Vodafone 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Delivering on

our strategic

objectives

Vodafone Group Plc

Annual Report

For the year ended 31 March 2007

Table of contents

-

Page 1

Delivering on our strategic objectives Vodafone Group Plc Annual Report For the year ended 31 March 2007 -

Page 2

... leader in an increasingly connected world This constitutes the Annual Report of Vodafone Group Plc (the "Company") in accordance with International Financial Reporting Standards ("IFRS") and with those parts of the Companies Act 1985 applicable to companies reporting under IFRS and is dated 29 May... -

Page 3

... Financial Statements of Vodafone Group Plc 149 Independent Auditor's Report to the Members of Vodafone Group Plc 10 Business Overview 24 Regulation 4 5 6 8 Chairman's Statement Group at a Glance Chief Executive's Review Delivering on our Strategic Objectives 150 Shareholder Information 157 Form... -

Page 4

... activities Net cash flows from investing activities Net cash flows from financing activities Free cash flow (Non-GAAP measure)(1) Consolidated Balance Sheet Data Total assets Total equity Total equity shareholders' funds Total liabilities Earnings Per Share ("EPS")(3) Weighted average number... -

Page 5

... multiplying earnings per ordinary share by ten, the number of ordinary shares per ADS. Dividend per ADS is calculated on the same basis. (4) 2005 net loss includes the cumulative effect of accounting changes related to intangible assets and post employment benefits that increase net loss by £6,372... -

Page 6

...penetrated markets. We have a particularly strong position in the business sector which we intend to develop further. We also plan to grow services beyond core voice and messaging and continue to search for new sources of revenue which are closely related to our customer's needs. The mobile phone is... -

Page 7

.... The Group is structured into two regions to address the different business challenges inherent in them. Europe Markets Germany Italy Spain UK Albania Greece Ireland Malta Netherlands Portugal Key Focus Revenue stimulation and cost reduction Key performance data(3) Revenue (£bn) 2007 2006 2005... -

Page 8

...markets • Actively manage our portfolio to maximise returns • Align capital structure and shareholder returns policy to strategy The past 12 months have been an important period for Vodafone. We updated our strategy in 2006 to address changing customer needs, the availability of new technologies... -

Page 9

...services. Align capital structure and shareholder returns policy to strategy In May 2006, we outlined a new capital structure and returns policy consistent with the operational strategy of the business, resulting in a targeted annual 60% payout of adjusted earnings per share in the form of dividends... -

Page 10

... of this change. Customers are increasingly looking for one supplier to address all their needs, whether that is for mobile or fixed services. The Group is increasingly targeting its propositions on replacing traditional fixed line providers in the home or office, as well as developing new and... -

Page 11

... to 46%. Key success factors have been customer focused propositions, in particular tariffs for small and medium sized businesses, as well as mobile data products such as 3G broadband USB modems and mobile connect data cards (where Vodafone has 55% market share), and mobile email solutions such as... -

Page 12

...-VPN") products. The mobile market share of the Group's operators in its principal markets, based on publicly available information, is estimated as follows: Customer market share (%) At 31 December 2006 Germany 36 33 31 26 Italy Spain UK 0 10 20 30 40 10 Vodafone Group Plc Annual Report 2007 -

Page 13

...internet and customer relations management to internet and intranet hosting services. The Group also has a direct and indirect interest constituting in aggregate a 9.99% ownership in Bharti Airtel, an Indian based mobile and fixed line telecommunications operation with three strategic business units... -

Page 14

... of Vodafone's global products and services to be marketed in that operator's territory. Under the terms of these Partner Market agreements, the Group and its partners co-operate in the development and marketing of certain services, often under dual brand logos. The Group's Partner Market strategy... -

Page 15

...there are several regional and numerous local operators. (13) The Group does not have any jointly controlled customers in India following the change in consolidation status of Bharti Airtel from a joint venture to an investment on 11 February 2007. Vodafone Group Plc Annual Report 2007 13 Business -

Page 16

..., while Vodafone Mobile Connect data cards allow people to access the internet, corporate intranets and their emails whilst on the move using their notebooks. During the current financial year, the Group has been executing on its total communications strategy through fixed location based services... -

Page 17

...less per call when abroad. Data services The Group offers a number of products and services to enhance customers' access to data services, including Vodafone live! for consumers, as well as a suite of products for business users consisting of Vodafone Mobile Connect data cards, internet based email... -

Page 18

... Vodafone email customers in the Group's controlled and jointly controlled markets as at 31 March 2007. Data roaming Vodafone has continued to improve the simplicity, price predictability and value for money offered to data services customers. For Vodafone Mobile Connect 3G broadband data card users... -

Page 19

... year, this business unit has developed a number of services and solutions specifically for global enterprises. The device portfolio offers a consistent range of mobile devices at different price points across multiple markets. Mobile Spend Management is an analysis and reporting tool which allows... -

Page 20

...as founding members. This strategic programme is expected to deliver long term cost savings and improve the time to market for new service innovations to be integrated on a mobile device. Customer strategy and management Vodafone continues to use a customer management system called 'customer delight... -

Page 21

...dial-up modem. Vodafone has expanded its service offering on 3G networks with high speed internet and e-mail access, video telephony, full track music downloads, mobile TV and other data services, in addition to existing voice and data services. The Group has secured 3G licences in all jurisdictions... -

