Travelers 2012 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2012 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300

|

|

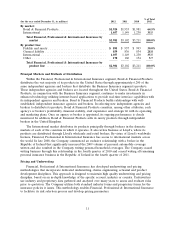

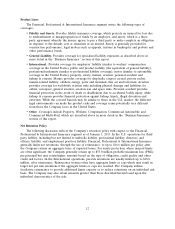

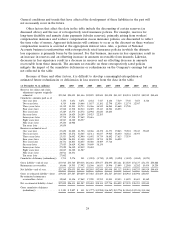

Selected Product and Distribution Channel Information

The following table sets forth net written premiums for the Personal Insurance segment’s business

by product line for the periods indicated. For a description of the product lines referred to in the

following table, see ‘‘—Product Lines.’’ In addition, see ‘‘—Principal Markets and Methods of

Distribution’’ for a discussion of distribution channels for Personal Insurance’s product lines.

% of Total

(for the year ended December 31, in millions) 2012 2011 2010 2012

By product line:

Automobile ...................................... $3,642 $3,788 $3,772 48.0%

Homeowners and Other ............................. 3,952 3,957 3,795 52.0

Total Personal Insurance ........................... $7,594 $7,745 $7,567 100.0%

Principal Markets and Methods of Distribution

Personal Insurance products are distributed primarily through approximately 12,000 active

independent agents located throughout the United States, supported by personnel in 13 sales regions

and seven service centers. While the principal markets for Personal Insurance products continue to be

in states along the East Coast, California and Texas, the business continues to expand its geographic

presence across the United States.

In selecting new independent agencies to distribute its products, Personal Insurance considers,

among other attributes, each agency’s profitability, financial stability, staff experience and strategic fit

with the segment’s operating and marketing plans. Once an agency is appointed, Personal Insurance

carefully monitors its performance.

Agents can access the Company’s agency service portal for a number of resources including

customer service, marketing and claims management. In addition, agencies can choose to shift the

ongoing service responsibility for Personal Insurance’s customers to one of the Company’s five

Customer Care Centers, where the Company provides, on behalf of an agency, a comprehensive array

of customer service needs, including response to billing and coverage inquiries, and policy changes.

Approximately 1,800 agents take advantage of this service alternative.

Personal Insurance also distributes its products through additional channels, including corporations

that make the company’s product offerings available to their employees primarily through payroll

deduction, consumer associations and affinity groups. Personal Insurance handles the sales and service

for these programs either through a sponsoring independent agent or through two of the Company’s

call center locations. In addition, since 1995, the Company has had a marketing agreement with

GEICO to underwrite homeowners business for their auto customers.

In 2009, the Company began marketing its insurance products directly to consumers, largely

through online channels. The investment in the direct-to-consumer initiative generated modest

premium volume for Personal Insurance in recent years, which was consistent with the Company’s

expectations. However, the direct-to-consumer initiative, while intended to enhance the Company’s

long-term ability to compete successfully in a consumer-driven marketplace, is expected to remain

unprofitable for a number of years as the Company continues to develop, test and evaluate this

distribution channel.

Pricing and Underwriting

Personal Insurance has developed a product management methodology that integrates the

disciplines of underwriting, claim, actuarial and product development. This approach is designed to

maintain high quality underwriting discipline and pricing segmentation. Proprietary data accumulated

over many years is analyzed and Personal Insurance uses a variety of risk differentiation models to

14