Travelers 2002 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

of claim payment, or for policies that have not been identified as cases

where the underwriter intended coverage. A significant portion of the

cost of administering these claims relates to claims that are eventually

settled without payment. Changes in social, judicial, legislative and

economic conditions could result in future unforeseen developments

and require reserve adjustments.

Asbestos — This exposure relates to general liability and workers’

compensation coverages on policies which can be interpreted to

cover asbestos-related exposures.This portion of business is defined

as that which is reported as “Asbestos losses” as described in more

detail on pages 48 through 49 of this discussion. Amounts are driven

by a few very large claims, accompanied by a large number of very

small claims or claims made with no payment. A significant portion of

the cost of administering the claims is spent on those claims that are

eventually settled without payment. Social, judicial, legislative and

economic changes could result in future unforeseen developments

and require reserve adjustments. Western MacArthur accounted for

the majority of paid losses on settled claims in 2002 ($173 million), as

well as the majority of costs to administer in 2002 ($12 million), with

the remainder relating to claims made in prior years. Approximately

25% of the pending asbestos claim supplements as of December 31,

2002 came from policyholders who tendered their first asbestos claim

within the last three years.The increase in newly reported claims arise

from policyholders who tendered their first claim to us within the last

three years. For example, approximately 59% of the claim supple-

ments reported during 2002 came from policyholders who tendered

their first claim after January 1, 2000. These claims are generally rel-

atively small and have, to date, presented minimal exposure.

Assumed Reinsurance — This portion of our business represents

our reported Reinsurance segment and includes property and liability

loss exposures assumed on both a proportional and excess of loss

basis. There are both low frequency, high severity exposures as well

as some event-driven high-severity exposures. A significant portion of

the high exposure business was catastrophe related. As of Novem-

ber 2, 2002, we are no longer significantly exposed to subsequent

events due to the transfer of our ongoing reinsurance operations to

Platinum Underwriters Holdings, Ltd. Although our property exposure

(included in this data) is not considered long tail, our casualty expo-

sure is considered long tail and — similar to our primary general lia-

bility exposures — is sensitive to the risk of unexpected increases in

inflation. The increase in loss settlement amounts during 2001 and

2002 was primarily due to losses resulting from the September 11,

2001 terrorist attack.

Prior-Year Loss Development Note 11 to the consolidated

financial statements includes a reconciliation of our beginning and

ending loss and loss adjustment expense reserves for each of the

years 2002, 2001 and 2000. That reconciliation shows that we

recorded an increase in the loss provision from continuing operations

for claims incurred in prior years totaling $1.0 billion in 2002, com-

pared with $577 million in 2001, and a reduction in prior-year incurred

losses of $265 million in 2000. Of the 2002 total, $472 million resulted

from the settlement of the Western MacArthur asbestos litigation, as

described in more detail on pages 27 through 28 of this discussion.

The majority of the remaining prior year development was concen-

trated in our Health Care, Surety & Construction, and Other seg-

ments, and that development is discussed in detail in the respective

segment sections included herein.

The increase in prior-year loss provisions in 2001 was driven by

additional losses in our Health Care segment. In 2000, loss trends in

this segment had indicated an increase in the severity of claims

incurred in the 1995 through 1997 accident years; accordingly, we

recorded a provision for prior-year losses. In 2001, loss activity con-

tinued to increase not only for the years 1995 through 1997, but also

1998, and early activity on claims incurred in the years 1999 through

2001 indicated an increase in severity for those years.Those develop-

ments led us to a much different view of loss development in this seg-

ment, which in turn caused us to record provisions for prior-year

losses totaling $735 million in this segment in 2001. At the end of the

48

year, we announced our intention to withdraw fully from the medical

liability insurance market.

A reduction in prior-year losses was recorded in 2000.In 2000, the

favorable prior-year loss development was widespread across our

business segments, with the exception of the Health Care segment.

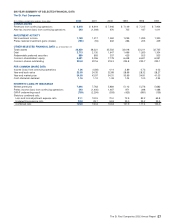

The following table summarizes the composition of our gross and

net loss and loss adjustment expense reserves by segment as of

December 31, 2002.

December 31, 2002 Gross Net

(In millions)

Specialty Commercial $3,694 $ 2,065

Commercial Lines 5,870 4,062

Surety & Construction 2,055 1,386

International & Lloyd’s 2,152 1,080

Subtotal – ongoing segments 13,771 8,593

Health Care 2,521 1,981

Reinsurance 4,337 3,019

Other 1,997 1,256

Subtotal – runoff segments 8,855 6,256

Total $22,626 $ 14,849

PROPERTY-LIABILITY UNDERWRITING

Environmental and Asbestos Claims

We continue to receive claims, including through lawsuits, alleging

injury or damage from environmental pollution or seeking payment for

the cost to clean up polluted sites. We also receive asbestos injury

claims, including through lawsuits, arising out of coverages under

general liability policies. Most of these claims arise from policies writ-

ten many years ago. Significant legal issues, primarily pertaining to

the scope of coverage, complicate the determination of our alleged

liability for both environmental and asbestos claims. In our opinion,

court decisions in certain jurisdictions have tended to broaden insur-

ance coverage for both environmental and asbestos matters beyond

the intent of the original insurance policies.

Our ultimate liability for environmental claims is difficult to estimate

because of these legal issues. Insured parties have submitted claims

for losses that in our view are not covered in their respective insur-

ance policies, and the final resolution of these claims may be subject

to lengthy litigation, making it difficult to estimate our potential liability.

In addition, variables such as the length of time necessary to clean up

a polluted site, and controversies surrounding the identity of the

responsible party and the degree of remediation deemed necessary,

make it difficult to estimate the total cost of an environmental claim.

Estimating our ultimate liability for asbestos claims is also very dif-

ficult. The primary factors influencing our estimate of the total cost of

these claims are case law and a history of prior claim development,

both of which continue to evolve and are complicated by aggressive lit-

igation against insurers, including us. Estimating ultimate liability is

also complicated by the difficulty of assessing what rights, if any, we

may have to seek contribution from other insurers of any policyholder.

Late in 2001, we hired a new Executive Vice President of Claims,

with extensive experience with environmental and asbestos claims

handling and environmental and asbestos reserves, who conducted a

summary level review of our environmental and asbestos reserves.As

a result of observations made in this review, we undertook more

detailed actuarial and claims analyses of environmental reserves. No

adjustment to reserves was made in the fourth quarter of 2001, since

management did not have a sufficient basis for making an adjustment

until such supplemental analyses were completed, and we believed

our environmental and asbestos reserves were adequate as of

December 31, 2001.

Our historical methodology (through the first quarter of 2002) for

reviewing the adequacy of environmental and asbestos reserves uti-

lized a survival ratio method, which considers ending reserves in rela-

tion to calendar year paid losses. When the environmental reserve

analyses were completed in the second quarter of 2002, we supple-

mented our survival ratio analysis with the detailed additional

analyses referred to above, and concluded that our environmental

reserves were redundant by approximately $150 million.Based on our