Page 22

... based data traffic using IP. Vodafone Mobile Connect data cards which support HSDPA are available commercially, and compatible Vodafone live! handsets were launched in the summer of 2006. HSDPA was launched commercially in many of the major mobile markets of the Group during the 2007 financial... -

Page 23

... of updated mobile phone and driving policy requirements and the continued development of group standards for the selection and evaluation of appropriately trained and qualified contractors and service providers. Supply chain management Handsets, network equipment, marketing and IT services account... -

Page 24

...voice and data communications for both consumer and enterprise customers. The Group has continued to execute on its strategy of actively managing its portfolio to maximise returns, with recent acquisitions in the high growth markets of Romania, the Czech Republic, Turkey and India. Vodafone began in... -

Page 25

... in Belgacom Mobile SA for â,¬2.0 billion (£1.3 billion). • 25 November 2006 - Netherlands: Group's shareholdings increased to 100.0% following a compulsory acquisition of outstanding shares. Business • 3 December 2006 - Egypt: Acquired an additional 4.8% stake in Vodafone Egypt bringing the... -

Page 26

...and, in January 2005, the Commission issued a statement of objections following its investigation of the German market. In both cases the statement of objections was addressed to both the national mobile operating subsidiaries and to the Company and, in both 24 Vodafone Group Plc Annual Report 2007 -

Page 27

... the setting of retail SMS prices and were fined Regulation in Vodafone's Markets Europe Germany Vodafone Germany has been found to have SMP in the call termination market and the NRA has set Vodafone's termination rate at 8.79 eurocents per minute. In April 2007, an administrative court ruled that... -

Page 28

...commercially agree "active" infrastructure sharing arrangements. This would include Node Bs, Radio Access Networks, and backhaul between Base Transceiver Stations and the Base Station Controller, but not spectrum. The DoT is considering the NRA's Recommendations. 26 Vodafone Group Plc Annual Report... -

Page 29

... 30 per minute retail price cap that will be imposed on mobile off-net voice calls from 1 July 2007. In September 2006, Safaricom obtained a one year 3G trial licence. New Zealand The NRA released a report proposing regulation of mobile termination rates for fixed to mobile calls, including a rate... -

Page 30

... status of foreign mobile termination rates, including actions taken to date by foreign regulators to address the issue. This proceeding remains pending. China The timing and terms of 3G licence awards, and related changes to the telecommunications regulatory framework, are currently under review by... -

Page 31

...Presentation of Information In the discussion of the Group's reported financial position and results, information in addition to that contained within the Consolidated Financial Statements is presented. Refer to page 159 for definition of terms. Vodafone Group Plc Annual Report 2007 29 Performance -

Page 32

... Financial Statements. Management has discussed its critical accounting estimates and associated disclosures with the Company's Audit Committee. value of the reporting unit and the fair value of the net assets of the reporting unit. The carrying value of the Group's mobile operations in Germany... -

Page 33

... position and performance. US GAAP For acquisitions prior to 29 September 2004, the key difference from IFRS was that for the acquisition of mobile network businesses, the excess of purchase price over the fair value of the identifiable assets and liabilities Vodafone Group Plc Annual Report... -

Page 34

... access charges, airtime charges, messaging, the provision of other mobile telecommunications services, including data services and information provision, fees for connecting users of other fixed line and mobile networks to the Group's network, revenue from the sale of equipment, including handsets... -

Page 35

.... Churn rates stated in this Annual Report are calculated for the entire financial year. Customer delight The Group uses a proprietary 'customer delight' system to track customer satisfaction across its controlled markets and jointly controlled market in Italy. More information on the benefits of... -

Page 36

...in Group revenue. Strong performances were recorded in Spain and a number of the Group's emerging markets. An increase in the average mobile customer base and usage stimulation initiatives resulted in organic revenue growth of 2.5% and 7.0% in voice and messaging revenue, respectively. Data revenue... -

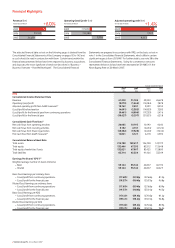

Page 37

... 24.3%. Strong performances were delivered in Spain, the US and a number of emerging markets. Adjusted operating profit is stated after charges in relation to regulatory fines in Greece of £53 million and restructuring costs within common functions, Vodafone Germany, Vodafone UK and Other Europe of... -

Page 38

... licence amortisation Depreciation and other amortisation Share of result in associates Adjusted operating profit Change at constant exchange rates Voice revenue Messaging revenue Data revenue Fixed line operator and DSL revenue Total service revenue Acquisition revenue Retention revenue Other... -

Page 39

...to increasing outgoing voice usage. In Italy, the increase in outgoing voice usage of 12.1% was mainly driven by demand stimulation initiatives such as fixed price per call Vodafone Group Plc Annual Report 2007 37 Service revenue Germany Italy Spain UK Arcor Other Europe Europe Total revenue Europe... -

Page 40

... for key IT systems. In October 2006, the Group announced that EDS and IBM had been selected to provide application development and maintenance services to separate groupings of operating companies within the Group. The initiative is currently in the 38 Vodafone Group Plc Annual Report 2007 -

Page 41

.... • The network team continues to focus on network sharing deals in a number of operating companies, with the principal objectives of cost saving and faster network rollout. Implementation is under way in Spain with Orange, the UK has announced its intention to sign a deal with Orange and other... -

Page 42

... Share of result in associates Adjusted operating profit Year ended 31 March 2006 Voice revenue Messaging revenue Data revenue Fixed line operators and DSL revenue Total service revenue Acquisition revenue Retention revenue Other revenue Total revenue Interconnect costs Other direct costs... -

