Travelers 2002 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

which are material to our consolidated results, the impact is included

in current period results.

The following discussion summarizes our process of reviewing our

investments for possible impairment.

Fixed Income and Securities on Loan — On a monthly basis,

these investments are reviewed by portfolio managers for impairment.

In general, the managers focus their attention on those fixed income

securities whose market value was less than 80% of their amortized

cost for at least one month in the previous nine months. Factors con-

sidered in evaluating potential impairment include the following.

• the degree to which any appearance of impairment is attributa-

ble to an overall change in market conditions (e.g., interest rates)

rather than changes in the individual factual circumstances and

risk profile of the issuer;

• the degree to which an issuer is current or in arrears in making

principal and interest payments on the debt securities in question;

• the issuer’s fixed-charge ratio at the date of acquisition and date

of evaluation;

• the issuer’s current financial condition and its ability to make future

scheduled principal and interest payments on a timely basis;

• the independent auditors’ report on the issuer’s recent financial

statements;

• buy/hold/sell recommendations of outside investment advisors

and analysts;

• relevant rating history, analysis and guidance provided by rating

agencies and analysts; and

• whether or not we have the ability and intent to hold the security

for a period of time sufficient to allow for recovery, enabling us to

receive value equal to or greater than our cost.

Equities — On a monthly basis, these investments are reviewed by

portfolio managers for impairment. In general, the managers focus

their attention on those equity securities whose market value was less

than 80% of their cost for six consecutive months. Factors considered

in evaluating potential impairment include the following.

• whether the decline appears to be related to general market or

industry conditions or is issuer-specific;

• the relationship of market prices per share to book value per

share at date of acquisition and date of evaluation;

• the price-earnings ratio at the time of acquisition and date of

evaluation;

• our ability and intent to hold the security for a period of time suf-

ficient to allow for recovery in the market value;

• the financial condition and near-term prospects of the issuer,

including any specific events that may influence the issuer’s

operations;

• the recent income or loss of the issuer;

• the independent auditors’ report on the issuer’s financial state-

ments;

• the dividend policy of the issuer at date of acquisition and date of

evaluation;

• any buy/hold/sell recommendations of investment advisors;

• rating agency announcements; and

• price projections of investment analysts.

Venture Capital — On a monthly basis, individual public invest-

ments are analyzed for impairment by portfolio managers as well as an

internal valuation committee. In general, attention is focused on those

marketable (public equity) securities whose market value has been

less than cost for six consecutive months. Factors considered are the

same as those enumerated above for our equity investments. With

respect to non-publicly traded venture capital investments, on a quar-

terly basis, the portfolio managers as well as the internal valuation

committee review and consider a variety of factors in determining the

potential for loss impairment. Factors considered include the following.

• the issuer’s most recent financing events;

• an analysis of whether fundamental deterioration has occurred;

• whether or not the issuer’s progress has been substantially less

than expected;

• whether or not the valuations have declined significantly in the

entity’s market sector;

32

• whether or not the internal valuation committee believes there is

a 50% probability that the issuer will need financing within six

months at a lower price than our carrying value; and

• whether or not we have the ability and intent to hold the security

for a period of time sufficient to allow for recovery, enabling us to

receive value equal to or greater than our cost.

The quarterly (or monthly) valuation procedures described above

are in addition to the portfolio managers’ ongoing responsibility to

frequently monitor developments affecting those invested assets, pay-

ing particular attention to events that might give rise to impairment

write-downs.

The size of our investment portfolio allows our portfolio managers

a degree of flexibility in determining which individual investments

should be sold to achieve our primary investment goals of assuring

our ability to meet our commitments to policyholders and other credi-

tors and maximizing our investment returns. In order to meet the

objective of maintaining a flexible portfolio that can achieve these

goals, our fixed income and equity portfolios are classified as “avail-

able-for-sale.” We continually evaluate these portfolios, and our pur-

chases and sales of investments are based on our cash

requirements, the characteristics of our insurance liabilities, and cur-

rent market conditions. At the time we determine an “other than tem-

porary” impairment in the value of a particular investment to have

occurred, we consider the current facts and circumstances and make

a decision to either record a writedown in the carrying value of the

security or sell the security; in either case, recognizing a realized loss.

With respect to our venture capital portfolio, we manage our port-

folio to maximize return, evaluating current market conditions and the

future outlook for the entities in which we have invested. Because this

portfolio primarily consists of privately-held, early-stage venture

investments, events giving rise to impairment can occur in a brief

period of time (e.g., the entity has been unsuccessful in securing addi-

tional financing, other investors decide to withdraw their support, com-

plications arise in the product development process, etc.), and

decisions are made at that point in time, based on the specific facts

and circumstances, with respect to a recognition of “other than tem-

porary” impairment, or sale of the investment.

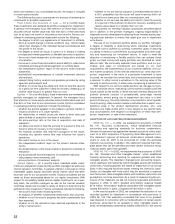

ADOPTION OF ACCOUNTING PRONOUNCEMENTS

SFAS No. 141 — In 2002, we adopted the provisions of SFAS

No. 141, “Business Combinations,” which established financial

accounting and reporting standards for business combinations.

(Nuveen Investments had applied the relevant provisions of this state-

ment to its 2001 acquisition of Symphony Asset Management LLC).

The statement requires all business combinations initiated subse-

quent to June 30, 2001 to be accounted for under the purchase

method of accounting. In addition, this statement required that intan-

gible assets that can be identified and meet certain criteria be recog-

nized as assets apart from goodwill.

SFAS No. 142 — In 2002, we implemented the provisions of SFAS

No. 142, “Goodwill and Other Intangible Assets”, which established

financial accounting and reporting for acquired goodwill and other

intangible assets. The statement changed prior accounting require-

ments relating to the method by which intangible assets with indefinite

useful lives, including goodwill, are tested for impairment on an annual

basis. It also required that those assets meeting the criteria for classi-

fication as intangible with finite useful lives be amortized to expense

over those lives, while intangible assets with indefinite useful lives and

goodwill are not to be amortized. As a result of implementing the pro-

visions of this statement, we did not record any goodwill amortization

expense in 2002. In 2001, goodwill amortization expense totaled

$114 million. Amortization expense associated with intangible assets

totaled $18 million in 2002, compared with $2 million in 2001.

In the second quarter of 2002, we completed the evaluation of our

recorded goodwill for impairment in accordance with provisions of

SFAS No. 142. That evaluation concluded that none of our goodwill

was impaired. In connection with our reclassification of certain assets

previously accounted for as goodwill to other intangible assets in

2002, we established a deferred tax liability of $6 million in the second