Vodafone 2007 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2007 103

Financials

The total remuneration includes £nil (2006: £1 million, 2005: £1 million) in respect of the Group’s discontinued operations in Japan.

In addition to the above, the Group’s joint ventures and associated undertakings paid fees totalling £2 million (2006: £2 million, 2005: £2 million) and

£4 million (2006: £4 million, 2005: £5 million), respectively, to Deloitte & Touche LLP and its affiliates during the year.

Deloitte & Touche LLP and its affiliates have also received amounts totalling less than £1 million in each of the last three years in respect of services provided

to pension schemes and charitable foundations associated to the Group.

A description of the work performed by the Audit Committee in order to safeguard auditor independence when non audit services are provided is set out in

“Governance – Corporate Governance” on page 72. In the year ended 31 March 2007, 2.6% of other fees were approved in accordance with US SEC Regulation

S-X Rule 2-01(c)(7)(i)(C).

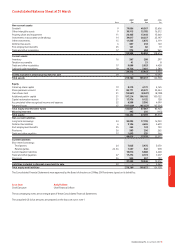

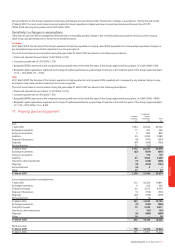

5. Investment income and financing costs

2007 2006 2005

£m £m £m

Investment income

Available-for-sale investments:

Dividends received 57 41 19

Loans and receivables at amortised cost(1) 452 153 201

Other(2) 86 ––

Fair value through the income statement (held for trading):

Derivatives – foreign exchange contracts 160 159 74

Equity put rights and similar arrangements(3) 34 ––

789 353 294

Financing costs

Items in hedge relationships:

Other loans 548 510 472

Interest rate swaps (9) (118) (198)

Dividends on redeemable preference shares 45 48 –

Fair value hedging instrument 42 213 231

Fair value of hedged item (47) (186) (213)

Other financial liabilities held at amortised cost:

Bank loans and overdrafts 126 126 129

Other loans 276 78 68

Dividends on redeemable preference shares – – 46

Potential interest charge on settlement of tax issues 406 329 245

Fair value through the income statement (held for trading):

Derivatives – forward starting swaps and futures 71 (48) 25

Other(4) 118 ––

Equity put rights and similar arrangements(3) 32 161 67

Finance leases 478

1,612 1,120 880

Net financing costs 823 767 586

Notes:

(1) Included are amounts of £77m arising from hedges of a net investment in a foreign operation.

(2) Gain resulting from refinancing of SoftBank related investments received as part of the consideration for the disposal of Vodafone Japan on 27 April 2006.

(3) Equity put rights and similar arrangements includes amounts in relation to the Group’s arrangements with Telecom Egypt and its minority partners in the Group’s other operations in Germany. Contracts

have been revalued to current redemption value. Further information is provided in “Option agreements and similar arrangements” on page 56.

(4) Other fair value through the income statement includes foreign exchange losses on certain intercompany balances and certain investments held following the disposal of Vodafone Japan to SoftBank.