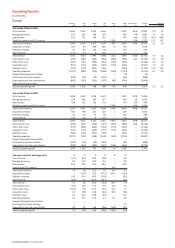

Vodafone 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2007 55

31 March 2007. During such time that the remaining B shares are

outstanding, they will accrue a non-cumulative dividend at the rate of 75%

of sterling LIBOR, payable semi-annually in arrears until redemption. The

Company has the right to redeem all remaining B shares by 5 August 2008.

Other returns

As a result of targeting a lower credit rating in May 2006 and the £9 billion

special distribution, the Group has no current plans for further share

purchases or other one-off shareholder returns. The Board will periodically

review the free cash flow, anticipated cash requirements, dividends, credit

profile and gearing of the Group and consider additional shareholder

returns.

Treasury shares

The Companies Act 1985 permits companies to purchase their own shares

out of distributable reserves and to hold shares with a nominal value not to

exceed 10% of the nominal value of their issued share capital in treasury. If

shares in excess of this limit are purchased they must be cancelled. Whilst

held in treasury, no voting rights or pre-emption rights accrue and no

dividends are paid in respect of treasury shares. Treasury shares may be sold

for cash, transferred (in certain circumstances) for the purposes of an

employee share scheme, or cancelled. If treasury shares are sold, such sales

are deemed to be a new issue of shares and will accordingly count towards

the 5% of share capital which the Company is permitted to issue on a non

pre-emptive basis in any one year as approved by its shareholders at the

AGM. The proceeds of any sale of treasury shares up to the amount of the

original purchase price, calculated on a weighted average price method, is

attributed to distributable profits which would not occur in the case of the

sale of non-treasury shares. Any excess above the original purchase price

must be transferred to the share premium account. The Company did not

repurchase any of its own shares, between 1 April 2006 and 31 March 2007.

Shares purchased are held in treasury in accordance with section 162 of the

Companies Act 1985. The movement in treasury shares during the financial

year is shown below:

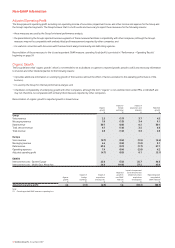

Number

million £m

1 April 2006 6,133 8,198

Consolidation of shares (762) –

Re-issue of shares (120) (151)

31 March 2007 5,251 8,047

Funding

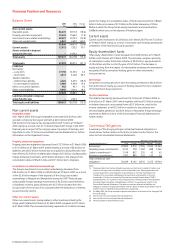

The Group’s consolidated net debt position for continuing operations is as

follows:

2007 2006

£m £m

Cash and cash equivalents (as presented in the

consolidated cash flow statement) 7,458 2,932

Bank overdrafts 23 18

Cash and cash equivalents for discontinued

operations –(161)

Cash and cash equivalents (as presented in the

consolidated balance sheet) 7,481 2,789

Trade and other receivables(1) 304 310

Trade and other payables(1) (219) (219)

Short term borrowings (4,817) (3,448)

Long term borrowings (17,798) (16,750)

(22,530) (20,107)

Net debt as extracted from the consolidated

balance sheet (15,049) (17,318)

Note:

(1) Trade and other receivables and payables include certain derivative financial instruments (see

notes 17 and 27 to the Consolidated Financial Statements).

At 31 March 2007, the Group had £7.5 billion of cash and cash equivalents,

with the increase since 31 March 2006 being due to the funding

requirements in relation to the completion of the Hutchison Essar

transaction, which occurred on 8 May 2007. Cash and cash equivalents are

held in accordance with the Group treasury policy.

The Group holds its cash and liquid investments in accordance with the

counterparty and settlement risk limits of the Board approved treasury

policy. The main forms of liquid investments at 31 March 2007 were money

market funds, commercial paper and bank deposits.

Net debt decreased to £15,049 million, from £17,318 million at 31 March

2006, principally as a result of the cash flow items noted above, partly offset

by equity dividend payments and £367 million of adverse foreign exchange

movements. This represented approximately 16% of the Group’s market

capitalisation at 31 March 2007 compared with 24% at 31 March 2006.

Average net debt at month end accounting dates over the 12 month period

ended 31 March 2007 was £15,631 million, and ranged between

£9,835 million and £20,229 million during the year.

Consistent with the development of its strategy, the Group targets low

single A long term credit ratings, with its current credit ratings being

P-2/F2/A-2 short term and Baa1 stable/A- stable/A- stable long term from

Moody’s, Fitch Ratings and Standard & Poor’s respectively. Following the

acquisition of Hutchison Essar, Moody’s downgraded their long term credit

rating for the Group from A3 to Baa1 on 16 May 2007. Credit ratings are not

a recommendation to purchase, hold or sell securities, in as much as ratings

do not comment on market price or suitability for a particular investor, and

are subject to revision or withdrawal at any time by the assigning rating

organisation. Each rating should be evaluated independently.

The Group’s credit ratings enable it to have access to a wide range of debt

finance, including commercial paper, bonds and committed bank facilities.

Commercial paper programmes

The Group currently has US and euro commercial paper programmes of

$15 billion and £5 billion, respectively, which are available to be used to

meet short term liquidity requirements. At 31 March 2007, $26 million

(£13 million) was drawn under the US commercial paper programme and

€1,531 million (£1,040 million) and £50 million were drawn under the euro

commercial paper programme. At 31 March 2006, $696 million

(£400 million) was drawn under the US commercial paper programme and

$80 million (£46 million) and £285 million were drawn under the euro

commercial paper programme. The commercial paper facilities were

supported by $10.9 billion (£5.6 billion) of committed bank facilities (see

“Committed facilities” below), comprised of a $5.9 billion Revolving Credit

Facility that matures on 24 June 2009 and a $5.0 billion Revolving Credit

Facility that matures on 22 June 2012. At 31 March 2007 and 31 March

2006, no amounts had been drawn under either bank facility. On 8 May

2007, the Group’s $5.9 billion Revolving Credit Facility was extended to

$6.1 billion and the $5.0 billion Revolving Credit Facility was extended to

$5.2 billion.

Bonds

The Group has a €25 billion Euro Medium Term Note programme and a

$12 billion US shelf programme, which are used to meet medium to long

term funding requirements. At 31 March 2007, the total amounts in issue

under these programmes split by currency were $16.5 billion, £1.5 billion,

€9.3 billion and AUD 0.3 billion.

Performance