Travelers 2012 Annual Report Download - page 220

Download and view the complete annual report

Please find page 220 of the 2012 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

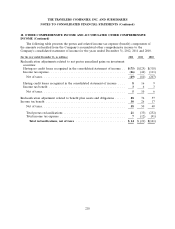

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

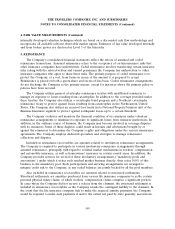

7. INSURANCE CLAIM RESERVES (Continued)

• while overall payment patterns have been generally stable, there has been an increase in severity

for certain policyholders due to the continued high level of litigation activity;

• continued moderate level of asbestos-related bankruptcy activity; and

• the absence of new theories of liability or new classes of defendants.

While the Company believes that over the past several years there has been a reduction in the

volatility associated with the Company’s overall asbestos exposure, there nonetheless remains a high

degree of uncertainty with respect to future exposure from asbestos claims.

During 2012, total gross and net asbestos-related payments decreased when compared with 2011,

primarily resulting from a decline in both gross and net payments to policyholders with whom the

Company has entered into settlement agreements. The Home Office and Field Office categories, which

account for the vast majority of policyholders with active asbestos-related claims, experienced a modest

reduction in gross asbestos-related payments during 2012 when compared with 2011, while net asbestos

payments were flat. Payments on behalf of policyholders in these categories continue to be influenced

by the high level of litigation activity in a limited number of jurisdictions where individuals alleging

serious asbestos-related injury continue to target previously peripheral defendants. The number of

policyholders tendering asbestos claims for the first time in 2012 and the number of policyholders with

open asbestos claims both increased slightly when compared with 2011.

The Company’s quarterly asbestos reserve reviews include an analysis of exposure and claim

payment patterns by policyholder category, as well as recent settlements, policyholder bankruptcies,

judicial rulings and legislative actions. The Company also analyzes developing payment patterns among

policyholders in the Home Office, Field Office and Assumed Reinsurance and Other categories as well

as projected reinsurance billings and recoveries. In addition, the Company reviews its historical gross

and net loss and expense paid experience, year-by-year, to assess any emerging trends, fluctuations, or

characteristics suggested by the aggregate paid activity. Conventional actuarial methods are not utilized

to establish asbestos reserves nor have the Company’s evaluations resulted in any way of determining a

meaningful average asbestos defense or indemnity payment.

The completion of these reviews and analyses in 2012, 2011 and 2010 resulted in $175 million,

$175 million and $140 million increases, respectively, in the Company’s net asbestos reserves in each

period. In each year, the reserve increases were primarily driven by increases in the Company’s

estimate of projected settlement and defense costs related to a broad number of policyholders in the

Home Office category and by higher projected payments on assumed reinsurance accounts. The

increase in the estimate of projected settlement and defense costs resulted from payment trends that

continue to be moderately higher than previously anticipated due to the impact of the current litigation

environment discussed above. The increase in 2010 also reflected increases in costs of litigating

asbestos-related coverage matters and was partially offset by a $70 million benefit from the reduction in

the allowance for uncollectible reinsurance resulting from a favorable ruling related to a reinsurance

dispute. Notwithstanding these trends, the Company’s overall view of the underlying asbestos

environment is essentially unchanged from recent periods, and there remains a high degree of

uncertainty with respect to future exposure to asbestos claims.

Net asbestos losses paid in 2012, 2011 and 2010 were $236 million, $284 million and $350 million,

respectively. Approximately 6%, 19% and 32% of total net paid losses in 2012, 2011 and 2010,

208