Vodafone 2007 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

128 Vodafone Group Plc Annual Report 2007

Notes to the Consolidated Financial Statements

continued

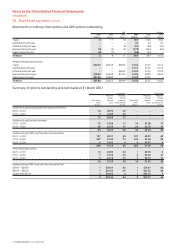

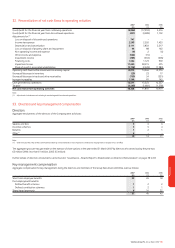

25. Post employment benefits continued

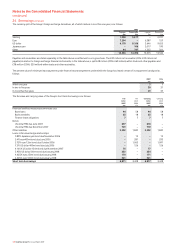

2007 2006 2005

£m £m £m

Movement in scheme liabilities:

1 April 1,224 998 794

Reclassification as held for sale –(31) –

Current service cost 74 57 58

Interest cost 61 52 42

Member cash contributions 13 11 12

Actuarial (gains)/losses (39) 164 126

Benefits paid (32) (27) (30)

Other movements 4(8) (9)

Exchange rate movements (13) 85

31 March 1,292 1,224 998

Accumulated benefit obligation 1,084 1,081 904

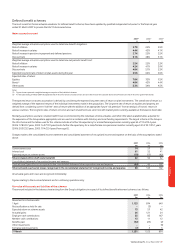

UK Other Total

2007 2006 2005 2007 2006 2005 2007 2006 2005

£m £m £m £m £m £m £m £m £m

Analysis of net assets/(deficits):

Total fair value of scheme assets 954 835 628 297 288 246 1,251 1,123 874

Present value of funded scheme liabilities (901) (847) (619) (293) (281) (299) (1,194) (1,128) (918)

Net assets/(deficits) for funded schemes 53 (12) 9 47 (53) 57 (5) (44)

Present value of unfunded scheme liabilities –––(98) (96) (80) (98) (96) (80)

Net assets/(deficits) 53 (12) 9 (94) (89) (133) (41) (101) (124)

Net assets/(deficits) are analysed as:

Assets 53 –929 19 3 82 19 12

Liabilities –(12) – (123) (108) (136) (123) (120) (136)

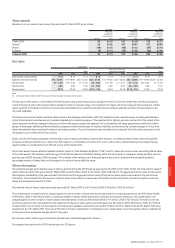

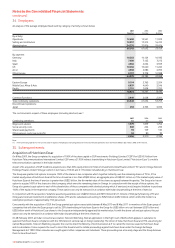

The funding policy for all schemes is reviewed on a systematic basis in consultation with the independent scheme actuary in order to ensure that the funding

contributions from sponsoring employers are appropriate to meet the liabilities of the schemes over the long term.

The deficit in respect of other schemes at 31 March 2007 primarily relates to various schemes in Germany and internally funded schemes in Italy and the

United States.

Actual return on scheme assets

2007 2006 2005

£m £m £m

Actual return on scheme assets 99 178 66

Analysis of scheme assets at 31 March is as follows: %% %

Equities 72.1 71.9 60.0

Bonds 27.5 26.5 25.9

Property 0.4 0.4 0.4

Other –1.2 13.7

100.0 100.0 100.0

The scheme has no investments in the Group’s equity securities or in property currently used by the Group.

History of experience adjustments

2007 2006 2005

£m £m £m

Experience adjustments on scheme liabilities:

Amount (£m) (2) (4) (60)

Percentage of scheme liabilities (%) ––6%

Experience adjustments on scheme assets:

Amount (£m) 26 121 24

Percentage of scheme assets (%) 2% 11% 3%

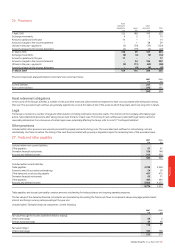

Expected contributions and benefit payments

£m

Expected employer’s contributions in the year ending 31 March 2008 54

Expected benefit payments in the year ending 31 March:

2008 36

2009 35

2010 37

2011 38

2012 40

2013-2018 220