Travelers 2012 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2012 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• Changing climate conditions could also impact the creditworthiness of issuers of securities in

which the Company invests. For example, water supply adequacy could impact the

creditworthiness of bond issuers in the Southwestern United States, and more frequent and/or

severe hurricanes could impact the creditworthiness of issuers in the Southeastern United States,

among other areas. See ‘‘Risk Factors—Our investment portfolio may suffer reduced returns or

material realized or unrealized losses.’’

• Increased regulation adopted in response to potential changes in climate conditions may impact

the Company and its customers. For example, state insurance regulation could impact the

Company’s ability to manage property exposures in areas vulnerable to significant climate driven

losses. If the Company is unable to implement risk based pricing, modify policy terms or reduce

exposures to the extent necessary to address rising losses related to catastrophes and smaller

scale weather events (should those increased losses occur), its business may be adversely

affected. See ‘‘Risk Factors—Catastrophe losses could materially and adversely affect our results

of operations, our financial position and/or liquidity, and could adversely impact our ratings, our

ability to raise capital and the availability and cost of reinsurance.’’

• The full range of potential liability exposures related to climate change continues to evolve.

Through the Company’s Emerging Issues Committee and its Committee on Climate, Energy and

the Environment, the Company works with its business units and corporate groups, as

appropriate, to identify and try to assess climate change-related liability issues, which are

continually evolving and often hard to fully evaluate. See ‘‘Risk Factors—The effects of

emerging claim and coverage issues on our business are uncertain.’’

Climate change regulation also could increase the Company’s customers’ costs of doing business.

For example, insureds faced with carbon management regulatory requirements may have less available

capital for investment in loss prevention and safety features which may, over time, increase loss

exposures. Also, increased regulation may result in reduced economic activity, which would decrease

the amount of insurable assets and businesses.

The Company regularly reviews emerging issues, such as changing climate conditions, to consider

potential changes to its modeling and the use of such modeling, as well as to help determine the need

for new underwriting strategies, coverage modifications or new products.

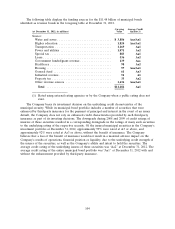

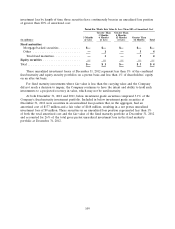

REINSURANCE RECOVERABLES

Ceded reinsurance involves credit risk, except with regard to mandatory pools for which liability is

mostly joint and several, and is generally subject to aggregate loss limits. Although the reinsurer is

liable to the Company to the extent of the reinsurance ceded, the Company remains liable as the direct

insurer on all risks reinsured. Reinsurance recoverables are reported after reductions for known

insolvencies and after allowances for uncollectible amounts. The Company monitors the financial

condition of reinsurers on an ongoing basis and reviews its reinsurance arrangements periodically.

Reinsurers are selected based on their financial condition, business practices and the price of their

product offerings. After reinsurance is purchased, the Company has limited ability to manage the credit

risk to a reinsurer. In addition, in a number of jurisdictions, particularly the European Union and the

United Kingdom, a reinsurer is permitted to transfer a reinsurance arrangement to another reinsurer,

which may be less creditworthy, without a counterparty’s consent, provided that the transfer has been

approved by the applicable regulatory and/or court authority.

The Company holds collateral, including trust agreements, escrow funds and letters of credit,

under certain reinsurance agreements. The Company has also entered into Master Security Agreements

with certain reinsurers. These agreements define conditions that require the reinsurer to provide

collateral. The specific conditions and the amounts and form of collateral to be provided by these

113