Travelers 2002 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Solutions, which have common underwriting, claim and risk control

functions. Commercial Lines also includes our participation in volun-

tary and involuntary pools, referred to as “Pools and Other.”

Although considered specialty businesses as well, our Surety &

Construction operations are under common leadership, which, in

addition to their shared customer base, provides the basis for their

continued combination into one segment.

Our International & Lloyd’s segment consists of the following com-

ponents: our ongoing operations at Lloyd’s, and our ongoing specialty

commercial operations outside of the United States, including our

Global Accounts business center (collectively referred to as “interna-

tional specialties”). Similar to our Specialty Commercial segment, this

segment includes operations that possess dedicated underwriting,

claims and risk control services that require specialized expertise and

focus exclusively on the customers served by respective operations.

This operation is under common executive management and its busi-

ness is generally conducted outside the United States.

Health Care (with the exception of international Health Care) and

Reinsurance continue to be reported as separate segments as they

have been in the past. Our Reinsurance segment includes all reinsur-

ance business written by our reinsurance operation, out of New York

and London. (In the fourth quarter of 2002, we transferred our remain-

ing ongoing reinsurance operations to Platinum Underwriters

Holdings, Ltd., as discussed in more detail in Note 2 to the consoli-

dated financial statements.

Our Other segment includes the results of our runoff operations at

Lloyd’s; Unionamerica, the London-based underwriting unit acquired

as part of our purchase of MMI in 2000; and all other international

runoff lines of business we decided to exit at the end of 2001, consist-

ing of Health Care business in the United Kingdom, Canada and

Ireland, as well as our underwriting operations in Germany, France,

the Netherlands, Argentina, Mexico (excluding surety business),

Spain, Australia, New Zealand, Botswana and South Africa. (In late

2002, we sold our operations in Argentina, Mexico and Spain).These

are international operations through which we are no longer writing

new business, and whose performance assessment and resource

allocation decisions are being made based on the dedicated financial

information reported for this reporting segment where the sole focus

is claims processing.

In 2001, we sold our life insurance operations and in 2000, we sold

our nonstandard auto business. These operations have been

accounted for as discontinued operations for all periods presented

and are not included in our segment data.

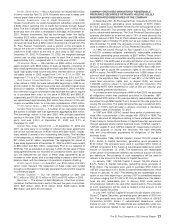

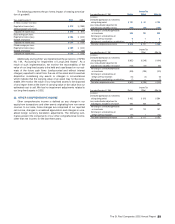

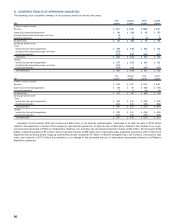

The summary below presents revenues and pretax income from

continuing operations for our reportable segments. The revenues of

our asset management segment include investment income and real-

ized investment gains. The table also presents identifiable assets for

our property-liability underwriting operation in total, and our asset

management segment.

The St. Paul Companies 2002 Annual Report 87

Years ended December 31 2002 2001 2000

(In millions)

REVENUES FROM CONTINUING OPERATIONS

Underwriting:

Specialty Commercial $1,856 $1,410 $ 1,095

Commercial Lines 1,760 1,504 1,387

Surety & Construction 1,141 926 782

International & Lloyd’s 716 590 255

Total ongoing insurance operations 5,473 4,430 3,519

Health Care 474 693 573

Reinsurance 1,071 1,593 1,121

Other 372 580 379

Total run-off insurance operations 1,917 2,866 2,073

Total underwriting 7,390 7,296 5,592

Investment operations:

Net investment income 1,161 1,199 1,247

Realized investment gains (losses) (162) (126) 624

Total investment operations 999 1,073 1,871

Other 116 119 81

Total property-liability insurance 8,505 8,488 7,544

Asset management 397 378 376

Total reportable segments 8,902 8,866 7,920

Parent company, other operations and consolidating eliminations 16 53 26

Total revenues from continuing operations $8,918 $8,919 $ 7,946

INCOME (LOSS) FROM CONTINUING OPERATIONS BEFORE INCOME TAXES AND CUMULATIVE EFFECT OF ACCOUNTING CHANGE

Underwriting:

Specialty Commercial $193 $(14) $ 64

Commercial Lines (331) (16) 84

Surety & Construction (222) (39) 64

International & Lloyd’s 60 (239) (8)

Total ongoing insurance operations (300) (308) 204

Health Care (166) (935) (220)

Reinsurance (22) (726) (115)

Other (221) (325) (178)

Total run-off insurance operations (409) (1,986) (513)

Total underwriting (709) (2,294) (309)

Investment operations:

Net investment income 1,161 1,199 1,247

Realized investment gains (losses) (162) (126) 624

Total investment operations 999 1,073 1,871

Other (46) (179) (95)

Total property-liability insurance 244 (1,400) 1,467

Asset management 162 142 135

Total reportable segments 406 (1,258) 1,602

Parent company, other operations and consolidating eliminations (230) (173) (201)

Total income (loss) from continuing operations before income taxes and cumulative effect of accounting change $176 $(1,431) $ 1,401