Travelers 2012 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2012 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(7) Workers’ compensation large deductible policies provide third party coverage in which the

Company typically is responsible for paying the entire loss under such policies and then seeks

reimbursement from the insured for the deductible amount. ‘‘Claims from large deductible

policies’’ represent the estimated future payment for claims and claim related expenses below the

deductible amount, net of the estimated recovery of the deductible. The liability and the related

deductible receivable for unpaid claims are presented in the consolidated balance sheet as

‘‘contractholder payables’’ and ‘‘contractholder receivables,’’ respectively. Most deductibles for such

policies are paid directly from the policyholder’s escrow which is periodically replenished by the

policyholder. The payment of the loss amounts above the deductible are reported within ‘‘Claims

and claim adjustment expenses’’ in the above table. Because the timing of the collection of the

deductible (contractholder receivables) occurs shortly after the payment of the deductible to a

claimant (contractholder payables), these cash flows offset each other in the table.

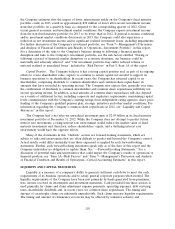

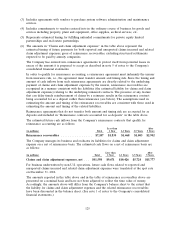

The estimated timing of the payment of the contractholder payables and the collection of

contractholder receivables for workers’ compensation policies is presented below:

Less than After

(in millions) Total 1 Year 1-3 Years 3-5 Years 5 Years

Contractholder payables/receivables ........... $4,806 $1,168 $1,306 $710 $1,622

(8) The amounts in ‘‘Loss-based assessments’’ relate to estimated future payments of second-injury

fund assessments which would result from payment of current claim liabilities. Second injury funds

cover the cost of any additional benefits for aggravation of a pre-existing condition. For loss-based

assessments, the cost is shared by the insurance industry and self-insureds, funded through

assessments to insurance companies and self-insureds based on losses. Amounts relating to second-

injury fund assessments are included in ‘‘other liabilities’’ in the consolidated balance sheet.

(9) The amounts in ‘‘Reinsurance contracts accounted for as deposits’’ represent estimated future

nominal payments for reinsurance agreements that are accounted for as deposits. Amounts payable

under deposit agreements are included in ‘‘other liabilities’’ in the consolidated balance sheet. The

amounts reported in the table are presented on a nominal basis and have not been adjusted to

reflect the time value of money. Accordingly, the amounts above will differ from the Company’s

balance sheet to the extent that deposit values in the balance sheet have been discounted using

deposit accounting.

(10) The amounts in ‘‘Payout from ceded funds withheld’’ represent estimated payments for losses and

return of funds held related to certain reinsurance arrangements whereby the Company holds a

portion of the premium due to the reinsurer and is allowed to pay claims from the amounts held.

(11) The Company’s current liabilities related to unrecognized tax benefits from uncertain tax positions

are $657 million. Offsetting these liabilities are deferred tax assets of $594 million associated with

the temporary differences that would exist if these positions become realized.

The above table does not include an analysis of liabilities reported for structured settlements for

which the Company has purchased annuities and remains contingently liable in the event of default by

the company issuing the annuity. The Company is not reasonably likely to incur material future

payment obligations under such agreements. In addition, the Company is not currently subject to any

minimum funding requirements for its qualified pension plan. Accordingly, future contributions are not

included in the foregoing table.

Dividend Availability

The Company’s principal insurance subsidiaries are domiciled in the state of Connecticut. The

insurance holding company laws of Connecticut applicable to the Company’s subsidiaries requires

notice to, and approval by, the state insurance commissioner for the declaration or payment of any

126