Travelers 2002 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Accounting Principles — We prepare our consolidated financial

statements in accordance with United States generally accepted

accounting principles (“GAAP”). We follow the accounting standards

established by the Financial Accounting Standards Board (“FASB”)

and the American Institute of Certified Public Accountants (“AICPA”).

Consolidation — We combine our financial statements with those

of our subsidiaries and present them on a consolidated basis. The

consolidated financial statements do not include the results of mate-

rial transactions between our subsidiaries and us or among our sub-

sidiaries. Certain of our foreign underwriting operations’ results, and

the results of certain of our investments in partnerships, are recorded

on a one-month to one-quarter lag due to time constraints in obtain-

ing and analyzing such results for inclusion in our consolidated finan-

cial statements on a current basis. In the event that significant events

occur during the lag period, the impact is included in the current

period results.

During 2001, we eliminated the one-quarter reporting lag for cer-

tain of our primary underwriting operations in foreign countries. The

effect of reporting these operations on a current basis was a $31 mil-

lion increase to our 2001 pretax loss on continuing operations.

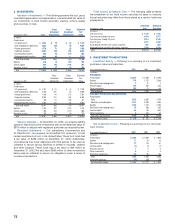

Related Party Transactions — The following summarizes our

related party transactions:

Indebtedness of Management — We have made loans to certain

current and former executive officers for their purchase of our com-

mon stock in the open market. These are full-recourse loans, further

secured by a pledge of the stock purchased with the proceeds. The

loans accrue interest at the applicable federal rate for loans of such

maturity. Loans to former executive officers are being repaid in accor-

dance with agreed-upon terms.The total amount receivable under this

program, included in “Other Assets”, on December 31, 2002 and 2001

was $7 million and $10 million, respectively. This program was termi-

nated effective March 20, 2002; consequently, no new loans were

made after that date.

Indebtedness of Venture Capital Management — We have made

loans to certain members of management of our Venture Capital

investment operation.The loans are secured by each individual’s own-

ership interest in the limited liability companies that hold most of our

venture capital investments, and accrue interest at the applicable fed-

eral rate for loans of such maturity.The total amount receivable under

this program, included in “Other Assets” at December 31, 2002 and

2001, was $7 million and $6 million, respectively.

Discontinued Operations — In 2001, we sold our life insurance

operations, and in 2000, we sold our nonstandard auto business.

Accordingly, the results of operations for all years presented reflect

the results for these businesses as discontinued operations.

Reclassifications — We reclassified certain amounts in our 2001

and 2000 consolidated financial statements and notes to conform to

the 2002 presentation. These reclassifications had no effect on net

income, or common or preferred shareholders’ equity, as previously

reported for those years.

Use of Estimates — We make estimates and assumptions that

have an effect on the amounts that we report in our consolidated

financial statements. Our most significant estimates are those relating

to our reserves for property-liability losses and loss adjustment

expenses.We continually review our estimates and make adjustments

as necessary, but actual results could turn out to be significantly dif-

ferent from what we expected when we made these estimates.

ACCOUNTING FOR OUR PROPERTY-LIABILITY

UNDERWRITING OPERATIONS

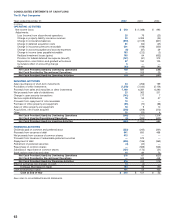

Premiums Earned — Premiums on insurance policies are our

largest source of revenue. We recognize the premiums as revenues

evenly over the policy terms using the daily pro rata method or, in the

case of our Lloyd’s business, the one-eighths method. The one-

eighths method reflects the fact that we convert Lloyd’s syndicate

The St. Paul Companies 2002 Annual Report 63

accounts to U.S. GAAP on a quarterly basis. Quarterly financial state-

ments are prepared for Lloyd’s syndicates, using the Lloyd’s three-

year accounting basis, which are subsequently converted to U.S.

GAAP. Since Lloyd’s accounting does not currently recognize the con-

cept of earned premium, we calculate earned premium as part of the

conversion to GAAP. We recognize written premium for U.S. GAAP

purposes quarterly, and assume that it is written at the middle of each

quarter (i.e., evenly throughout each period), effectively breaking the

calendar year into earning periods of eighths.

Revenues in our Health Care segment include premiums gener-

ated from extended reporting endorsements. Our medical liability

claims-made policies give our insureds the right to purchase a report-

ing endorsement, which is also referred to as “tail coverage,” at the

time their policies expire. This endorsement protects an insured

against any claims that arise from a medical incident that occurred

while the claims-made policy was in force, but which had not yet been

reported by the time the policy expired. Premiums on these endorse-

ments are fully earned as revenue, and the expected losses are

reserved, at the time the endorsement is written.

We record premiums that we have not yet recognized as revenues

as unearned premiums on our balance sheet. Assumed reinsurance

premiums are recognized as revenues proportionately over the con-

tract period. Premiums earned are recorded in our statement of oper-

ations, net of our cost to purchase reinsurance.

Insurance Losses and Loss Adjustment Expenses — Losses rep-

resent the amounts we paid or expect to pay to claimants for events

that have occurred.The costs of investigating, resolving and process-

ing these claims are known as loss adjustment expenses (“LAE”).We

record these items on our statement of operations net of reinsurance,

meaning that we reduce our gross losses and loss adjustment

expenses incurred by the amounts we have recovered or expect to

recover under reinsurance contracts.

Reinsurance — Written premiums, earned premiums and incurred

insurance losses and LAE all reflect the net effects of assumed and

ceded reinsurance transactions. Assumed reinsurance refers to our

acceptance of certain insurance risks that other insurance companies

have underwritten. Assumed reinsurance has, for the most part, been

written through our St. Paul Re operation.During 2002, we transferred

our ongoing business previously written through St. Paul Re to

Platinum Underwriters Holdings, Ltd. See Note 2 for a more detailed

discussion of this transfer. Ceded reinsurance means other insurance

companies have agreed to share certain risks with us. Reinsurance

accounting is followed for assumed and ceded transactions when risk

transfer requirements have been met.These requirements involve sig-

nificant assumptions being made related to the amount and timing of

expected cash flows, as well as the interpretation of underlying con-

tract terms.

Insurance Reserves — We establish reserves for the estimated

total unpaid cost of losses and LAE, which cover events that occurred

in 2002 and prior years. These reserves reflect our estimates of the

total cost of claims that were reported to us (“case” reserves), but not

yet paid, and the cost of claims incurred but not yet reported to us

(“IBNR”). We reduce our loss reserves for estimated amounts of sal-

vage and subrogation recoveries. Estimated amounts recoverable from

reinsurers on paid and unpaid losses and LAE, net of an allowance for

estimated unrecoverable amounts, are reflected as assets.

For reported losses, we establish reserves on a “case” basis within

the parameters of coverage provided in the insurance policy or reinsur-

ance agreement. For IBNR losses, we estimate reserves using estab-

lished actuarial methods. Our case and IBNR reserve estimates

consider such variables as past loss experience, changes in legislative

conditions, changes in judicial interpretation of legal liability and policy

coverages, and inflation. We consider not only monetary increases in

the cost of what we insure, but also changes in societal factors that

influence jury verdicts and case law and, in turn, claim costs.

Notes to Consolidated Financial Statements

The St. Paul Companies