Travelers 2002 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25. IMPACT OF ACCOUNTING PRONOUNCEMENTS TO BE

ADOPTED IN THE FUTURE

In January 2003, the FASB issued FASB Interpretation No. 46,

“Consolidation of Variable Interest Entities” (“FIN 46”), which requires

consolidation of all variable interest entities (“VIE”) by the primary ben-

eficiary, as these terms are defined in FIN 46, effective immediately for

VIEs created after January 31, 2003. The consolidation requirements

apply to VIEs existing on January 31, 2003 for reporting periods begin-

ning after June 15, 2003. In addition, it requires expanded disclosure

for all VIEs. We do not expect the adoption of FIN 46 to have a mate-

rial impact on our consolidated financial statements.

In December 2002, the FASB issued SFAS No. 148, “Accounting

for Stock-Based Compensation — Transition and Disclosure,” which

provides alternative methods of transition for a voluntary change to

the fair value based method of accounting for stock-based employee

compensation. This statement requires additional disclosures in the

event of a voluntary change. It also no longer permits the use of the

original prospective method of transition for changes to the fair value

based method for fiscal years beginning after December 15, 2003.We

currently account for stock-based compensation under APB Opinion

No. 25, “Accounting for Stock Issued to Employees”, using the intrin-

sic value method, and have not made a determination regarding any

change to the fair value method.

In November 2002, the FASB issued FASB Interpretation No. 45,

“Guarantor’s Accounting and Disclosure Requirements for

Guarantees, Including Indirect Guarantees of Indebtedness of

Others” (“FIN 45”), which expands the disclosures to be made by a

guarantor in the consolidated financial statements and generally

requires recognition of a liability for the fair value of a guarantee at its

inception.The disclosure requirements of this interpretation are effec-

tive for the company for fiscal periods ending after December 15,

2002, and, accordingly, have been included in Note 17.The measure-

ment provisions of this interpretation are applicable on a prospective

basis to guarantees issued or modified after December 31, 2002.This

interpretation does not apply to guarantees issued by insurance com-

panies accounted for under insurance-specific accounting literature.

We do not expect the adoption of the measurement provisions of FIN

45 to have a material impact on our consolidated financial statements.

In July 2002, the FASB issued SFAS No. 146, “Accounting for

Costs Associated with Exit or Disposal Activities,” which requires com-

panies to recognize costs associated with exit or disposal activities

when they are incurred rather than the current practice of recognizing

those costs at the date of a commitment to exit or a disposal plan.The

provisions of SFAS No. 146 are to be applied prospectively to exit or

disposal activities initiated after December 31, 2002. The adoption of

SFAS No. 146 will result in changes to the timing only of recognition

of such costs.

In April 2002, the FASB issued SFAS No. 145, “Rescission of

FASB Statements No. 4, 44, and 64, Amendment of FASB Statement

No. 13, and Technical Corrections.” The primary impact of SFAS

No. 145 was to rescind the requirement to report the gain or loss from

the extinguishment of debt as an extraordinary item on the statement

of income.The provisions of this Statement are generally effective for

fiscal years beginning after May 15, 2002.We do not expect the adop-

tion of SFAS No. 145 to have a material impact on our consolidated

financial statements.

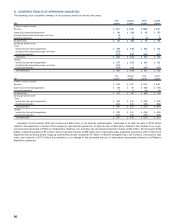

26. VARIABLE INTEREST ENTITIES

In January 2003, the FASB issued FASB Interpretation No. 46,

“Consolidation of Variable Interest Entities” (“FIN 46”), which requires

consolidation of all variable interest entities (“VIE”) by the primary

beneficiary, as these terms are defined in FIN 46, effective immedi-

ately for VIEs created after January 31, 2003. The consolidation

requirements apply to VIEs existing on January 31, 2003 for reporting

periods beginning after June 15, 2003. In addition, it requires

expanded disclosure for all VIEs.

The following represents VIEs, which may be subject to the con-

solidation or disclosure provisions of FIN 46 once this interpretation

becomes effective:

Municipal Trusts: We have purchased interests in certain uncon-

solidated trusts holding highly rated municipal securities that were

formed for the purpose of enabling the company to more flexibly gen-

erate investment income in a manner consistent with our investment

objectives and tax position. As of December 31, 2002, there were a

total of 36 trusts, which held a combined total market value of

$445 million in municipal securities. We own approximately 100% of

28 of these trusts, which are reflected in our financial statements.The

remaining 8 trusts, which represent $84 million in market value of

securities, are not currently consolidated in our results.

Joint Ventures: Our subsidiary, Fire and Marine, is a party to five

separate joint ventures, in each of which Fire and Marine is a 50%

owner of various real estate holdings and does not exercise control

over the joint ventures, financed by non-recourse mortgage notes.

Because we own only 50% of the holdings, we do not consolidate

these entities and the joint venture debt does not appear on our bal-

ance sheet. Our maximum exposure under each of these joint ven-

tures, in the event of foreclosure of a property, is limited to our

carrying value in the joint venture, ranging individually from $8 million

to $29 million, and cumulatively totaling $62 million at December 31,

2002. The total assets included in these joint ventures as of

December 31, 2002 were $160 million.

The St. Paul Companies 2002 Annual Report 91