Travelers 2012 Annual Report Download - page 226

Download and view the complete annual report

Please find page 226 of the 2012 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300

|

|

THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

8. DEBT (Continued)

Shelf Registration

In December 2011, the Company filed with the Securities and Exchange Commission a universal

shelf registration statement for the potential offering and sale of securities to replace the Company’s

previous registration statement that had expired in the normal course of business. The Company may

offer these securities from time to time at prices and on other terms to be determined at the time of

offering.

9. SHAREHOLDERS’ EQUITY AND DIVIDEND AVAILABILITY

Common Stock

The Company is governed by the Minnesota Business Corporation Act. All authorized shares of

voting common stock have no par value. Shares of common stock reacquired are considered authorized

and unissued shares. The number of authorized shares of the company is 1.75 billion, consisting of

1.745 billion shares of voting common stock and five million undesignated shares. The Company’s

articles of incorporation authorize the board of directors to establish, from the undesignated shares,

one or more classes and series of shares, and to further designate the type of shares and terms thereof.

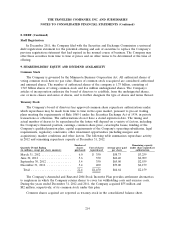

Treasury Stock

The Company’s board of directors has approved common share repurchase authorizations under

which repurchases may be made from time to time in the open market, pursuant to pre-set trading

plans meeting the requirements of Rule 10b5-1 under the Securities Exchange Act of 1934, in private

transactions or otherwise. The authorizations do not have a stated expiration date. The timing and

actual number of shares to be repurchased in the future will depend on a variety of factors, including

the Company’s financial position, earnings, common share price, catastrophe losses, funding of the

Company’s qualified pension plan, capital requirements of the Company’s operating subsidiaries, legal

requirements, regulatory constraints, other investment opportunities (including mergers and

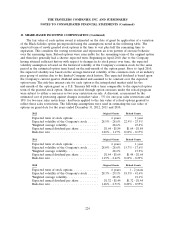

acquisitions), market conditions and other factors. The following table summarizes repurchase activity

in 2012 and remaining repurchase capacity at December 31, 2012.

Number of Remaining capacity

Quarterly Period Ending shares Cost of shares Average price paid under share repurchase

(in millions, except per share amounts) purchased repurchased per share authorization

March 31, 2012 ................. 6.0 $ 350 $58.73 $3,259

June 30, 2012 .................. 5.6 350 $62.40 $2,909

September 30, 2012 .............. 5.4 350 $65.00 $2,559

December 31, 2012 .............. 5.4 400 $73.00 $2,159

Total ....................... 22.4 $1,450 $64.64 $2,159

The Company’s Amended and Restated 2004 Stock Incentive Plan provides settlement alternatives

to employees in which the Company retains shares to cover tax withholding costs and exercise costs.

During the years ended December 31, 2012 and 2011, the Company acquired $55 million and

$82 million, respectively, of its common stock under this plan.

Common shares acquired are reported as treasury stock in the consolidated balance sheet.

214