Travelers 2012 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2012 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

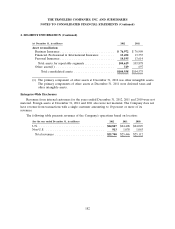

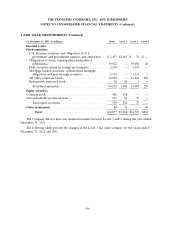

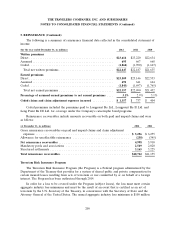

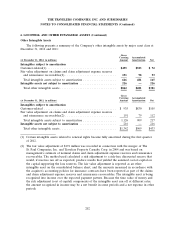

4. FAIR VALUE MEASUREMENTS (Continued)

are observable. In determining the level of the hierarchy in which the estimate is disclosed, the highest

priority is given to unadjusted quoted prices in active markets and the lowest priority to unobservable

inputs that reflect the Company’s significant market assumptions. The level in the fair value hierarchy

within which the fair value measurement is reported is based on the lowest level input that is significant

to the measurement in its entirety. The three levels of the hierarchy are as follows:

• Level 1—Unadjusted quoted market prices for identical assets or liabilities in active markets that

the Company has the ability to access.

• Level 2—Quoted prices for similar assets or liabilities in active markets; quoted prices for

identical or similar assets or liabilities in inactive markets; or valuations based on models where

the significant inputs are observable (e.g., interest rates, yield curves, prepayment speeds, default

rates, loss severities, etc.) or can be corroborated by observable market data.

• Level 3—Valuations based on models where significant inputs are not observable. The

unobservable inputs reflect the Company’s own assumptions about the inputs that market

participants would use.

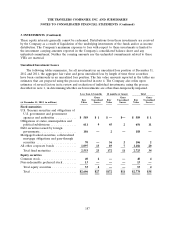

Valuation of Investments Reported at Fair Value in Financial Statements

The fair value of a financial instrument is the estimated amount at which the instrument could be

exchanged in an orderly transaction between knowledgeable, unrelated, willing parties, i.e., not in a

forced transaction. The estimated fair value of a financial instrument may differ from the amount that

could be realized if the security was sold in an immediate sale, e.g., a forced transaction. Additionally,

the valuation of investments is more subjective when markets are less liquid due to the lack of market

based inputs, which may increase the potential that the estimated fair value of an investment is not

reflective of the price at which an actual transaction would occur.

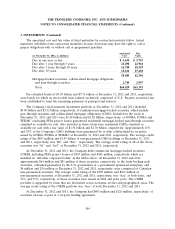

For investments that have quoted market prices in active markets, the Company uses the

unadjusted quoted market prices as fair value and includes these prices in the amounts disclosed in

Level 1 of the hierarchy. The Company receives the quoted market prices from a third party, nationally

recognized pricing service (pricing service). When quoted market prices are unavailable, the Company

utilizes a pricing service to determine an estimate of fair value, which is mainly used for its fixed

maturity investments. The fair value estimates provided from this pricing service are included in the

amount disclosed in Level 2 of the hierarchy. If quoted market prices and an estimate from a pricing

service are unavailable, the Company produces an estimate of fair value based on internally developed

valuation techniques, which, depending on the level of observable market inputs, will render the fair

value estimate as Level 2 or Level 3. The Company bases all of its estimates of fair value for assets on

the bid price as it represents what a third-party market participant would be willing to pay in an arm’s

length transaction.

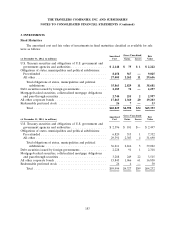

Fixed Maturities

The Company utilizes a pricing service to estimate fair value measurements for approximately 98%

of its fixed maturities. The pricing service utilizes market quotations for fixed maturity securities that

have quoted prices in active markets. Since fixed maturities other than U.S. Treasury securities

generally do not trade on a daily basis, the pricing service prepares estimates of fair value

measurements for these securities using its proprietary pricing applications, which include available

192