Page 43

... 29.3%, calculated by applying the Group's current equity interest to the whole of the 2006 financial year. The continued expansion of 3G network coverage, the successful launch of 3G broadband, together with introductory promotional offers, and increased sales of Vodafone Mobile Connect data cards... -

Page 44

... launch of services by a new operator and in South Africa in response to the introduction of mobile number portability during the year, with the provision of 3G and data 42 Vodafone Group Plc Annual Report 2007 Verizon Wireless (100% basis) 2007 2006 Total revenue (£m) Closing customers ('000... -

Page 45

... costs less charges to the Group's operations. Adjusted operating profit has been impacted in the 2007 financial year by restructuring costs incurred in the central functions, principally marketing and technology, which amounted to £36 million. Vodafone Group Plc Annual Report 2007 43 Performance -

Page 46

... on an organic basis, as an increase in the average customer base and the number of messages sent per customer was offset by tariff declines. The success of 3G, Vodafone live! and offerings in the business segment, including Vodafone Mobile Connect data cards and BlackBerry from Vodafone, were the... -

Page 47

...tax issues Changes in the fair value of equity put rights and similar arrangements Dividends from investments Net financing costs (318) (329) (161) 41 (767) (293) (245) 8.5 34.3 On 17 March 2006, the Group announced that an agreement had been reached to sell its 97.68% interest in Vodafone Japan... -

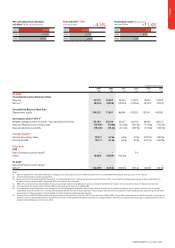

Page 48

... operating profit Change at constant exchange rates Voice revenue Messaging revenue Data revenue Fixed line and DSL revenue Total service revenue Acquisition revenue Retention revenue Other revenue Total revenue Interconnect costs Other direct costs Acquisition costs Retention costs Operating... -

Page 49

... the 3G market in Spain, along with an 84.3% increase in the number of Vodafone live! devices. In the UK, growth of 843,000 over the financial year in registered 3G devices and the continued success of Vodafone Mobile Connect data cards and Vodafone Group Plc Annual Report 2007 47 Performance -

Page 50

...the increased Group charge for use of the brand and related trademarks. Interconnect costs fell as a proportion of service revenue, due to promotions which encouraged calls to be made to Vodafone and fixed-line numbers, which incur lower interconnect costs, and the cut in termination rates. A higher... -

Page 51

...Share of result in associates Adjusted operating profit Change at constant exchange rates Voice revenue Messaging revenue Data revenue Fixed line operator and DSL revenue Total service...96) (652) âˆ' (35) (410) 1,980 2,645 23.9 7.8 Vodafone Group Plc Annual Report 2007 49 Performance 2,392 280 37 -

Page 52

....9%. The stake increases in Romania and South Africa and the acquisitions in India and the Czech Republic increased reported total revenue by 26.5%, while favourable exchange rates increased total revenue growth by 6.6%. Eastern Europe The key drivers behind the growth in service revenue in Eastern... -

Page 53

... innovative new data services in areas such as full track music downloads and location based services. In local currency, the Group's share of Verizon Wireless' operating profit increased by 21.5%, driven by revenue growth and a leading cost efficiency position in the US market. The Group's share of... -

Page 54

... change in consolidation status of the Group's investment in Bharti Airtel in India, an increase of £1.0 billion in the listed share price of China Mobile in which the Group has an equity investment, and investments in SoftBank, which arose on the disposal of Vodafone Japan. Current assets Current... -

Page 55

... increases in dividend per share in the near term until the payout ratio returns to 60%. Cash dividends, if any, will be paid by the Company in respect of ordinary shares in pounds sterling or, to holders of ordinary shares with a registered Vodafone Group Plc Annual Report 2007 53 Performance -

Page 56

...of the sale of Vodafone Japan, the Group stated that it would make a special distribution to shareholders of approximately £6 billion. Consistent with the Group's strategy of targeting a low single A credit rating over the long term, on 30 May 2006 the Group announced that it would return a further... -

Page 57

... targeting a lower credit rating in May 2006 and the £9 billion special distribution, the Group has no current plans for further share purchases or other one-off shareholder returns. The Board will periodically review the free cash flow, anticipated cash requirements, dividends, credit profile and... -

Page 58

... structural changes that do not affect the obligations of the Company to be specifically excluded from the definition of a change of control. This is in addition to the rights of lenders to cancel their commitment if the Company has committed an event of default. 56 Vodafone Group Plc Annual Report... -

Page 59

... disclosures about market risk A discussion of the Group's financial risk management objectives and policies and the exposure of the Group to liquidity, market and credit risk is included within note 24 to the Consolidated Financial Statements. Vodafone Group Plc Annual Report 2007 57 Performance -

Page 60

..."Business - Regulation". Expected benefits from cost reduction initiatives may not be realised. The Group has entered into several cost reduction initiatives principally relating to the outsourcing of IT application development and maintenance, data centre consolidation, supply chain management and... -

Page 61

...mobile networks due to increased usage and the need to offer new services and greater functionality afforded by new or evolving telecommunications technologies. Accordingly, the rate of the Group's capital expenditures in future years could remain high or exceed that which it has experienced to date... -

Page 62

...of the Europe region and common functions when compared with the 2006 financial year on an organic basis, excluding the potential impact from developing and delivering new services and from any business restructuring costs. Proportionate information includes results from the Group's equity accounted... -

