Travelers 2012 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2012 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

then current Treasury rate (as defined) plus 15 basis points for the 2020 senior notes and 20 basis

points for the 2040 notes.

Prior to November 2010, the Company was subject to a replacement capital covenant that it had

granted to the holders of its 6.75% senior notes due June 20, 2036 (the senior notes). The replacement

capital covenant restricted the Company’s ability to repurchase its $1.00 billion in outstanding 6.25%

fixed-to-floating rate junior subordinated debentures due March 15, 2067 (the debentures). In

November 2010, the Company paid approximately $4 million to holders of the senior notes to

terminate the replacement capital covenant. Following the termination, the Company purchased

approximately $885 million aggregate principal amount of the debentures. A $60 million pretax loss was

recognized in 2010 related to these transactions.

On September 16, 2010, the Company repaid the remaining $4 million principal balance on its

7.81% private placement senior notes. On August 23, 2010, the Company’s $21 million, 7.415%

medium-term notes matured and were fully paid. On April 15, 2010, the Company’s $250 million,

8.125% senior notes matured and were fully paid. All of these debt payments were made from

internally-generated funds.

The amount of debt obligations, other than commercial paper, that becomes due in 2013 is

$500 million. In 2014, no debt obligations become due. In 2015, the amount of debt obligations, other

than commercial paper, that comes due is $400 million. The Company may refinance maturing debt

through funds generated internally or, depending on market conditions, through funds generated

externally, including as a result of the issuance of debt or other securities.

Dividends. Dividends paid to shareholders were $694 million, $665 million and $673 million in

2012, 2011 and 2010, respectively. The declaration and payment of future dividends to holders of the

Company’s common stock will be at the discretion of the Company’s board of directors and will depend

upon many factors, including the Company’s financial position, earnings, capital requirements of the

Company’s operating subsidiaries, legal requirements, regulatory constraints and other factors as the

board of directors deems relevant. Dividends will be paid by the Company only if declared by its board

of directors out of funds legally available, subject to any other restrictions that may be applicable to the

Company. On January 22, 2013, the Company announced that it declared a regular quarterly dividend

of $0.46 per share, payable March 29, 2013 to shareholders of record on March 8, 2013.

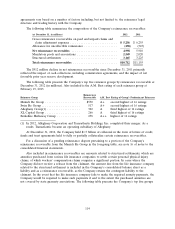

Share Repurchases. The Company’s board of directors has approved common share repurchase

authorizations under which repurchases may be made from time to time in the open market, pursuant

to pre-set trading plans meeting the requirements of Rule 10b5-1 under the Securities Exchange Act of

1934, in private transactions or otherwise. The authorizations do not have a stated expiration date. The

timing and actual number of shares to be repurchased in the future will depend on a variety of factors,

including the Company’s financial position, earnings, share price, catastrophe losses, funding of the

Company’s qualified pension plan, capital requirements of the Company’s operating subsidiaries, legal

requirements, regulatory constraints, other investment opportunities (including mergers and

acquisitions), market conditions and other factors. The following table summarizes repurchase activity

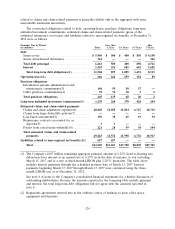

in 2012 and remaining repurchase capacity at December 31, 2012.

Number of Remaining capacity

Quarterly Period Ending shares Cost of shares Average price paid under share repurchase

(in millions, except per share amounts) purchased repurchased per share authorization

March 31, 2012 ................. 6.0 $ 350 $58.73 $3,259

June 30, 2012 .................. 5.6 350 $62.40 $2,909

September 30, 2012 .............. 5.4 350 $65.00 $2,559

December 31, 2012 .............. 5.4 400 $73.00 $2,159

Total ....................... 22.4 $1,450 $64.64 $2,159

121