Travelers 2012 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2012 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

For years prior to 2004, the table excludes reserves of SPC, which were acquired in the Merger on

April 1, 2004. Accordingly, the reserve development (net reserves for claims and claim adjustment

expense re-estimated as of subsequent years less net reserves recorded at the end of the year, as

originally estimated) for years prior to 2004 relates only to losses recorded by TPC and does not

include reserve development recorded by SPC. For 2004 and subsequent years, the table includes SPC

reserves acquired and subsequent development recorded on those reserves. At December 31, 2004, SPC

gross reserves were $23,274 million, and net reserves were $15,959 million.

In December 2008, the Company completed the sale of Unionamerica Holdings Limited

(Unionamerica), which comprised its United Kingdom (U.K.)-based runoff insurance and reinsurance

businesses. (Unionamerica was acquired in 2004 as part of the Merger.) Immediately before the sale,

the claims and claim adjustment expense reserves of Unionamerica totaled $790 million. As a result of

the sale, those obligations ceased being the responsibility of the Company and its affiliates. The sale is

reflected in the table as a reduction in December 31, 2008 net reserves of $790 million and as a $790

million increase in paid losses for each of the years 2004 through 2007 to reflect the transfer (payment)

of the reserves to the buyer, resulting in no impact to incurred losses.

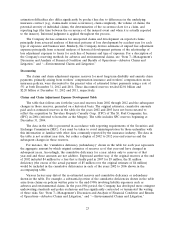

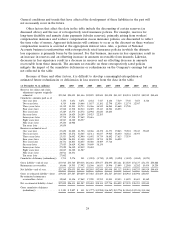

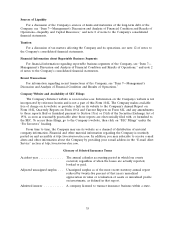

The gross and net cumulative deficiency (redundancy) by calendar year as set forth in the table

above includes the following impact of unfavorable prior year reserve development related to asbestos

and environmental claims and claim adjustment expenses, in millions:

Asbestos 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Gross ........................ $1,728 $1,703 $1,913 $1,079 $882 $883 $813 $628 $366 $171

Net ......................... $1,604 $1,580 $1,732 $ 901 $745 $745 $675 $490 $350 $175

Environmental 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Gross ........................ $ 807 $ 748 $ 701 $ 684 $576 $394 $309 $224 $179 $ 99

Net ......................... $ 760 $ 701 $ 691 $ 661 $541 $356 $271 $201 $166 $ 90

Reserves on Statutory Accounting Basis

At December 31, 2012, 2011 and 2010, claims and claim adjustment expense reserves (net of

reinsurance) shown in the preceding table, which are prepared in accordance with U.S. generally

accepted accounting principles (GAAP reserves), were $22 million lower, $20 million higher and $20

million higher, respectively, than those reported in the Company’s respective annual reports filed with

insurance regulators, which are prepared in accordance with statutory accounting practices (statutory

reserves).

The differences between GAAP and statutory reserves are primarily due to the differences in

GAAP and statutory accounting for two items, (1) fees associated with billing of required

reimbursements under large deductible business, and (2) the accounting for retroactive reinsurance. For

large deductible business, the Company pays the deductible portion of a casualty insurance claim and

then seeks reimbursement from the insured, plus a fee. This fee is reported as fee income for GAAP

reporting, but as an offset to claim expenses paid for statutory reporting. Retroactive reinsurance

balances result from reinsurance placed to cover losses on insured events occurring prior to the

inception of a reinsurance contract. For GAAP reporting, retroactive reinsurance balances are included

in reinsurance recoverables and result in lower net reserve amounts. Statutory accounting practices

require retroactive reinsurance balances to be recorded in other liabilities as contra-liabilities rather

than in loss reserves.

Asbestos and Environmental Claims

Asbestos and environmental claims are segregated from other claims and are handled separately by

the Company’s Special Liability Group, a separate unit staffed by dedicated legal, claim, finance and

25