Page 63

... products, services or technologies in new markets; • the ability of the Group to offer new services and secure the timely delivery of high quality, reliable network equipment and other key products from suppliers; Furthermore, a review of the reasons why actual results and developments may differ... -

Page 64

... effect of factors unrelated to the operating performance of the business; • it is used by the Group for internal performance analysis; and • it facilitates comparability of underlying growth with other companies, although the term "organic" is not a defined term under IFRS, or US GAAP, and may... -

Page 65

...cash available for such discretionary activities, to strengthen the balance sheet or to provide returns to shareholders in the form of dividends or share purchases; • free cash flow facilitates comparability of results with other companies, although the Group's measure of free cash flow may not be... -

Page 66

... and Senior Management The business of the Company is managed by its board of directors ("the Board"). Biographical details of the directors and senior management at the date of this report are as follows: Directors Chairman 1. Sir John Bond became Chairman of Vodafone Group Plc in July 2006 having... -

Page 67

... based in Asia, where he has held positions with Jardine Matheson, Deutsche Bank and Hutchison Whampoa where, as Group Managing Director, he oversaw the development and launch of mobile telecommunications networks in many parts of the world. He remains on the Boards of Cheung Kong Holdings Limited... -

Page 68

... Plc Annual Report 2007 Frank Rovekamp, Global Chief Marketing Officer, was appointed to this position and joined the Executive Committee in May 2006. He joined Vodafone in 2002 as Marketing Director and a member of the Management Board of Vodafone Netherlands and later moved to Vodafone Germany... -

Page 69

...Internal Control - Control Environment - Review of Effectiveness - Relations with Shareholders - Political Donations - Auditors - US Listing Requirements - Differences from the New York Stock Exchange Corporate Governance Practices - The Sarbanes-Oxley Act 2002 - Corporate Governance Rating - Report... -

Page 70

... to Group's employees; and develop an understanding of the Group's main relationships. The Company Secretary provides a programme of on-going training for the directors, which covers a number of sector specific and business issues, as well as legal, accounting and regulatory changes and developments... -

Page 71

... insurance policy throughout the financial year. This policy has been renewed for the next financial year. Neither the Company's indemnity nor the insurance provides cover in the event that the director is proven to have acted dishonestly or fraudulently. Vodafone Group Plc Annual Report 2007... -

Page 72

... management of the Group's businesses, the overall financial performance of the Group in fulfilment of strategy, plans and budgets and Group capital structure and funding. It also reviews major acquisitions and disposals. The members of the Executive Committee and their biographical details are set... -

Page 73

...for monitoring the system of internal control and reporting any significant control failings or weaknesses together with details of corrective action. A formal annual confirmation is provided by the chief executive officer and chief financial officer of each Group company certifying the operation of... -

Page 74

... by the SEC. Differences from the New York Stock Exchange Corporate Governance Practices Independence The NYSE rules require that a majority of the Board must be comprised of independent directors and the rules include detailed tests that US companies must use for determining independence... -

Page 75

...financial reports In relation to Section 302 of the Act, which covers disclosure controls and procedures, the Company established a Disclosure Committee reporting to the Chief Executive and Chief Financial Officer. It is chaired by the Group General Counsel and comprises members of senior management... -

Page 76

...Group evaluated its control environment, its risk assessment process and the way in which significant business risks were managed. It also considered the Group Audit department's reports on the effectiveness of internal controls, significant frauds and any fraud that involved management or employees... -

Page 77

... fixed-line business in Germany. CR performance is closely monitored and reported to most mobile operating company boards on a regular basis. CR is also integrated into Vodafone's risk management processes such as the formal annual confirmation provided by each mobile operating company detailing the... -

Page 78

.... During the year, Vodafone has focused on the clarity of marketing communications and the way in which the Group handles customer privacy, particularly in relation to the launch of mobile advertising services announced in May 2006 and in response to increasing demands from law enforcement agencies... -

Page 79

... or coverage. During the year, Vodafone announced the intention to participate in a number of network sharing agreements in the Czech Republic, Spain and the UK. Environmental Performance Indicators 2007(1)(2) 2006(1)(3) 2005(1) Energy use and efficiency Climate change is widely recognised as the... -

Page 80

... be subject to change over time as the business evolves. The total remuneration will be benchmarked against the relevant market. Vodafone is one of the largest companies in Europe and is a global business; Vodafone's policy will be to provide executive directors with remuneration generally at levels... -

Page 81

... business KPIs that will further the Company's medium term objectives. The Deferred Share Bonus offers an incentive for executives to co-invest. Share awards made in Vodafone Group Plc Annual Report 2007 79 Long term incentive Report on Executive Directors' Remuneration for the 2007 Financial... -

Page 82

.... The Remuneration Committee reviews and sets the GSTIP performance targets on an annual basis, taking into account business strategy. The performance measures for the 2007 financial year were adjusted operating profit, revenue, free cash flow and customer delight. Each element is weighted... -

Page 83

... employees may contribute up to £125 each month and the trustee of the plan uses the money to buy shares on their behalf. An equivalent number of shares are purchased with contributions from the employing company. UK based executive directors are eligible to participate in the SIP and details... -

Page 84

... directorships in other companies Some executive directors hold positions in other companies as non-executive directors. The fees received in respect of the 2007 financial year and retained by directors were as follows: 82 Vodafone Group Plc Annual Report 2007 TSR performance The following chart... -

