Travelers 2012 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2012 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE TRAVELERS COMPANIES, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

by the Company. The Company determines the undiscounted recovery value by allocating the estimated

value of the issuer to the Company’s assessment of the priority of claims. The present value of the cash

flows is determined by applying the effective yield of the security at the date of acquisition (or the most

recent implied rate used to accrete the security if the implied rate has changed as a result of a previous

impairment) and an estimated recovery time frame. Generally, that time frame for securities for which

the issuer is in bankruptcy is 12 months. For securities for which the issuer is financially troubled but

not in bankruptcy, that time frame is generally 24 months. Included in the present value calculation are

expected principal and interest payments; however, for securities for which the issuer is classified as

bankrupt or in default, the present value calculation assumes no interest payments and a single

recovery amount.

In estimating the recovery value, significant judgment is involved in the development of

assumptions relating to a myriad of factors related to the issuer including, but not limited to, revenue,

margin and earnings projections, the likely market or liquidation values of assets, potential additional

debt to be incurred pre- or post-bankruptcy/restructuring, the ability to shift existing or new debt to

different priority layers, the amount of restructuring/bankruptcy expenses, the size and priority of

unfunded pension obligations, litigation or other contingent claims, the treatment of intercompany

claims and the likely outcome with respect to inter-creditor conflicts.

For structured fixed maturity securities (primarily residential and commercial mortgage-backed

securities and asset-backed securities), the Company estimates the present value of the security by

projecting future cash flows of the assets underlying the securitization, allocating the flows to the

various tranches based on the structure of the securitization, and determining the present value of the

cash flows using the effective yield of the security at the date of acquisition (or the most recent implied

rate used to accrete the security if the implied rate has changed as a result of a previous impairment or

changes in expected cash flows). The Company incorporates levels of delinquencies, defaults and

severities as well as credit attributes of the remaining assets in the securitization, along with other

economic data, to arrive at its best estimate of the parameters applied to the assets underlying the

securitization. In order to project cash flows, the following assumptions are applied to the assets

underlying the securitization: (1) voluntary prepayment rates, (2) default rates and (3) loss severity. The

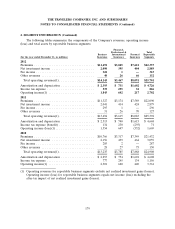

key assumptions made for the Prime, Alt-A and first-lien Sub-Prime mortgage-backed securities at

December 31, 2012 were as follows:

(at December 31, 2012) Prime Alt-A Sub-Prime

Voluntary prepayment rates ......................... 2% - 35% 0% - 16% 1% - 10%

Percentage of remaining pool liquidated due to defaults .... 2% - 63% 13% - 70% 24% - 80%

Loss severity .................................... 25% - 65% 40% - 73% 65% - 92%

Real Estate Investments

On at least an annual basis, the Company obtains independent appraisals for substantially all of its

real estate investments. In addition, the carrying value of all real estate investments is reviewed for

impairment on a quarterly basis or when events or changes in circumstances indicate that the carrying

amount may not be recoverable. The review for impairment considers the valuation from the

independent appraisal, when applicable, and incorporates an estimate of the undiscounted cash flows

expected to result from the use and eventual disposition of the real estate property. An impairment loss

is recognized if the expected future undiscounted cash flows are less than the carrying value of the real

estate property. The impairment loss is the amount by which the carrying amount exceeds fair value.

169