Travelers 2012 Annual Report Download - page 94

Download and view the complete annual report

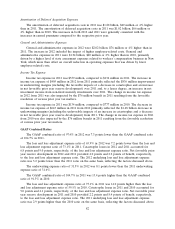

Please find page 94 of the 2012 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Amortization of Deferred Acquisition Expenses

The amortization of deferred acquisition costs in 2012 was $1.88 billion, $69 million or 4% higher

than in 2011. The amortization of deferred acquisition costs in 2011 was $1.82 billion, $66 million or

4% higher than in 2010. The increases in both 2012 and 2011 were generally consistent with the

increases in earned premiums compared to the respective prior year.

General and Administrative Expenses

General and administrative expenses in 2012 were $2.02 billion, $76 million or 4% higher than in

2011. The increase in 2012 included the impact of higher employee-related costs. General and

administrative expenses in 2011 were $1.94 billion, $40 million or 2% higher than in 2010, primarily

driven by a higher level of state assessment expenses related to workers’ compensation business in New

York, which more than offset an overall reduction in operating expenses that was driven by lower

employee-related costs.

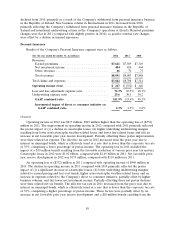

Income Tax Expense

Income tax expense in 2012 was $539 million, compared to $134 million in 2011. The increase in

income tax expense of $405 million in 2012 from 2011 primarily reflected the $836 million improvement

in underwriting margins (including the favorable impacts of a decrease in catastrophes and an increase

in net favorable prior year reserve development) over 2011 and, to a lesser degree, an increase in net

investment income from non-fixed maturity investments over 2011. The change in income tax expense

in 2012 from 2011 was also impacted by the $76 million benefit in 2011 resulting from the favorable

resolution of various prior year tax matters.

Income tax expense in 2011 was $134 million, compared to $777 million in 2010. The decrease in

income tax expense of $643 million in 2011 from 2010 primarily reflected the $1.48 billion decrease in

underwriting margins (including the unfavorable impacts of an increase in catastrophes and a decrease

in net favorable prior year reserve development) from 2011. The change in income tax expense in 2011

from 2010 was also impacted by the $76 million benefit in 2011 resulting from the favorable resolution

of various prior year tax matters.

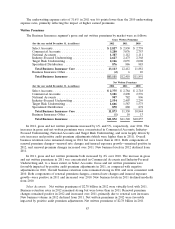

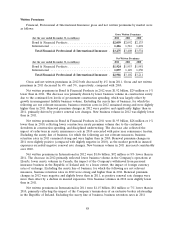

GAAP Combined Ratios

The GAAP combined ratio of 97.4% in 2012 was 7.3 points lower than the GAAP combined ratio

of 104.7% in 2011.

The loss and loss adjustment expense ratio of 65.9% in 2012 was 7.2 points lower than the loss and

loss adjustment expense ratio of 73.1% in 2011. Catastrophe losses in 2012 and 2011 accounted for

6.8 points and 9.0 points, respectively, of the loss and loss adjustment expense ratio. Net favorable prior

year reserve development in 2012 and 2011 provided 4.0 points and 2.2 points of benefit, respectively,

to the loss and loss adjustment expense ratio. The 2012 underlying loss and loss adjustment expense

ratio was 3.2 points lower than the 2011 ratio on the same basis, reflecting the factors discussed above.

The underwriting expense ratio of 31.5% in 2012 was 0.1 points lower than the 2011 underwriting

expense ratio of 31.6%.

The GAAP combined ratio of 104.7% in 2011 was 13.4 points higher than the GAAP combined

ratio of 91.3% in 2010.

The loss and loss adjustment expense ratio of 73.1% in 2011 was 14.0 points higher than the loss

and loss adjustment expense ratio of 59.1% in 2010. Catastrophe losses in 2011 and 2010 accounted for

9.0 points and 4.1 points, respectively, of the loss and loss adjustment expense ratio. Net favorable prior

year reserve development in 2011 and 2010 provided 2.2 points and 8.4 points of benefit, respectively,

to the loss and loss adjustment expense ratio. The 2011 underlying loss and loss adjustment expense

ratio was 2.9 points higher than the 2010 ratio on the same basis, reflecting the factors discussed above.

82