Page 85

... of the base share awards under the Vodafone Group Short Term Incentive Plan applicable to the year ended 31 March 2007. These awards are in relation to the performance achievements against targets in adjusted operating profit, revenue, free cash flow and customer delight for the 2007 financial year... -

Page 86

... March 2007 is calculated using the closing middle market price of the Company's ordinary shares at 30 March 2007 of 135.5p. The aggregate number of shares conditionally awarded during the year under the Deferred Share Bonus to the Company's senior management, other than executive directors, is 304... -

Page 87

... under the Vodafone Group 1998 Executive Share Option Scheme, Vodafone Group Plc 1999 Long Term Stock Incentive Plan and the Vodafone Global Incentive Plan, which are not HM Revenue & Customs approved. No other directors have options under any of these schemes. Governance Latest expiry date Only... -

Page 88

... the Company, which are traded on the New York Stock Exchange. The number and option price have been converted into the equivalent amounts for the Company's ordinary shares, with the option price being translated at the 31 March 2007 exchange rate of $1.9685:£1. 86 Vodafone Group Plc Annual Report... -

Page 89

.... Directors' interests in contracts None of the current directors had a material interest in any contract of significance to which the Company or any of its subsidiary undertakings was a party during the financial year. Luc Vandevelde On behalf of the Board Vodafone Group Plc Annual Report 2007... -

Page 90

... not evaluated the internal controls of Vodacom Group (Pty) Limited ("Vodacom"), which is accounted for using proportionate consolidation. The conclusion regarding the effectiveness of internal control over financial reporting does not extend to the internal controls of Vodacom. Management is unable... -

Page 91

... of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. Vodafone Group Plc Annual Report 2007 89 In our opinion, management's assessment that the Group maintained effective internal control over financial reporting as of 31 March 2007 is fairly... -

Page 92

... of Vodafone Group Plc at 31 March Notes to the Company Financial Statements 1. Basis of preparation 2. Significant accounting policies 3. Fixed assets 4. Debtors 5. Creditors 6. Share capital 7. Share based payments 8. Reserves and reconciliation of movements in equity shareholders' funds 9. Equity... -

Page 93

.... Information relating to the nature and effect of such differences is presented in note 38 to the Consolidated Financial Statements. We have also audited, in accordance with the standards of the Public Company Oversight Board (United States), the effectiveness of the Group's internal control over... -

Page 94

...Actuarial gains/(losses) on defined benefit pension schemes, net of tax Revaluation gain Transfer to the income statement on disposal of foreign operations Net (expense)/income recognised directly in equity (Loss)/profit for the financial year Total recognised income and expense relating to the year... -

Page 95

...were signed on its behalf by: Arun Sarin Chief Executive Andy Halford Chief Financial Officer The accompanying notes are an integral part of these Consolidated Financial Statements. The unaudited US dollar amounts are prepared on the basis set out in note 1. Vodafone Group Plc Annual Report 2007... -

Page 96

... shares B share capital redemption B share preference dividends paid Equity dividends paid Dividends paid to minority shareholders in subsidiary undertakings Interest paid Net cash flows used in financing activities Net cash flows Cash and cash equivalents at beginning of the financial year Exchange... -

Page 97

... are incorporated in the Consolidated Financial Statements using the equity method of accounting. Under the equity method, investments in associates are carried in the consolidated balance sheet at cost as adjusted for post-acquisition changes in the Group's share of the net assets of the associate... -

Page 98

...are dependent on specific technologies. Amortisation is charged to the income statement on a straight-line basis over the estimated useful lives from the commencement of service of the network. Computer software Computer software licences are capitalised on the basis of the costs incurred to acquire... -

Page 99

... data services and information provision, fees for connecting users of other fixed line and mobile networks to the Group's network, revenue from the sale of equipment, including handsets, and revenue arising from Partner Market agreements. Access charges and airtime used by contract customers... -

Page 100

... plans, the difference between the fair value of the plan assets and the present value of the plan liabilities is recognised as an asset or liability on the balance sheet. During the year ended 31 March 2006, the Group early adopted the amendment to IAS 19, "Employee Benefits", issued by the IASB... -

Page 101

..., net of direct issue costs. Derivative financial instruments and hedge accounting The Group's activities expose it to the financial risks of changes in foreign exchange rates and interest rates. The use of financial derivatives is governed by the Group's policies approved by the Board of directors... -

Page 102

... with the new structure. See note 29 for information on discontinued operations. Germany and Arcor together form the geographic segment of Germany. Germany £m Italy £m Spain £m UK £m Arcor(1) £m Other Europe £m Total - Europe £m Eastern Europe £m Middle East, Africa & Asia £m Pacific... -

Page 103

Germany £m Italy £m Spain £m UK £m Arcor(1) £m Other Europe £m Total - Europe £m Eastern Europe £m Middle East, Africa & Asia £m Pacific £m Associates Associates - US - Other £m £m Total Common - EMAPA Functions £m £m Group £m 31 March 2006 Service revenue Equipment and ... -

Page 104

... 404 of the US Sarbanes-Oxley Act of 2002. (2) Amounts for 2007, 2006 and 2005 include fees mainly relating to the preparatory work required in advance of the implementation of Section 404 of the US Sarbanes-Oxley Act of 2002 and general accounting advice. 102 Vodafone Group Plc Annual Report 2007 -

Page 105

... the disposal of Vodafone Japan on 27 April 2006. (3) Equity put rights and similar arrangements includes amounts in relation to the Group's arrangements with Telecom Egypt and its minority partners in the Group's other operations in Germany. Contracts have been revalued to current redemption value... -

