Travelers 2002 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and poor current-year results from North American liability and reinsur-

ance business. Unionamerica’s underwriting loss in 2002 of $60 million

included $27 million of adverse prior year loss development (which has

not been attributed to specific accident years, since such information

is not readily available), with the remainder reflecting current year

losses related to strengthened loss assumptions related to contracts

still in effect in 2002.These losses are centered in three lines of busi-

ness underwritten through Lloyd’s syndicates that are now managed

by Unionamerica: excess-of-loss reinsurance on U.S. medical mal-

practice, directors’and officers’liability business, and U.S.surplus lines

business. All other international runoff lines of business accounted for

$56 million of underwriting losses in 2002, compared with $94 million

of losses in 2001. Losses in 2002 were centered in the Netherlands

and Spain, whereas in 2001 losses were concentrated in health care

business and construction coverages offered in the United Kingdom.

The decline in these other international runoff losses in 2002 reflected

the impact of our decision to withdraw from those markets.

During the first half of 2002 we experienced reported losses in

excess of what we expected in our Lloyd’s syndicates involved in

underwriting casualty business. These losses were concentrated in

North American casualty coverages (reinsurance and primary), as well

as the specific lines associated with financial institutions and profes-

sional coverages.The unexpected loss activity caused us to revise our

assumptions related to future payments in both of these businesses

and increase reserve levels accordingly.The North American casualty

reserve charge totaled $44 million, and the financial institutions and

professionals charge totaled $21 million. During the third quarter of

2002, reported losses once again were more than expected. Reserves

were further increased as follows: $25 million in financial institutions

and professionals, and $31 million in other casualty lines for a total of

$56 million. In addition, we recorded an additional $20 million provision

in all other lines combined. Since Lloyd’s accounting does not capture

prior year loss development by accident year, we have not attributed

these reserve charges to specific accident years.

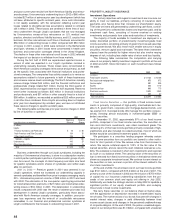

The following table summarizes prior year reserve charges in 2002

by line of business or operation.

2002

Beginning Reserve

Line of business or operation: Reserve Charge

(In millions)

Lloyd’s:

Financial Institutions and Professional $ 78 $46

North American and Other Casualty 154 75

Other Lloyd’s runoff lines 239 14

Subtotal — Lloyd’s 471 135

Unionamerica 445 27

Other international lines 333 6

Total $ 1,249 $168

Business underwritten through our Lloyd’s syndicates, including the

majority of Unionamerica’s business, is done in a subscription market,

in which parties participate in portions of policies and/or groups of poli-

cies. As a result, the concepts of claim frequency and claim size trend

for specific syndicates and/or shares of syndicates are neither avail-

able nor pertinent.

2001 vs. 2000 — Premium growth in 2001 was centered in our

Lloyd’s operations, where we increased our underwriting capacity in

several syndicates and benefited from price increases averaging nearly

20%. Unionamerica premium volume of $99 million in 2001 was level

with 2000. The elimination of the one-quarter reporting lag accounted

for incremental written premiums of $27 million and incremental under-

writing losses of $16 million in 2001. The deterioration in underwriting

results compared with 2000 was the result of adverse prior-year loss

development in several Lloyd’s syndicates, particularly those associ-

ated with North American casualty coverages. In addition, poor prior-

year loss experience and the write-off of uncollectible reinsurance

receivables in our financial and professional services syndicate at

Lloyd’s contributed to the increase in underwriting losses in 2001.

44

PROPERTY-LIABILITY INSURANCE

Investment Operations

Our primary objectives with regard to investments are to ensure our

ability to meet our liabilities, primarily consisting of insurance claim

payments, and, having done that, increase our shareholders’ equity.

The funds we invest are generated by underwriting cash flows, consist-

ing of the premiums collected less losses and expenses paid, and by

investment cash flows, consisting of income received on existing

investments and proceeds from sales and maturities of investments.

The majority of funds available for investment are deployed in a

widely diversified portfolio of predominantly investment-grade fixed

income securities, consisting primarily of government-issued securities

and corporate bonds. We also invest much smaller amounts in equity

securities, venture capital and real estate. The latter three investment

classes have the potential for higher returns but also involve varying

degrees of risk, including less stable rates of return and less liquidity.

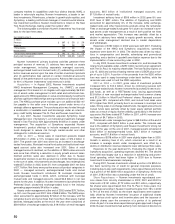

The following table summarizes the composition and carrying

value of our property-liability investment segment’s portfolio at the end

of 2002 and 2001. More information on each investment class follows

the table.

December 31 2002 2001

(In millions)

Fixed income securities $17,135 $15,756

Real estate and mortgage loans 873 972

Venture capital 581 859

Equities 355 1,110

Securities on loan 806 775

Short-term investments 2,070 2,043

Other investments 657 67

Total investments $22,477 $21,582

Fixed Income Securities — Our portfolio of fixed income invest-

ments is primarily composed of high-quality, intermediate-term tax-

able U.S. government, corporate and mortgage-backed bonds, and

tax-exempt U.S. municipal bonds. We manage this portfolio conserv-

atively, investing almost exclusively in investment-grade (BBB- or

better) securities.

At December 31, 2002, approximately 97% of our fixed income

portfolio, comprised of our fixed income securities, the securities on

loan and short-term investments, was rated investment grade. The

remaining 3% of this fixed income portfolio primarily consisted of high-

yield bonds, and also included non-rated securities, most of which we

believe would be considered investment-grade, if rated.

We participate in a securities lending program whereby certain

fixed income securities from our portfolio are loaned to other institu-

tions for short periods of time. We receive a fee from the borrower in

return. We require collateral equal to 102% of the fair value of the

loaned securities, and we record the cash collateral received as a lia-

bility.The collateral is invested in short-term investments and reported

as such on our balance sheet. The carrying value of the securities on

loan is removed from fixed income securities on the balance sheet and

shown as a separate investment asset.We continue to earn interest on

the securities on loan, and earn a portion of the interest related to the

short-term investments.

At the end of 2002, the amortized cost of our fixed income portfolio

was $16.1 billion, compared with $15.2 billion at the end of 2001.The

primary source of the increase in 2002 was the infusion of $750 million

of capital into our insurance underwriting subsidiaries from the pro-

ceeds of our common stock and equity unit offering in July 2002.

Additionally, we made the strategic decision in May 2002 to liquidate a

significant portion of our equity investment portfolio and re-deploy

those funds in fixed income investments.

We carry these securities on our balance sheet at market value,

with the appreciation or depreciation recorded in shareholders’ equity,

net of taxes.The market values of our bonds fluctuate with changes in

market interest rates, changes in yield differentials between fixed

income asset classes and changes in the perceived creditworthiness

of corporate obligors. At the end of 2002, the pretax unrealized appre-

ciation of our bond portfolio was $1.0 billion, compared with unrealized