Travelers 2002 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

fees received by each party. These indemnifications survive until the

applicable statutes of limitation expire.

In addition, we agreed to provide indemnification to Platinum and

its subsidiaries, directors and employees for losses incurred due to

inaccurate or omitted information in certain sections of the Platinum

Registration Statements and Prospectuses used in connection with

Platinum’s initial public offering of securities, or the Private Placement

Memorandum used in connection with Platinum’s private offering of

securities to Renaissance Reinsurance.We also agreed to make cer-

tain payments to the underwriters of the Platinum public offerings if

Platinum fails to satisfy certain indemnification obligations to them in

specified circumstances. Our obligations pursuant to these indemni-

ties have an aggregate limit of $400 million, which amount will be

reduced by any payments we make to investors in the public or pri-

vate offerings. The obligation to indemnify Platinum and its sub-

sidiaries, directors and employees expires on November 1, 2004.

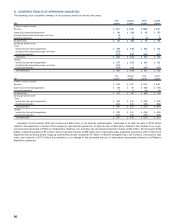

Sales of Business Entities — In the ordinary course of selling busi-

ness entities to third parties, we have agreed to indemnify purchasers

for losses arising out of breaches of representations and warranties

with respect to the business entities being sold, covenants and obli-

gations of us and/or our subsidiaries following the closing, and in cer-

tain cases obligations arising from undisclosed liabilities, adverse

reserve development, premium deficiencies or certain named litiga-

tion. Such indemnification provisions generally survive for periods

ranging from 12 months following the applicable closing date to the

expiration of the relevant statutes of limitation, or in some cases

agreed upon term limitations. As of December 31, 2002, the aggre-

gate amount of our quantifiable indemnification obligations in effect for

sales of business entities was $1.9 billion, with a deductible amount

of $62 million.

In addition, we have agreed to provide indemnification to third party

purchasers for certain losses associated with sold business entities

that are not limited by a contractual monetary amount. As of

December 31, 2002, we had outstanding unlimited indemnification

obligations in connection with the sales of certain of our business enti-

ties for tax liabilities arising prior to a purchaser’s ownership of an

entity, losses arising out of employee matters relating to acts or omis-

sions of such business entity or us prior to the closing, losses resulting

out of such sold business entities being deemed part of The St. Paul

group prior to their respective sales to third parties for purposes of

Internal Revenue Code Section 412 or Title IV of ERISA, and in some

cases losses arising from certain litigation and undisclosed liabilities.

These indemnification obligations survive until the applicable statutes

of limitation expire, or until the agreed upon contract terms expire.

18. RESTRUCTURING AND OTHER CHARGES

Fourth-Quarter 2001 Strategic Review — In December 2001, we

announced the results of a strategic review of all of our operations,

which included a decision to exit a number of businesses and coun-

tries, as discussed in Note 5. Related to this strategic review, we

recorded a pretax charge of $62 million, including $46 million of

employee-related costs, $9 million of occupancy-related costs, $4 mil-

lion of equipment charges and $3 million of legal costs. The charge

was included in “Operating and administrative expenses” in the 2001

statement of operations; with $42 million included in “Property-liability

insurance — other” and $20 million included in “Parent company,

other operations and consolidating eliminations” in the table titled

“Income (Loss) from Continuing Operations Before Income Taxes and

Cumulative Effect of Accounting Change” in Note 21.

The employee-related costs represent severance and related ben-

efits such as outplacement services to be paid to, or incurred on

behalf of, employees to be terminated by the end of 2002. We esti-

mated that a total of approximately 1,200 employees would ultimately

be terminated under this action, with approximately 800 employees

expected to be terminated by the end of 2002. The remaining

400 employees are not included in the restructuring charge since they

will either be terminated after 2002 or are part of one of the operations

that may be sold. Of the total, approximately 650 work in offices out-

side the U.S. (many of which are closing), approximately 300 work in

84

our Health Care business (which is being exited), and the remaining

250 are spread throughout our domestic operations. As of

December 31, 2002, 713 of the estimated 800 positions had been

eliminated.The remaining 87 positions are primarily due to employees

who found alternate positions within the company or external employ-

ment before termination.

The occupancy-related cost represents excess space created by

the terminations, calculated by determining the anticipated excess

space, by location, as a result of the terminations.The percentage of

excess space in relation to the total leased space was then applied to

the current lease costs over the remaining lease period. The amounts

payable under the existing leases were not discounted, and sublease

income was included in the calculation only for those locations where

sublease agreements were in place. The equipment costs represent

the net book value of computer and other equipment that will no

longer be used following the termination of employees and closing of

offices. The legal costs represent our estimate of fees to be paid to

outside legal counsel to obtain regulatory approval to exit certain

states or countries.

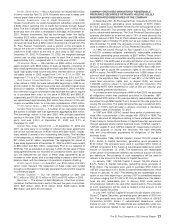

The following presents a rollforward of activity related to this accrual.

Reserve at Reserve at

Original Pre- Dec. 31, Dec. 31,

Charges to earnings: Tax Charge 2001 Payments Adjustments 2002

(In millions)

Employee-related $ 46 $ 46 $(33) $ 1 $ 14

Occupancy-related 9 9 (1) — 8

Equipment charges 4 N/A N/A N/A N/A

Legal costs 3 3 (1) (2) —

Total $ 62 $ 58 $(35) $ (1) $ 22

The adjustment of $1 million to the employee related accrual is the

net result of $3 million in additional charges applied as we met the cri-

teria for accrual throughout 2002, and an offsetting $2 million

decrease due to a fourth quarter 2002 revaluation adjustment. The

$2 million adjustment to legal costs was a result of the same fourth

quarter 2002 revaluation adjustment. This revaluation was the result

of a review of actual costs incurred and anticipated costs yet to be

paid under the action, and adjusts the remaining restructuring charge

to current estimates of reserve need.

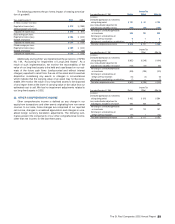

Other Restructuring Charges — Since 1997, we have recorded in

continuing operations four other restructuring charges related to

actions taken to improve our operations. (Also see Note 16 for a

discussion of the charge related to the sale of our standard personal

insurance business, which was included in discontinued operations

in 1999.)

Related to our April 2000 purchase of MMI (see Note 6), we

recorded a charge of $28 million, including $4 million of employee-

related costs and $24 million of occupancy-related costs. The

employee-related costs represented severance and related benefits

such as outplacement counseling to be paid to, or incurred on behalf

of, terminated employees. We estimated that approximately

130 employee positions would be eliminated, at all levels throughout

MMI, and 119 employees were terminated. The occupancy-related

cost represented excess space created by the terminations, calcu-

lated by determining the percentage of anticipated excess space, by

location, and the current lease costs over the remaining lease period.

The amounts payable under the existing leases were not discounted,

and sublease income was included in the calculation only for those

locations where sublease agreements were in place.

The charge was included in “Operating and administrative

expenses” in the 2000 statement of operations and in “Property-liabil-

ity insurance — other” in the table titled “Income (Loss) from

Continuing Operations Before Income Taxes and Cumulative Effect of

Accounting Change” in Note 21.

In August 1999, we announced a cost reduction program designed

to enhance our efficiency and effectiveness in a highly competitive

environment. In the third quarter of 1999, we recorded a pretax

charge of $60 million related to this program, including $25 million in