Travelers 2002 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

$150 million, 8.375% senior notes that matured in June and $46 mil-

lion of medium-term notes that matured throughout the year. During

2001, Nuveen Investments utilized a portion of its $250 million revolv-

ing line of credit for general corporate purposes, including funding a

portion of its acquisition of Symphony Asset Management LLC, and

the reacquisition of its common shares. At year-end 2001, $183 mil-

lion, bearing a weighted average interest rate of approximately 3.1%,

was outstanding under Nuveen Investments’ line of credit agreement.

Company-obligated Mandatorily Redeemable Preferred

Securities — These securities were issued by five business trusts

wholly-owned and fully consolidated by The St. Paul. Each trust was

formed for the sole purpose of issuing the preferred securities.

St. Paul Capital Trust I was established in November 2001 and issued

$575 million of preferred securities that make preferred distributions

at a rate of 7.6%.These securities have a mandatory redemption date

of October 15, 2050, but we can redeem them on or after

November 13, 2006. The proceeds received from the sale of these

securities were used by the issuer to purchase our subordinated

debentures, and $500 million of the net proceeds were ultimately con-

tributed to the capital of one of our insurance subsidiaries.

MMI Capital Trust I was acquired in our purchase of MMI in 2000.

In 1997, the trust issued $125 million of 30-year redeemable preferred

securities. The securities make preferred distributions at a rate of

7.625% and have a mandatory redemption date of December 15,

2027. In 2002, we repurchased and retired $4 million of securities of

this trust.

The remaining three trusts, acquired in the USF&G merger, each

issued $100 million of preferred securities making preferred distribu-

tions at rates of 8.5%, 8.47% and 8.312%, respectively. In 2001, we

repurchased and retired $20 million of securities of the 8.5% trust.

Our total distribution expense related to the preferred securities

was $70 million in 2002, $33 million in 2001, and $31 million in 2000.

The increase in 2002 was due to the $575 million, 7.6% securities

issued by St. Paul Capital Trust I in November 2001.

Major Acquisitions and Divestitures — In March 2002, we com-

pleted our acquisition of London Guarantee (now St. Paul Guarantee)

for a total cost of approximately $80 million, financed with internally

generated funds.

In September 2001, we sold our life insurance subsidiary, F&G

Life, to Old Mutual plc, for $335 million in cash and 190.4 million Old

Mutual ordinary shares (valued at $300 million at closing). The cash

proceeds received were used for general corporate purposes. In June

2002, we sold all of the Old Mutual shares we were holding for total

net proceeds of $287 million, which were also used for general corpo-

rate purposes.

We purchased MMI in April 2000 for approximately $206 million

in cash, and the assumption of $165 million of short-term debt and

preferred securities. The short-term debt of $45 million was retired

subsequent to the acquisition. The cash portion of this transaction

and the repayment of debt were financed with internally generated

funds.In addition, our purchase of Pacific Select in February 2000 for

approximately $37 million in cash was financed with internally gener-

ated funds.

In May 2000, we completed the sale of our nonstandard auto oper-

ations for a total cash consideration of approximately $175 million (net

of a $25 million dividend paid by these operations to our property-

liability operations prior to closing).

Capital Commitments — We made no major capital improvements

during any of the last three years, and none are anticipated in 2003.

THE ST. PAUL COMPANIES

Liquidity

Liquidity is a measure of our ability to generate sufficient cash flows

to meet the short- and long-term cash requirements of our business

operations.Our underwriting operations’short-term cash needs prima-

rily consist of paying insurance loss and loss adjustment expenses and

day-to-day operating expenses. Those needs are met through cash

receipts from operations, which consist primarily of insurance premi-

ums collected and investment income. Our investment portfolio is also

52

a source of additional liquidity, through the sale of readily marketable

fixed maturities, equity securities and short-term investments, as well

as longer-term investments such as real estate and venture capital

holdings. After satisfying our cash requirements, excess cash flows

from these underwriting and investment activities are used to build the

investment portfolio and thereby increase future investment income.

