Vodafone 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

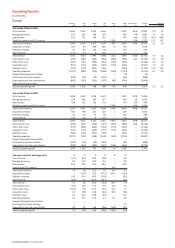

56 Vodafone Group Plc Annual Report 2007

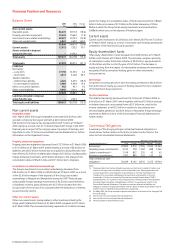

Financial Position and Resources

continued

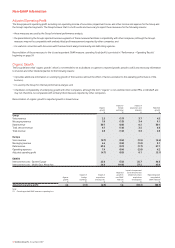

In the year to 31 March 2007, bonds with a nominal value of £4.2 billion

were issued under the US shelf and the Euro Medium Term Note

programme. The bonds issued during the year were:

US shelf/Euro

Medium Term

Amount Note (“EMTN”)

Date of bond issue Maturity of bond Currency Million programme

14 June 2006 14 June 2016 EUR 300 EMTN

14 June 2006 13 January 2012 EUR 1,000 EMTN

10 August 2006 10 January 2013 AUD 265 EMTN

29 August 2006 13 January 2012 EUR 300 EMTN

5 September 2006 5 September 2013 EUR 850 EMTN

27 November 2006 14 June 2016 EUR 200 EMTN

30 January 2007 30 January 2009 EUR 300 EMTN

5 February 2007 5 February 2009 EUR 150 EMTN

15 February 2007 15 February 2010 EUR 300 EMTN

27 February 2007 27 February 2012 USD 500 US shelf

27 February 2007 27 February 2012 USD 500 US shelf

27 February 2007 27 February 2017 USD 1,300 US shelf

27 February 2007 27 February 2037 USD 1,200 US shelf

At 31 March 2007, the Group had bonds outstanding with a nominal value

of £17,101 million.

Committed facilities

The following table summarises the committed bank facilities available to

the Group at 31 March 2007:

Committed Bank Facilities Amounts drawn

24 June 2004

$5.9 billion Revolving Credit No drawings have been made against

Facility, maturing 24 June 2009. this facility. The facility supports the

Group’s commercial paper

programmes and may be used for

general corporate purposes including

acquisitions.

24 June 2005

$5.0 billion Revolving Credit No drawings have been made against

Facility, maturing 22 June 2012. this facility. The facility supports the

Group’s commercial paper programmes

and may be used for general corporate

purposes including acquisitions.

21 December 2005

¥258.5 billion Term Credit Facility, The facility was drawn down in full on

maturing 16 March 2011, entered 21 December 2005. The facility is

into by Vodafone Finance K.K. available for general corporate

and guaranteed by the Company. purposes, although amounts drawn

must be on-lent to the Company.

16 November 2006

€0.4 billion Loan Facility, The facility was drawn down in full on

maturing 14 February 2014 14 February 2007. The facility is available

for financing capital expenditure in the

Group’s Turkish operating company.

Under the terms and conditions of the $10.9 billion committed bank

facilities, lenders have the right, but not the obligation, to cancel their

commitments and have outstanding advances repaid no sooner than

30 days after notification of a change of control of the Company. The facility

agreements provide for certain structural changes that do not affect the

obligations of the Company to be specifically excluded from the definition

of a change of control. This is in addition to the rights of lenders to cancel

their commitment if the Company has committed an event of default.

Substantially the same terms and conditions apply in the case of Vodafone

Finance K.K.’s ¥258.5 billion term credit facility, although the change of

control provision is applicable to any guarantor of borrowings under the

term credit facility. As of 31 March 2007, the Company was the sole

guarantor.

The terms and conditions of the €0.4 billion loan facility are similar to those

of the $10.9 billion committed bank facilities, with the addition that, should

the Group’s Turkish operating company spend less than the equivalent of

$0.8 billion on capital expenditure, the Group will be required to repay the

drawn amount of the facility that exceeds 50% of the capital expenditure.

Furthermore, two of the Group’s subsidiary undertakings are funded by

external facilities which are non-recourse to any member of the Group other

than the borrower, due to the level of country risk involved. These facilities

may only be used to fund their operations. Vodafone Egypt has a partly

drawn (EGP 1 billion (£89 million)) syndicated bank facility of EGP 3 billion

(£268 million) that matures in March 2014. Vodafone Romania has a fully

drawn €156 million (£106 million) syndicated bank facility that matures at

various dates up to October 2010.

In aggregate, the Group has committed facilities of approximately

£7,982 million, of which £5,842 million was undrawn and £2,140 million

was drawn at 31 March 2007. On 8 May 2007, the Group’s $5.9 billion

Revolving Credit Facility was extended to $6.1 billion and the $5.0 billion

Revolving Credit Facility was extended to $5.2 billion.

The Group believes that it has sufficient funding for its expected working

capital requirements. Further details regarding the maturity, currency and

interest rates of the Group’s gross borrowings at 31 March 2007 are

included in note 24 of the Consolidated Financial Statements.

Financial assets and liabilities

Analyses of financial assets and liabilities, including the maturity profile of

debt, currency and interest rate structure, are included in notes 18 and 24

to the Consolidated Financial Statements. Details of the Group’s treasury

management and policies are included within note 24 to the Consolidated

Financial Statements.

Option agreements and similar arrangements

Potential cash inflows

As part of the agreements entered into upon the formation of Verizon

Wireless, the Company entered into an Investment Agreement with Verizon

Communications, formerly Bell Atlantic Corporation, and Verizon Wireless.

Under this agreement, dated 3 April 2000, the Company has the right to

require Verizon Communications or Verizon Wireless to acquire interests in

the Verizon Wireless partnership from the Company with an aggregate

market value of up to $20 billion during certain periods up to August 2007,

dependent on the value of the Company’s 45% stake in Verizon Wireless.

This represents a potential source of liquidity to the Group.

Exercise of the option could have occurred in either one or both of two

phases. The Phase I option expired in August 2004 without being exercised.

The Phase II option may be exercised during the period commencing

30 days before and ending 30 days after 10 July 2007. Similar arrangements

for 10 July 2006 expired unexercised. The Phase II option also limits the

aggregate amount paid to $20 billion and caps the payments under single

exercises to $10 billion. Determination of the market value of the

Company’s interests will be by mutual agreement of the parties to the

transaction or, if no such agreement is reached within 30 days of the