Travelers 2012 Annual Report Download - page 19

Download and view the complete annual report

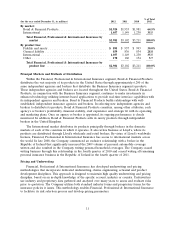

Please find page 19 of the 2012 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.For smaller businesses meeting pre-determined exposure characteristics and thresholds, Select

Accounts utilizes an automated underwriting system that enables agents to issue a significant number of

new policies at their desktop.

A portion of business in this segment, particularly in National Accounts and Construction, is

written with large deductible insurance policies. Under workers’ compensation insurance contracts with

deductible features, the Company is obligated to pay the claimant the full amount of the claim. The

Company is subsequently reimbursed by the contractholder for the deductible amount and is subject to

credit risk until such reimbursement is made. At December 31, 2012, contractholder payables on

unpaid losses within the deductible layer of large deductible policies and the associated receivables

were each approximately $4.78 billion. Retrospectively rated policies are primarily used for workers’

compensation coverage. Although the retrospectively rated feature of the policy substantially reduces

insurance risk for the Company, it introduces additional credit risk to the Company. Premium

receivables from holders of retrospectively rated policies totaled approximately $116 million at

December 31, 2012. Significant collateral, primarily letters of credit and, to a lesser extent, cash

collateral or trusts, is generally requested for large deductible plans and/or retrospectively rated policies

that provide for deferred collection of deductible recoveries and/or ultimate premiums. The amount of

collateral requested is predicated upon the creditworthiness of the customer and the nature of the

insured risks. Business Insurance continually monitors the credit exposure on individual accounts and

the adequacy of collateral.

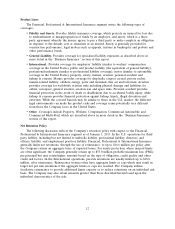

Product Lines

The Business Insurance segment writes the following types of coverages:

•Workers’ Compensation. Provides coverage for employers for specified benefits payable under

state or federal law for workplace injuries to employees. There are typically four types of

benefits payable under workers’ compensation policies: medical benefits, disability benefits, death

benefits and vocational rehabilitation benefits. The Company emphasizes managed care cost

containment strategies, which involve employers, employees and care providers in a cooperative

effort that focuses on the injured employee’s early return to work and cost-effective quality care.

The Company offers the following types of workers’ compensation products:

• guaranteed-cost insurance products, in which policy premium charges are fixed for the

period of coverage and do not vary as a result of the insured’s loss experience;

• loss-sensitive insurance products, including large deductible and retrospectively rated

policies, in which fees or premiums are adjusted based on actual loss experience of the

insured during the policy period; and

• service programs, which are generally sold to the Company’s National Accounts customers,

where the Company receives fees rather than premiums for providing loss prevention, risk

management, and claim and benefit administration services to organizations under service

agreements.

The Company also participates in state assigned risk pools as a servicing carrier and pool

participant.

•Commercial Automobile. Provides coverage for businesses against losses incurred from personal

bodily injury, bodily injury to third parties, property damage to an insured’s vehicle and property

damage to other vehicles and other property resulting from the ownership, maintenance or use

of automobiles and trucks in a business.

•Commercial Property. Provides coverage for loss of or damage to buildings, inventory and

equipment from a variety of events, including, among others, hurricanes and other windstorms,

earthquakes, hail, wildfires, severe winter weather, floods, volcanic eruptions, tsunamis, theft,

7