Page 106

... operations, at the UK statutory tax rate of 30% for 2007, 2006 and 2005, and the Group's total tax expense for each year. Further discussion of the current year tax expense can be found in the section titled "Performance - Operating Results". 2007 £m 2006 £m 2005 £m (Loss)/profit before tax on... -

Page 107

... tax losses. In particular, the Group's subsidiary Vodafone 2 is responding to an enquiry by HM Revenue & Customs ("HMRC") with regard to the UK tax treatment of one of its Luxembourg holding companies under the controlled foreign companies ("CFC") rules. Further details in relation to this enquiry... -

Page 108

... 2,753 728 1,263 1,991 Proposed or declared after the balance sheet date and not recognised as a liability: Final dividend for the year ended 31 March 2007: 4.41 pence per share (2006: 3.87 pence per share, 2005: 2.16 pence per share) 2,331 2,328 1,386 106 Vodafone Group Plc Annual Report 2007 -

Page 109

...the financial liability relating to the initial shareholder agreement was released from the Group's balance sheet. Fair value movements are determined by reference to the quoted share price of Vodafone Egypt. For the 2007 financial year, a credit of £34 million was recognised. The capital structure... -

Page 110

... the cost of sales line within the Income Statement. The net book value at 31 March 2007 and expiry dates of the most significant purchased licences are as follows: Expiry date 2007 £m 2006 £m Germany UK December 2020 December 2021 4,684 4,912 5,165 5,245 108 Vodafone Group Plc Annual Report... -

Page 111

...: Cash generating unit: Reportable segment: 2007 £m 2006 £m 2005 £m Germany Italy Sweden Germany Italy Other Europe 6,700 4,900 - 11,600 19,400 3,600 515 23,515 - - 475 475 During the year ended 31 March 2007, the increase in long term interest rates, which led to higher discount rates, led... -

Page 112

... of each the Group's operations is based on the risk free rate for ten year bonds issued by the government in the respective market, adjusted for a risk premium to reflect both the increased risk of investing in equities and the systematic risk of the specific Group operating company. In making this... -

Page 113

... in Germany and Italy are disclosed below under "Sensitivity to changes in assumptions". During the year ended 31 March 2007, the most recent value in use calculation for Group's operations in Spain was based on a pre-tax risk adjusted discount rate of 9.7% (2006: 9.0%) and long term growth rate of... -

Page 114

... S.A., Vodafone Holding GmbH, Vodafone Holdings Europe S.L. and Vodafone Romania S.A. have a 31 December year end. Accounts are drawn up to 31 March 2007 for inclusion in the Consolidated Financial Statements. (4) Share capital consists of 540,561,699 ordinary shares and 1.65 million class D and... -

Page 115

... Name Principal activity Polkomtel S.A.(3) Safaricom Limited(4) Vodacom Group (Pty) Limited Vodafone Fiji Limited Vodafone Omnitel N.V.(5) Mobile network operator Mobile network operator Holding company Mobile network operator Mobile network operator Poland Kenya South Africa Fiji Netherlands... -

Page 116

...The fair values of listed securities are based on quoted market prices, and include; • the Group's 3.3% investment in China Mobile Limited, which is listed on the Hong Kong and New York stock exchanges and incorporated under the laws of Hong Kong. China Mobile Limited is a mobile network operator... -

Page 117

... - 138 166 304 19 30 1 50 260 310 The fair values of these financial instruments are calculated by discounting the future cash flows to net present values using appropriate market interest and foreign currency rates prevailing at the year end. Vodafone Group Plc Annual Report 2007 115 Financials -

Page 118

... existing issued ordinary share held at the close of business on 28 July 2006 and the consolidation of existing ordinary shares on the basis of 7 new ordinary shares for 8 existing ordinary shares. On 31 July 2006, the new ordinary shares were admitted to the London Stock Exchange official list, and... -

Page 119

... subject to performance conditions other than continued employment. Vodafone Group executive plans Under the Vodafone Global Incentive Plan and its predecessor the Vodafone Group Plc 1999 Long Term Stock Incentive Plan, awards of performance shares are granted to directors and certain employees. The... -

Page 120

... remaining price contractual life Months Outstanding shares Millions Exercisable shares Millions Vodafone Group Savings Related and Sharesave Scheme: £0.01 - £1.00 £1.01 - £2.00 Vodafone Group Executive Schemes: £1.01 - £2.00 £2.01 - £3.00 Vodafone Group 1999 Long Term Stock Incentive... -

Page 121

... expected to be recognised over a weighted average period of two years. No cash was used to settle equity instruments granted under share-based payment schemes. The average share price for the 2007 financial year was 129 pence. Financials Other information Vodafone Group Plc Annual Report 2007 119 -

Page 122

... Cancellation of own shares held Share-based payment charge, inclusive of tax credit of £9 million 31 March 2006 Issue of new shares Own shares released on vesting of share awards Share consolidation B share capital redemption B share preference dividend Share-based payment charge, inclusive of tax... -

Page 123

...relation to the Group's non-derivative financial liabilities, on an undiscounted basis and which, therefore, differs from both the carrying value and fair value, is as follows: Redeemable preference shares...793 14,009 600 556 523 315 2,851 18,854 Vodafone Group Plc Annual Report 2007 121 Financials -

