Travelers 2012 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2012 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.event (occurring over several days) anywhere in the United States, Canada, the Caribbean and Mexico

and waters contiguous thereto may be used to satisfy the retention. Recoveries under the catastrophe

bond programs (if any) would be first applied to reduce losses subject to this treaty.

General Catastrophe Aggregate Excess-of-Loss Reinsurance Treaty. For the period January 1, 2013 to

December 31, 2013, the Company has entered into a reinsurance agreement that covers the

accumulation of certain property losses arising from multiple occurrences. For each occurrence,

qualifying losses are 90% of $1.4 billion in excess of $100 million. The treaty covers aggregate

qualifying losses during 2013 for 40% of $1.0 billion in excess of $1.5 billion. The treaty covers all of

the Company’s exposures in the United States and Canada and their possessions, and waters contiguous

thereto, the Caribbean and Mexico.

Earthquake Excess-of-Loss Reinsurance Treaty. For the period July 1, 2012 through June 30, 2013,

the Company has entered into an earthquake excess-of-loss treaty that provides for up to $142.5 million

of coverage, subject to a $125 million retention, for earthquake losses incurred under policies written

by the National Property business unit in the Company’s Business Insurance segment.

International Reinsurance Treaties. For business underwritten in Canada, the United Kingdom and

Republic of Ireland and in the Company’s operations at Lloyd’s, separate reinsurance protections are

purchased locally that have lower net retentions more commensurate with the size of the respective

local balance sheet. The Company conducts an ongoing review of its risk and catastrophe coverages

and makes changes as it deems appropriate.

Terrorism Risk Insurance Program. The Terrorism Risk Insurance Program (the Program) is a

Federal program administered by the Department of the Treasury that provides for a system of shared

public and private compensation for certain insured losses resulting from acts of terrorism or war

committed by or on behalf of a foreign interest. The Program has been authorized through 2014. For a

further description of the Program, including the Company’s estimated deductible under the Program in

2012, see note 5 of notes to the Company’s consolidated financial statements in this annual report and

‘‘Item 1A—Risk Factors—Catastrophe losses could materially and adversely affect our results of

operations, our financial position and/or liquidity, and could adversely impact our ratings, our ability to

raise capital and the availability and cost of reinsurance.’’

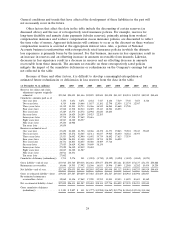

CLAIMS AND CLAIM ADJUSTMENT EXPENSE RESERVES

Claims and claim adjustment expense reserves represent management’s estimate of ultimate unpaid

costs of losses and loss adjustment expenses for claims that have been reported and claims that have

been incurred but not yet reported.

The Company continually refines its reserve estimates in a regular ongoing process that includes

review of key assumptions, underlying variables and historical loss experience. The Company reflects

adjustments to reserves in the results of operations in the periods in which the estimates are changed.

In establishing reserves, the Company takes into account estimated recoveries for reinsurance, salvage

and subrogation. The reserves are also reviewed regularly by qualified actuaries employed by the

Company. For additional information on the process of estimating reserves and a discussion of

underlying variables and risk factors, see ‘‘Item 7—Management’s Discussion and Analysis of Financial

Condition and Results of Operations—Critical Accounting Estimates.’’

The process of estimating loss reserves involves a high degree of judgment and is subject to a

number of variables. These variables (discussed by product line in the ‘‘Critical Accounting Estimates’’

section of ‘‘Item 7—Management’s Discussion and Analysis of Financial Condition and Results of

Operations’’) are affected by both internal and external events, such as changes in claims handling

procedures, inflation, judicial trends and legislative changes, among others. The impact of many of

these items on ultimate costs for claims and claim adjustment expenses is difficult to estimate. Reserve

22