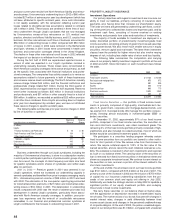

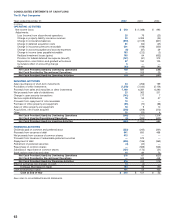

Net cash flows provided by continuing operations totaled $129 mil-

lion in 2002, compared with cash provided by continuing operations of

$884 million in 2001 and cash used by continuing operations of

$588 million in 2000. Our operational cash flows in 2002 were nega-

tively impacted by the $248 million payment made in June related to

the Western MacArthur asbestos litigation settlement, net payments

of $289 million associated with our transfer of unearned premium bal-

ances and other reinsurance-related balances to Platinum

Underwriters Holdings, Ltd. in November, loss payments totaling

$242 million related to the September 11, 2001 terrorist attack and

contributions to our pension plans totaling $158 million in December.

Loss and loss adjustment expense payments from our other business

segments in runoff, where our written premium volume was signifi-

cantly less than in 2001, also negatively impacted our consolidated

operating cash flows.

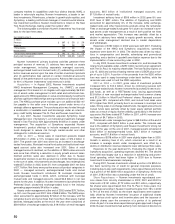

We expect operational cash flows during 2003 to continue to be

negatively impacted by insurance losses and loss adjustment

expenses payable related to the September 11, 2001 terrorist attack,

as well as losses payable related to our operations in runoff and the

first quarter 2003 payment of $740 million related to the Western

MacArthur asbestos litigation settlement. However, we also expect

continued improvement in operational cash flows from ongoing oper-

ations in 2003 as a result of price increases and expense reductions

throughout our operations.

In the second quarter of 2002, A.M.Best Co.lowered certain of our

financial ratings and those of our insurance subsidiaries and estab-

lished a stable outlook on the ratings going forward. In the third quar-

ter of 2002, Standard & Poor’s Ratings Group lowered certain of our

financial ratings and those of our insurance underwriting subsidiaries,

and removed them from CreditWatch, while retaining a negative out-

look. In February 2003, Moody’s Investors Services, Inc. placed cer-

tain of our financial ratings and those of our insurance underwriting

subsidiaries under review for possible downgrade. We believe our

financial strength continues to provide us with the flexibility and

capacity to obtain funds externally through debt or equity financings

on both a short-term and long-term basis.We continue to maintain an

$800 million commercial paper program with $600 million of back-up

liquidity, consisting of bank credit agreements totaling $540 million

and $60 million of highly liquid, high-quality fixed income securities. In

January 2003, we established a program providing for the offering of

up to $500 million of medium-term notes. As of February 28, 2003, we

had not issued any notes under this program.

We primarily depend on dividends from our subsidiaries to pay div-

idends to our shareholders, service our debt, and pay expenses.

St. Paul Fire and Marine Insurance Company (“Fire and Marine”) is

our lead U.S.property-liability underwriting subsidiary and its dividend

paying capacity is limited by the laws of Minnesota, its state of domi-

cile. Business and regulatory considerations may impact the amount

of dividends actually paid. Approximately $505 million will be available

to us from payment of ordinary dividends by Fire and Marine in 2003.

Any dividend payments beyond the $505 million limitation would

require prior approval of the Minnesota Commissioner of Commerce.

Fire and Marine’s ability to receive dividends from its direct and indi-

rect underwriting subsidiaries is subject to restrictions of their respec-

tive states or other jurisdictions of domicile. We received no cash

dividends from our U.S. property-liability underwriting subsidiaries in

2002. During 2001, we received dividends in the form of cash and

securities of $827 million from our U.S. underwriting subsidiaries.

We are not aware of any current recommendations by regulatory

authorities that, if implemented, might have a material impact on our

liquidity, capital resources or operations.