Vodafone 2007 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2007 147

Financials

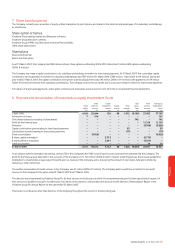

7. Share based payments

The Company currently uses a number of equity settled share plans to grant options and shares to the directors and employees of its subsidiary undertakings,

as listed below.

Share option schemes

Vodafone Group savings related and Sharesave schemes

Vodafone Group executive schemes

Vodafone Group 1999 Long Term Stock Incentive Plan and ADSs

Other share option plans

Share plans

Share Incentive Plan

Restricted share plans

As at 31 March 2007, the Company had 584 million ordinary share options outstanding (2006: 787 million) and 3 million ADS options outstanding

(2006: 8 million).

The Company has made a capital contribution to its subsidiary undertakings in relation to share based payments. At 31 March 2007, the cumulative capital

contribution net of payments received from subsidiary undertakings was £397 million (31 March 2006: £383 million, 1 April 2005: £419 million). During the

year ended 31 March 2007, the capital contribution arising from share based payments was £93 million (2006: £114 million), with payments of £79 million

(2006: £150 million) received from subsidiary undertakings. The Company does not incur a profit and loss account charge in relation to share based payments.

Full details of share based payments, share option schemes and share plans are disclosed in note 20 to the Consolidated Financial Statements.

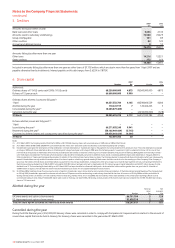

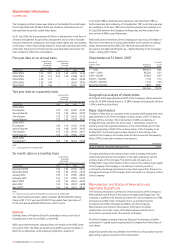

8. Reserves and reconciliation of movements in equity shareholders’ funds

Share Capital Own Profit Total equity

Share premium redemption Capital Other shares and loss shareholders’

capital account reserve reserve reserves held account funds

£m £m £m £m £m £m £m £m

1 April 2006 4,165 52,444 128 88 1,012 (8,186) 27,452 77,103

Allotments of shares 7 154 – – – – – 161

Own shares released on vesting of share awards – – – – – 142 – 142

Profit for the financial year – – – – – – 11,126 11,126

Dividends – – – – – – (3,566) (3,566)

Capital contribution given relating to share based payments – – – – 93 – – 93

Contribution received relating to share based payments – – – – (79) – – (79)

Share consolidation – (9,026) – – – – – (9,026)

B share capital redemption – – 5,713 – – – (5,713) –

B share preference dividend – – 3,291 – – – (3,291) –

Other movements – – – – – – 13 13

31 March 2007 4,172 43,572 9,132 88 1,026 (8,044) 26,021 75,967

In accordance with the exemption allowed by section 230 in the Companies Act 1985, no profit and loss account has been presented by the Company. The

profit for the financial year dealt with in the accounts of the Company is £11,126 million (2006: £12,671 million). Under English law, the amount available for

distribution to shareholders is based upon the profit and loss reserve of the Company and is reduced by the amount of own shares held and is limited by

statutory or other restrictions.

The auditor remuneration for audit services to the Company was £1 million (2006: £1 million). The Company paid no audit fees in relation to non audit

services to the Company for the years ended 31 March 2007 and 31 March 2006.

The directors are remunerated by Vodafone Group Plc for their services to the Group as a whole. No remuneration was paid to them specifically in respect of

their services to Vodafone Group Plc for either year. Full details of the directors’ remuneration are disclosed in the Directors’ Remuneration Report in the

Vodafone Group Plc Annual Report for the year ended 31 March 2007.

There were no employees other than directors of the Company throughout the current or the preceding year.