Travelers 2012 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2012 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Many coverage disputes with policyholders are only resolved through settlement agreements.

Because many policyholders make exaggerated demands, it is difficult to predict the outcome of

settlement negotiations. Settlements involving bankrupt policyholders may include extensive releases

which are favorable to the Company but which could result in settlements for larger amounts than

originally anticipated. There also may be instances where a court may not approve a proposed

settlement, which may result in additional litigation and potentially less beneficial outcomes for the

Company. As in the past, the Company will continue to pursue settlement opportunities.

In addition to claims against policyholders, proceedings have been launched directly against

insurers, including the Company, by individuals challenging insurers’ conduct with respect to the

handling of past asbestos claims and by individuals seeking damages arising from alleged asbestos-

related bodily injuries. It is possible that the filing of other direct actions against insurers, including the

Company, could be made in the future. It is difficult to predict the outcome of these proceedings,

including whether the plaintiffs will be able to sustain these actions against insurers based on novel

legal theories of liability. The Company believes it has meritorious defenses to these claims and has

received favorable rulings in certain jurisdictions.

Travelers Property Casualty Corp. (TPC), a wholly-owned subsidiary of the Company, had entered

into settlement agreements which are subject to a number of contingencies, in connection with a

number of these direct action claims (Direct Action Settlements). For a full discussion of these

settlement agreements, see the ‘‘Asbestos Direct Action Litigation’’ section of note 16 of notes to the

consolidated financial statements.

Because each policyholder presents different liability and coverage issues, the Company generally

reviews the exposure presented by each policyholder at least annually. Among the factors which the

Company may consider in the course of this review are: available insurance coverage, including the role

of any umbrella or excess insurance the Company has issued to the policyholder; limits and deductibles;

an analysis of the policyholder’s potential liability; the jurisdictions involved; past and anticipated future

claim activity and loss development on pending claims; past settlement values of similar claims;

allocated claim adjustment expense; potential role of other insurance; the role, if any, of non-asbestos

claims or potential non-asbestos claims in any resolution process; and applicable coverage defenses or

determinations, if any, including the determination as to whether or not an asbestos claim is a products/

completed operation claim subject to an aggregate limit and the available coverage, if any, for that

claim.

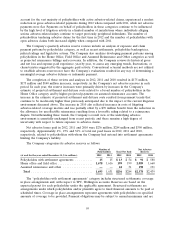

In the third quarter of 2012, the Company completed its annual in-depth asbestos claim review. As

in prior years, the annual claim review considered active policyholders and litigation cases for potential

product and ‘‘non-product’’ liability. The Company noted the following trends:

• continued high level of litigation activity in certain jurisdictions involving individuals alleging

serious asbestos-related illness;

• while overall payment patterns have been generally stable, there has been an increase in severity

for certain policyholders due to the continued high level of litigation activity;

• continued moderate level of asbestos-related bankruptcy activity; and

• the absence of new theories of liability or new classes of defendants.

While the Company believes that over the past several years there has been a reduction in the

volatility associated with the Company’s overall asbestos exposure, there nonetheless remains a high

degree of uncertainty with respect to future exposure from asbestos claims.

During 2012, total gross and net asbestos-related payments decreased when compared with 2011,

primarily resulting from a decline in both gross and net payments to policyholders with whom the

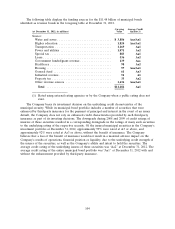

Company has entered into settlement agreements. The Home Office and Field Office categories, which

94