarily of licences, in Vodafone Germany and Vodafone

Italy using undiscounted cash flows and determined that the carrying

amount of these assets was recoverable. As a result, the IFRS impairment

losses of £11,600 million related to Vodafone Germany and Vodafone Italy

were not recognised under US GAAP.

During the year ended 31 March 2006, the Group also recorded an

impairment loss under IFRS of £515 million and £4,900 million in relation to

the goodwill of Vodafone Sweden and Vodafone Japan, respectively. Under

US GAAP, the Group recognised impairment losses of licences of £883 million

and £8,556 million in Vodafone Sweden and in Vodafone Japan. As a result of

these impairment losses, the Group released related deferred tax liabilities of

£247 million and £3,508 million, which have been included in the

adjustment for income taxes for the period. The impairment losses on

Vodafone Sweden’s and Vodafone Japan’s licences have been included in

discontinued operations under US GAAP.

Cumulative foreign currency gains and losses arising on the translation of the

assets and liabilities into sterling have been included in the carrying value of

a discontinued operation when assessing that carrying value for impairment.

f. Capitalised interest

Under IFRS, the Group has adopted the benchmark accounting treatment for

borrowing costs and, as a result, the Group does not capitalise interest costs

on borrowings in respect of the acquisition or construction of tangible and

intangible fixed assets. Under US GAAP, the interest costs of financing the

acquisition or construction of network assets and other fixed assets is

capitalised during the period of construction until the date that the asset is

placed in service. Interest costs of financing the acquisition of licences are

also capitalised until the date that the related network service is launched.

Capitalised interest costs are amortised over the estimated useful lives of the

related assets.

g. Other

Financial instruments

Under IFRS, equity put rights and similar arrangements are classified as

financial liabilities. The liabilities are measured as the present value of the

estimated exercise prices of the equity put rights and similar arrangements,

which is the fair value of the underlying shares on the date of exercise, with

any changes in this estimate recognised in the consolidated income

statement each period. Under US GAAP, the redemption amount under these

arrangements is credited to the minority interest and changes in the

redemption amount are reflected as a charge or credit to retained earnings.