Travelers 2012 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2012 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

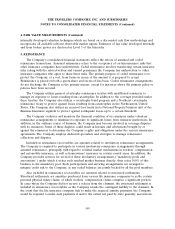

7. INSURANCE CLAIM RESERVES (Continued)

reinsurance resulted primarily from favorable resolutions of claims and disputes from accident years

2002 and prior. In addition, better than expected loss development in the Business Insurance segment

in recent years resulted in a favorable re-estimation of reserves for unallocated loss adjustment

expenses in 2010. The net favorable prior year reserve development in these product lines in 2010 was

partially offset by $140 million and $35 million increases to asbestos and environmental reserves,

respectively.

Financial, Professional & International Insurance. Net favorable prior year reserve development

totaled $259 million in 2010. In Bond & Financial Products, net favorable prior year reserve

development in 2010 was driven by better than expected loss development in the surety and

management liability lines of business due to lower than expected claim activity and loss severity in the

2008 and prior accident years. In International, the majority of net favorable prior year reserve

development in 2010 occurred at the Company’s operation at Lloyd’s, in Canada and in the United

Kingdom.

Personal Insurance. Net favorable prior year reserve development of $87 million in 2010 was

concentrated in the Homeowners and Other product line, primarily driven by favorable loss

development in the 2008 and prior accident years, primarily for the umbrella line of business, partially

offset by unfavorable loss development in the 2009 accident year for the homeowners line of business

that was driven by higher than anticipated late-reported claims related to storms in 2009.

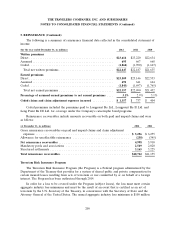

Asbestos and Environmental Reserves

At December 31, 2012 and 2011, the Company’s claims and claim adjustment expense reserves

included $2.73 billion and $2.78 billion, respectively, for asbestos and environmental-related claims, net

of reinsurance.

It is difficult to estimate the reserves for asbestos and environmental-related claims due to the

vagaries of court coverage decisions, plaintiffs’ expanded theories of liability, the risks inherent in

complex litigation and other uncertainties, including, without limitation, those which are set forth

below.

Asbestos Reserves. Because each policyholder presents different liability and coverage issues, the

Company generally reviews the exposure presented by each policyholder at least annually. Among the

factors which the Company may consider in the course of this review are: available insurance coverage,

including the role of any umbrella or excess insurance the Company has issued to the policyholder;

limits and deductibles; an analysis of the policyholder’s potential liability; the jurisdictions involved; past

and anticipated future claim activity and loss development on pending claims; past settlement values of

similar claims; allocated claim adjustment expense; potential role of other insurance; the role, if any, of

non-asbestos claims or potential non-asbestos claims in any resolution process; and applicable coverage

defenses or determinations, if any, including the determination as to whether or not an asbestos claim

is a products/completed operation claim subject to an aggregate limit and the available coverage, if any,

for that claim.

In the third quarter of 2012, the Company completed its annual in-depth asbestos claim review. As

in prior years, the annual claim review considered active policyholders and litigation cases for potential

product and ‘‘non-product’’ liability. The Company noted the following trends:

• continued high level of litigation activity in certain jurisdictions involving individuals alleging

serious asbestos-related illness;

207