Travelers 2012 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2012 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.estimation difficulties also differ significantly by product line due to differences in the underlying

insurance contract (e.g., claims-made versus occurrence), claim complexity, the volume of claims, the

potential severity of individual claims, the determination of the occurrence date for a claim, and

reporting lags (the time between the occurrence of the insured event and when it is actually reported

to the insurer). Informed judgment is applied throughout the process.

The Company derives estimates for unreported claims and development on reported claims

principally from actuarial analyses of historical patterns of loss development by accident year for each

type of exposure and business unit. Similarly, the Company derives estimates of unpaid loss adjustment

expenses principally from actuarial analyses of historical development patterns of the relationship of

loss adjustment expenses to losses for each line of business and type of exposure. For a description of

the Company’s reserving methods for asbestos and environmental claims, see ‘‘Item 7—Management’s

Discussion and Analysis of Financial Condition and Results of Operations—Asbestos Claims and

Litigation,’’ and ‘‘—Environmental Claims and Litigation.’’

Discounting

The claims and claim adjustment expense reserves for most long-term disability and annuity claim

payments, primarily arising from workers’ compensation insurance and workers’ compensation excess

insurance policies, were discounted to the present value of estimated future payments using a rate of

5% at both December 31, 2012 and 2011. These discounted reserves totaled $2.01 billion and

$2.20 billion at December 31, 2012 and 2011, respectively.

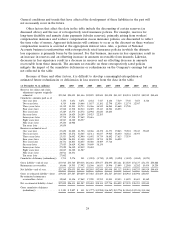

Claims and Claim Adjustment Expense Development Table

The table that follows sets forth the year-end reserves from 2002 through 2012 and the subsequent

changes in those reserves, presented on a historical basis. The original estimates, cumulative amounts

paid and re-estimated reserves in the table for the years 2002 and 2003 have not been restated to

reflect the acquisition by Travelers Property Casualty Corp. (TPC) of The St. Paul Companies, Inc.

(SPC) in 2004 (referred to hereafter as the Merger). The table includes SPC reserves beginning at

December 31, 2004.

The data in the table is presented in accordance with reporting requirements of the Securities and

Exchange Commission (SEC). Care must be taken to avoid misinterpretation by those unfamiliar with

this information or familiar with other data commonly reported by the insurance industry. The data in

the table is not accident year data, but rather a display of 2002 to 2012 year-end reserves and the

subsequent changes in those reserves.

For instance, the ‘‘cumulative deficiency (redundancy)’’ shown in the table for each year represents

the aggregate amount by which original estimates of reserves as of that year-end have changed in

subsequent years. Accordingly, the cumulative deficiency for a year relates only to reserves at that

year-end and those amounts are not additive. Expressed another way, if the original reserves at the end

of 2002 included $4 million for a loss that is finally paid in 2007 for $5 million, the $1 million

deficiency (the excess of the actual payment of $5 million over the original estimate of $4 million)

would be included in the cumulative deficiencies in each of the years 2002 to 2006 shown in the

accompanying table.

Various factors may distort the re-estimated reserves and cumulative deficiency or redundancy

shown in the table. For example, a substantial portion of the cumulative deficiencies shown in the table

arise from claims on policies written prior to the mid-1980s involving liability exposures such as

asbestos and environmental claims. In the post-1984 period, the Company has developed more stringent

underwriting standards and policy exclusions and has significantly contracted or terminated the writing

of these risks. See ‘‘Item 7—Management’s Discussion and Analysis of Financial Condition and Results

of Operations—Asbestos Claims and Litigation,’’ and ‘‘—Environmental Claims and Litigation.’’

23