Travelers 2012 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2012 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and pollution exposures; estimating additional living expenses; estimating the impact of demand surge,

infrastructure disruption, fraud, the effect of mold damage and business interruption costs; and

reinsurance collectibility. The timing of a catastrophe, such as at or near the end of a reporting period,

can also affect the information available to the Company in estimating reserves for that reporting

period. The estimates related to catastrophes are adjusted as actual claims emerge.

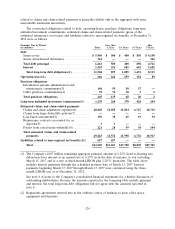

A portion of the Company’s gross claims and claim adjustment expense reserves (totaling

$3.04 billion at December 31, 2012) are for asbestos and environmental claims and related litigation.

While the ongoing review of asbestos and environmental claims and associated liabilities considers the

inconsistencies of court decisions as to coverage, plaintiffs’ expanded theories of liability and the risks

inherent in complex litigation and other uncertainties, in the opinion of the Company’s management, it

is possible that the outcome of the continued uncertainties regarding these claims could result in

liability in future periods that differs from current reserves by an amount that could be material to the

Company’s future operating results. See the preceding discussion of ‘‘Asbestos Claims and Litigation’’

and ‘‘Environmental Claims and Litigation.’’

General Discussion

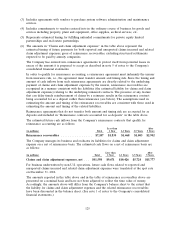

The process for estimating the liabilities for claims and claim adjustment expenses begins with the

collection and analysis of claim data. Data on individual reported claims, both current and historical,

including paid amounts and individual claim adjuster estimates, are grouped by common characteristics

(components) and evaluated by actuaries in their analyses of ultimate claim liabilities by product line.

Such data is occasionally supplemented with external data as available and when appropriate. The

process of analyzing reserves for a component is undertaken on a regular basis, generally quarterly, in

light of continually updated information.

Multiple estimation methods are available for the analysis of ultimate claim liabilities. Each

estimation method has its own set of assumption variables and its own advantages and disadvantages,

with no single estimation method being better than the others in all situations and no one set of

assumption variables being meaningful for all product line components. The relative strengths and

weaknesses of the particular estimation methods when applied to a particular group of claims can also

change over time. Therefore, the actual choice of estimation method(s) can change with each

evaluation. The estimation method(s) chosen are those that are believed to produce the most reliable

indication at that particular evaluation date for the claim liabilities being evaluated.

In most cases, multiple estimation methods will be valid for the particular facts and circumstances

of the claim liabilities being evaluated. This will result in a range of reasonable estimates for any

particular claim liability. The Company uses such range analyses to back test whether previously

established estimates for reserves at the reporting segments are reasonable, given subsequent

information. Reported values found to be closer to the endpoints of a range of reasonable estimates

are subject to further detailed reviews. These reviews may substantiate the validity of management’s

recorded estimate or lead to a change in the reported estimate.

The exact boundary points of these ranges are more qualitative than quantitative in nature, as no

clear line of demarcation exists to determine when the set of underlying assumptions for an estimation

method switches from being reasonable to unreasonable. As a result, the Company does not believe

that the endpoints of these ranges are or would be comparable across companies. In addition, potential

interactions among the different estimation assumptions for different product lines make the

aggregation of individual ranges a highly judgmental and inexact process.

Property-casualty insurance policies are either written on a claims-made or on an occurrence basis.

Claims-made policies generally cover, subject to requirements in individual policies, claims reported

during the policy period. Policies that are written on an occurrence basis require that the insured

130