Page 124

...euro 500m bond due January 2008 Short term borrowings 94 23 7 897 749 2,202 - - - - 76 252 170 341 4,811 58 18 7 - - 1,840 15 281 1,063 126 - - - - 3,408 94 23 7 878 770 2,202 - - - - 77 254 171 341 4,817 58 18 7 - - 1,840 15 293 1,091 126 - - - - 3,448 122 Vodafone Group Plc Annual Report 2007 -

Page 125

... 480 281 - 16,750 Fair values are calculated using discounted cash flows with a discount rate based upon forward interest rates available to the Group at the balance sheet date. Banks loans include a ZAR8 billion loan held by Vodafone Holdings SA Pty Limited ("VHSA"), which directly and indirectly... -

Page 126

... terms and conditions of the $5,925 million and $5,025 million bank facilities, lenders have the right, but not the obligation, to cancel their commitment 30 days from the date of notification of a change of control of the Company and have outstanding advances repaid on the last day of the current... -

Page 127

... of the Group's Chief Financial Officer, Group General Counsel and Company Secretary, Group Treasurer and Director of Financial Reporting, meets at least annually to review treasury activities and its members receive management information relating to treasury activities on a quarterly basis. In... -

Page 128

... of the UK employees are members of the Vodafone Group Pension Scheme (the "main scheme"), which was closed to new entrants from 1 January 2006. This is a tax approved final salary defined benefit scheme, the assets of which are held in an external trusteeadministered fund. The investment policy and... -

Page 129

... Benefits paid Other movements Exchange rate movements 31 March 1,123 - 73 26 55 13 (32) - (7) 1,251 874 (3) 57 121 85 11 (27) - 5 1,123 640 - 42 24 167 12 (7) (9) 5 874 Vodafone Group Plc Annual Report 2007 127 Financials Current service cost Interest cost Expected return on scheme assets... -

Page 130

...the Consolidated Financial Statements continued 25. Post employment benefits continued Movement in scheme liabilities: 1 April Reclassification as held for sale Current service cost Interest cost Member cash contributions Actuarial (gains)/losses Benefits paid Other movements Exchange rate movements... -

Page 131

...within "Derivative financial instruments" are the following: 2007 £m 2006 £m Fair value through the income statement (held for trading): Interest rate swaps Foreign exchange swaps Fair value hedges: Interest rate swaps 68 48 116 103 219 2 69 71 148 219 Vodafone Group Plc Annual Report 2007 129... -

Page 132

...minor employee-related liabilities and outstanding service credits to be fulfilled. The transaction has been accounted for by the purchase method of accounting. Book value £m Fair value adjustments £m Fair value £m Net assets acquired: Intangible assets(1) Property, plant and equipment Inventory... -

Page 133

... £m Vodafone Group Plc Annual Report 2007 131 Financials Net cash flows from operating activities Net cash flows from investing activities Net cash flows from financing activities Net increase in cash and cash equivalents Cash and cash equivalents at the beginning of the financial year Exchange... -

Page 134

... £m Net assets disposed Total cash consideration Other effects(1) Net gain on disposal Note: (1) Other effects include the recycling of currency translation on disposal and professional fees related to the disposal. 901 1,343 (1) 441 1,664 1,776 (44) 68 132 Vodafone Group Plc Annual Report 2007 -

Page 135

... in Japan, which were sold on 27 April 2006. During the year ended 31 March 2007, the Group entered into various agreements in relation to its acquisition of Hutchison Essar from Hutchison Telecommunications International Ltd. See note 35 for further details. Vodafone Group Plc Annual Report 2007... -

Page 136

...the event that the Group does not perform what is expected of it under the terms of any related contracts. Group performance bonds include £57 million (2006: £152 million) in respect of undertakings to roll out 3G networks in Spain. Court and Court of Appeal. The Vodafone 2 reference has still to... -

Page 137

...Short term employee benefits Post-employment benefits: Defined benefit schemes Defined contribution schemes Share-based payments 29 1 1 6 37 26 2 2 16 46 18 2 1 22 43 Vodafone Group Plc Annual Report 2007 135 Financials Aggregate compensation for key management, being the directors and members... -

Page 138

...Government to initiate proceedings against Hutchison Essar under the Foreign Exchange Management Act 1999. Other remedies are sought against other companies and individuals. These proceedings are at an early stage and the Group believes them to be without merit. 136 Vodafone Group Plc Annual Report... -

Page 139

... a 100% basis from accounts prepared under IFRS at 31 March and for the years then ended, is set out below. 50% or less owned entities classified as associated undertakings Revenue Profit for the financial year Non-current assets Current assets Total assets Total equity shareholders' funds Minority... -

Page 140

...financial information of Vodafone Omnitel N.V., extracted on a 100% basis from financial statements prepared under IFRS at 31 March and for the years then ended, is set out below: 2007 £m 2006 £m 2005 £m Revenue (Loss)/profit for the financial year Non-current assets Current assets Total assets... -

Page 141

... in the Consolidated Financial Statements using the equity method of accounting. Under the equity method, investments in jointly controlled entities are carried in the consolidated balance sheet at cost as adjusted for post-acquisition changes in the Group's share of the net assets of the... -

Page 142

... of licences are also capitalised until the date that the related network service is launched. Capitalised interest costs are amortised over the estimated useful lives of the related assets. g. Other Financial instruments Under IFRS, equity put rights and similar arrangements are classified as... -

Page 143

... are reported outside of shareholders' equity and the minority interest in the income of consolidated subsidiaries is an adjustment to US GAAP net income. j. Changes in accounting principles Post employment benefits During the second half of the year ended 31 March 2005, the Group amended its policy... -

