Travelers 2012 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2012 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Unanticipated changes in risk factors can affect reserves. As an indicator of the causal effect that a

change in one or more risk factors could have on reserves for International and other (excluding

asbestos and environmental), a 1% increase (decrease) in incremental paid loss development for each

future calendar year could result in a 1.2% increase (decrease) in claims and claim adjustment expense

reserves. International and other reserves (excluding asbestos and environmental) represent

approximately 7% of the Company’s total claims and claim adjustment expense reserves.

International and other represents a combination of different product lines, some of which are in

runoff. Comparative historical information is not available for international product lines as insurers

domiciled outside of the U.S. do not file U.S. statutory reports. Comparative historical information on

runoff business is not indicative of reasonably possible one-year changes in the reserve estimate for this

mix of runoff business. Accordingly, the Company has not included comparative analyses for

International and other.

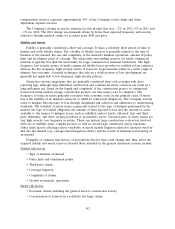

Reinsurance Recoverables

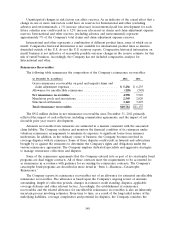

The following table summarizes the composition of the Company’s reinsurance recoverables:

(at December 31, in millions) 2012 2011

Gross reinsurance recoverables on paid and unpaid claims and

claim adjustment expenses ........................... $ 5,256 $ 6,255

Allowance for uncollectible reinsurance ................... (258) (345)

Net reinsurance recoverables .......................... 4,998 5,910

Mandatory pools and associations ....................... 2,549 2,020

Structured settlements ............................... 3,165 3,225

Total reinsurance recoverables ......................... $10,712 $11,155

The $912 million decline in net reinsurance recoverables since December 31, 2011 primarily

reflected the impact of cash collections, including commutation agreements, and the impact of net

favorable prior year reserve development.

Amounts recoverable from reinsurers are estimated in a manner consistent with the associated

claim liability. The Company evaluates and monitors the financial condition of its reinsurers under

voluntary reinsurance arrangements to minimize its exposure to significant losses from reinsurer

insolvencies. In addition, in the ordinary course of business, the Company becomes involved in

coverage disputes with its reinsurers. Some of these disputes could result in lawsuits and arbitrations

brought by or against the reinsurers to determine the Company’s rights and obligations under the

various reinsurance agreements. The Company employs dedicated specialists and aggressive strategies

to manage reinsurance collections and disputes.

Some of the reinsurance agreements that the Company entered into as part of its catastrophe bond

programs are dual trigger contracts. All of these contracts meet the requirements to be accounted for

as reinsurance in accordance with guidance for accounting for reinsurance contracts. The Company’s

catastrophe bond programs are described in more detail in ‘‘Item 1—Business—Catastrophe

Reinsurance.’’

The Company reports its reinsurance recoverables net of an allowance for estimated uncollectible

reinsurance recoverables. The allowance is based upon the Company’s ongoing review of amounts

outstanding, length of collection periods, changes in reinsurer credit standing, disputes, applicable

coverage defenses and other relevant factors. Accordingly, the establishment of reinsurance

recoverables and the related allowance for uncollectible reinsurance recoverables is also an inherently

uncertain process involving estimates. From time to time, as a result of the long-tailed nature of the

underlying liabilities, coverage complexities and potential for disputes, the Company considers the

148