Travelers 2002 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

additional analyses, we released approximately $150 million of envi-

ronmental reserves in the second quarter of 2002. Had we continued

to rely solely on our survival ratio analysis, we would have recorded

no adjustment to our environmental reserves through the six months

ended June 30, 2002.

In the second quarter of 2002, we also supplemented our survival

ratio analysis of asbestos reserves with a detailed claims analysis. We

determined that, excluding the impact of the Western MacArthur set-

tlement, our asbestos reserves were adequate; however, including that

impact, we determined that our asbestos reserves were inadequate.

As a result of developments in the asbestos litigation environment

generally, we determined in the first quarter of 2002 that it would be

desirable to seek earlier and ultimately less costly resolutions of

certain pending asbestos-related litigations. As a result, we have

decided where possible to seek to resolve these matters while contin-

uing to vigorously assert defenses in pending litigations. We are tak-

ing a similar approach to environmental litigations. As discussed in

more detail on pages 27 through 28 of this discussion, in the second

quarter of 2002 we entered into a definitive agreement to settle

asbestos claims for a total gross cost of $995 million arising from any

insuring relationship we and certain of our subsidiaries may have had

with MacArthur Company, Western MacArthur Company or Western

Asbestos Company.

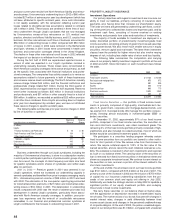

The table below represents a reconciliation of total gross and net

environmental reserve development for the years ended

December 31, 2002, 2001 and 2000. Amounts in the “net” column are

reduced by reinsurance recoverables. The disclosure of environmen-

tal reserve development includes all claims related to environmental

exposures. Additional disclosure has been provided to separately

identify loss payments and reserve amounts related to policies that

were specifically underwritten to cover environmental exposures,

referred to as “Underwritten,” as well as amounts related to environ-

mental exposures that were not specifically underwritten, referred to

as “Not Underwritten.” In 1988, we completed our implementation of a

pollution exclusion in our commercial general liability policies; there-

fore, activity related to accident years after 1988 generally relates to

policies underwritten to include environmental exposures.

The amounts presented for paid losses in the following table as

“Underwritten” include primarily exposures related to accident years

after 1988 for policies which the underwriter contemplated providing

environmental coverage. In addition, certain pre-1988 exposures, pri-

marily first party losses, are included since, they too, were contem-

plated by the underwriter to include environmental coverage. “Not

Underwritten” primarily represents exposures related to accident

years 1988 and prior for policies which were not contemplated by the

underwriter to include environmental coverage.

2002 2001 2000

(In millions) Gross Net Gross Net Gross Net

ENVIRONMENTAL

Beginning reserves $604 $ 519 $684 $ 573 $ 698 $ 599

Reserves acquired ————2710

Incurred losses (2) (3) 6212116

Reserve reduction (150) (150) ————

Paid losses:

Not underwritten (70) (56) (74) (63) (48) (39)

Underwritten (12) (12) (12) (12) (14) (13)

Ending reserves $370 $ 298 $604 $ 519 $ 684 $ 573

The $150 million reduction of environmental reserves discussed

previously was included in the gross and net incurred losses for 2002.

For the year 2000, the gross and net environmental “underwritten”

reserves at the beginning of the year totaled $27 million and $26 mil-

lion, respectively, and at the end of the year totaled $27 million and

$26 million, respectively. For 2001, the year-end gross and net envi-

ronmental “underwritten” reserves were both $28 million, and at

December 31, 2002 the gross and net reserves were both $36 mil-

lion. These reserves relate to policies, which were specifically

underwritten to include environmental exposures. These “under-

written” reserve amounts are included in the total reserve amounts in

the preceding table.

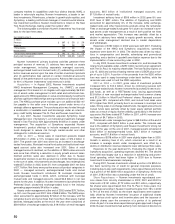

The following table represents a reconciliation of total gross and

net reserve development for asbestos claims for each of the years in

the three-year period ended December 31, 2002. No policies have

been underwritten to specifically include asbestos exposure.

2002 2001 2000

(In millions) Gross Net Gross Net Gross Net

ASBESTOS

Beginning reserves $577 $ 387 $471 $ 315 $ 398 $ 298

Reserves acquired ————5211

Incurred losses 846 482 167 116 72 40

Reserve increase 150 150 ————

Paid losses (328) (241) (61) (44) (51) (34)

Ending reserves $1,245 $ 778 $577 $ 387 $ 471 $ 315

Included in gross incurred losses in 2002 (including the $150 mil-

lion reserve increase) were $995 million of losses related to the

Western MacArthur litigation settlement. Also included in the gross

and net incurred losses for the year ended December 31, 2002, but

reported separately in the above table, was a $150 million increase in

asbestos reserves. Gross paid losses include the $248 million

Western MacArthur payment made in June 2002.

Our reserves for environmental and asbestos losses at

December 31, 2002 represent our best estimate of our ultimate liabil-

ity for such losses, based on all information currently available.

Because of the inherent difficulty in estimating such losses, however,

we cannot give assurances that our ultimate liability for environmen-

tal and asbestos losses will, in fact, match current reserves. We con-

tinue to evaluate new information and developing loss patterns, as

well as the potential impact of our determination to seek earlier and

ultimately less costly resolutions of certain pending asbestos and

environmental related litigations. Future changes in our estimates of

our ultimate liability for environmental and asbestos claims may be

material to our results of operations, but we do not believe they will

materially impact our liquidity or overall financial position.

In 2001, we completed a periodic analysis of environmental and

asbestos reserves at one of our subsidiaries in the United Kingdom.

The analysis was based on a policy-by-policy review of our known

and unknown exposure to damages arising from environmental pollu-

tion and asbestos litigation. The analysis concluded that loss experi-

ence for environmental exposures was developing more favorably

than anticipated, while loss experience for asbestos exposures was

developing less favorably than anticipated. The divergence in loss

experience had an offsetting impact on respective reserves for envi-

ronmental and asbestos exposures; as a result, we recorded a

$48 million reduction in net incurred environmental losses in 2001,

and an increase in net incurred asbestos losses for the same amount.

Total gross environmental and asbestos reserves at December 31,

2002, of $1.6 billion represented approximately 7% of gross consoli-

dated reserves of $22.6 billion.

ASSET MANAGEMENT

Nuveen Investments, Inc.

We hold a 79% interest in Nuveen Investments, Inc. (“Nuveen

Investments,” formerly The John Nuveen Company), which consti-

tutes our asset management segment. Nuveen Investments’ core

businesses are asset management and related research, as well as

the development, marketing and distribution of investment products

and services for the affluent, high-net-worth and institutional market

segments. Nuveen Investments distributes its investment products

and services, including individually managed accounts, closed-end

exchange-traded funds and mutual funds, to the affluent and high-net-

worth market segments through unaffiliated intermediary firms includ-

ing broker/dealers, commercial banks, affiliates of insurance

providers, financial planners, accountants, consultants and invest-

ment advisors. Nuveen Investments also provides managed account

services to several institutional market segments and channels. The

The St. Paul Companies 2002 Annual Report 49