Page 144

... 2007 and is currently assessing the impact of the adoption of this standard on the Group's results and financial position. EITF Issue 06-1 EITF Issue 06-1, "Accounting for Consideration Given by a Service Provider to Manufacturers or Resellers of Equipment Necessary for an End-Customer to Receive... -

Page 145

... Net current assets Total assets less current liabilities Creditors: amounts falling due after more than one year Capital and reserves Called up share capital Share premium account Capital redemption reserve Capital reserve Other reserves Own shares held Profit and loss account Equity shareholders... -

Page 146

... net of direct issue costs. Derivative financial instruments and hedge accounting The Company's activities expose it to the financial risks of changes in foreign exchange rates and interest rates. The use of financial derivatives is governed by the Group's policies approved by the board of directors... -

Page 147

...contributions payable for the years ended 31 March 2007 and 31 March 2006. Share based payments The Group operates a number of equity settled share based compensation plans for the employees of subsidiary undertakings, using the Company's equity instruments. The fair value of the compensation given... -

Page 148

... existing issued ordinary share held at the close of business on 28 July 2006 and the consolidation of existing ordinary shares on the basis of 7 new ordinary shares for 8 existing ordinary shares. On 31 July 2006, the new ordinary shares were admitted to the London Stock Exchange official list, and... -

Page 149

7. Share based payments The Company currently uses a number of equity settled share plans to grant options and shares to the directors and employees of its subsidiary undertakings, as listed below. Share option schemes Vodafone Group savings related and Sharesave schemes Vodafone Group executive ... -

Page 150

... Other guarantees principally comprise of a guarantee relating to a bid for a UMTS licence in Hungary. Legal proceedings Details regarding certain legal actions which involve the Company are set out in note 31 to the Consolidated Financial Statements. 148 Vodafone Group Plc Annual Report 2007 -

Page 151

... balance sheet and the related notes numbered 1 to 10. These parent Company Financial Statements have been prepared under the accounting policies set out therein. The corporate governance statement and the directors' remuneration report are included in the Group annual report of Vodafone Group Plc... -

Page 152

... date. The shareholder will be sent a tax voucher confirming the amount of dividend and the account into which it has been paid. 150 Vodafone Group Plc Annual Report 2007 Registrars and Transfer Office The Company's ordinary share register is maintained by: Computershare Investor Services PLC... -

Page 153

... download the Annual Report and the Annual Review & Summary Financial Statement 2007; • check the current share price; • calculate dividend payments; and • use interactive tools to calculate the value of shareholdings, look up the historic price on a particular date and chart Vodafone ordinary... -

Page 154

... rights" below. Five year data on an annual basis London Stock Exchange Pounds per ordinary share High Low Frankfurt Stock Exchange Euros per ordinary share NYSE Dollars per ADS High Low High Low Shareholders at 31 March 2007 Number of ordinary shares held Number of accounts % of total issued... -

Page 155

... or an officer or is otherwise interested, provided that the director (together with any connected person) is not interested in 1% or more of any class of the company's equity share capital or the voting rights available to its shareholders, (e) relating to the arrangement of any employee benefit in... -

Page 156

...since the date of the preceding annual general meeting. Variation of rights If, at any time, the Company's share capital is divided into different classes of shares, the rights attached to any class may be varied, subject to the provisions of the Companies Act, either with the consent in writing of... -

Page 157

... under "Performance - Financial Position and Resources". Exchange Controls There are no UK government laws, decrees or regulations that restrict or affect the export or import of capital, including but not limited to, foreign exchange controls on remittance of dividends on the ordinary shares or on... -

Page 158

... instrument of transfer are executed and retained at all times outside the United Kingdom. A transfer of shares in the Company in registered form will attract ad valorem stamp duty generally at the rate of 0.5% of the purchase price of the shares. There is no charge to ad valorem stamp duty on... -

Page 159

...- Board of Directors and Group Management Business - Business Overview - Our Technology and Resources Note 34 "Employees" Governance - Board's Report to Shareholders on Directors' Remuneration Note 20 "Share-based payments" Shareholders - Shareholder Information - Markets Governance - Board's Report... -

Page 160

... Offer and Listing 9A Offer and listing details 9B Plan of distribution 9C Markets 9D Selling shareholders 9E Dilution 9F Expenses of the issue Additional Information 10A Share capital 10B Memorandum and articles of association 10C Material contracts 10D Exchange controls 10E Taxation 10F Dividends... -

Page 161

... operator when a customer makes a call to another mobile or fixed line network operator. A handset or device equipped with the Vodafone live! portal which has made or received a chargeable event in the last month. Glossary Vodafone Group Plc Annual Report 2007 159 Data revenue Depreciation and... -

Page 162

Notes 160 Vodafone Group Plc Annual Report 2007 -

Page 163

Contact Details Investor Relations: Telephone: +44 (0) 1635 664447 Media Relations: Telephone: +44 (0) 1635 664444 Corporate Responsibility: Fax: E-mail: Website: +44 (0) 1635 674478 [email protected] www.vodafone.com/responsibility We want to keep the environmental impact of the ... -

Page 164

Vodafone Group Plc Annual Report for the year ended 31 March 2007 Vodafone Group Plc Registered ofï¬ce: Vodafone House The Connection Newbury Berkshire RG14 2FN England Registered in England No.1833679 Tel: +44 (0) 1635 33251 Fax: +44 (0) 1635 45713 www.vodafone.com